Ripple’s XRP is once again at the center of a long-running debate about the future of global payments, as new comments from a former SWIFT executive reignite speculation about potential integration with the world’s dominant interbank messaging network.

Crypto analyst SMQKE recently highlighted a growing trend suggesting that SWIFT may eventually integrate cryptocurrencies like XRP once regulatory clarity improves. The discussion gained traction after remarks from Gottfried Leibbrandt, former CEO of SWIFT, who openly acknowledged XRP’s role in Ripple’s value proposition — while also outlining why banks remain cautious.

Former SWIFT CEO Acknowledges XRP’s Potential

“I think that the big part of Ripple’s value proposition is the cryptocurrency XRP,” Leibbrandt stated, pointing directly to the digital asset’s importance within Ripple’s ecosystem, as reported by Coinpaper.

However, he also emphasized why adoption has been slow. Currency volatility remains a key concern for banks, which operate in tightly regulated, risk-averse environments. While blockchain technology promises faster and cheaper cross-border payments, sudden price fluctuations in digital assets like XRP create balance-sheet and compliance risks that many institutions are unwilling to accept — at least for now.

These remarks reflect the broader stance of global financial institutions, where innovation is welcome, but not at the expense of legal certainty and financial stability.

Recent XRP Price Momentum

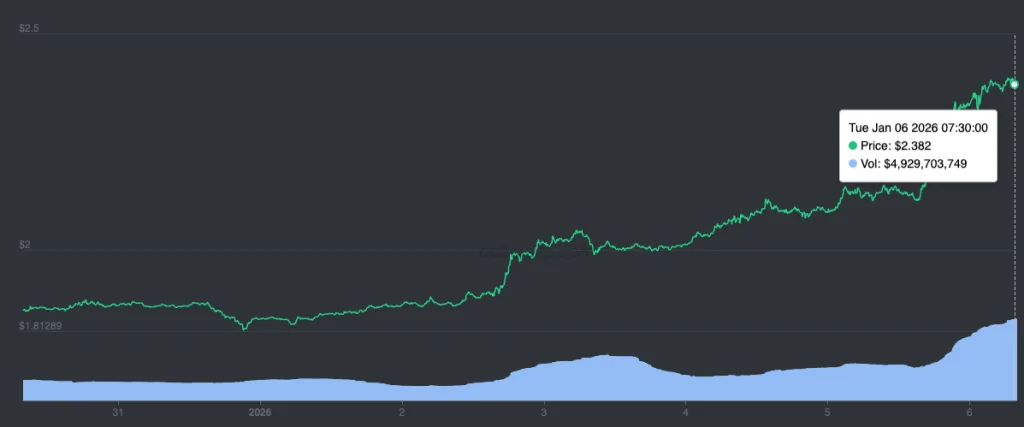

XRP has shown notable strength in recent trading, gaining around 28% over the past 7 days and currently trading at approximately $2.38 per token.

Source: CoinCarp

Regulation Remains the Biggest Barrier

SWIFT’s cautious approach is largely driven by regulatory uncertainty surrounding cryptocurrencies, particularly across multiple jurisdictions. Banks operating internationally must navigate complex compliance frameworks, and unclear crypto regulations often outweigh the operational benefits of faster settlement times.

Experts widely agree that large-scale adoption of digital assets by banks is unlikely until regulatory clarity improves. That said, momentum is building. Market structure and crypto clarity bills are progressing, especially in the United States, potentially laying the groundwork for broader institutional participation.

Leibbrandt suggested that SWIFT is closely monitoring the crypto space and could move decisively once volatility stabilizes and regulatory frameworks mature.

Why XRP Still Stands Out

Despite these challenges, crypto adoption in traditional finance is accelerating, and XRP remains one of the few digital assets purpose-built for cross-border payments.

XRP offers:

- Near-instant settlement

- Lower transaction costs

- High transparency

- Scalability for global payment flows

If SWIFT were to integrate XRP — even partially — the impact on international transfers could be transformative. Legacy systems known for slow processing times and high fees could be replaced by efficient, real-time settlement rails, fundamentally reshaping how money moves across borders.

At that point, adopting digital assets would no longer be just a technological upgrade — it would become a strategic necessity for banks seeking to remain competitive in a rapidly evolving financial landscape.

XRP Price Prediction: Analyst Targets $15

Beyond fundamentals, technical analysts are increasingly optimistic about XRP’s long-term price trajectory.

According to a widely shared TradingView analysis, XRP is currently testing a major support zone on the weekly chart, following a rally of nearly 400%. Consolidation at this level is considered normal after such a strong move.

The analyst notes:

- XRP may briefly break support before quickly returning to its broader channel

- The weekly RSI is oversold, hovering around the 30 level

- Historical data suggests oversold conditions have often preceded major rallies

Source: TradingView

Historical XRP RSI Rallies

When XRP reached similar RSI levels in the past, the following moves occurred:

- 2018: +200% in 1 month

- 2019: +100% in 3 months

- 2020: +600% in 8 months

- 2022: +60% in 2 weeks

- 2024: +50% in 1 month

- Mid-2024: +700% over roughly 1 year

Excluding the extreme 2017 bull market, historical rallies have ranged from 50% to 700%, suggesting significant upside remains possible.

On lower timeframes, the analyst highlights a falling wedge pattern approaching a breakout, alongside a bullish cross on the 3-day RSI — both traditionally bullish technical signals.

Based on this data, the analyst believes $15 is a realistic long-term target for XRP, particularly if the broader altcoin bull market continues into 2026.

Conclusion

SWIFT’s potential adoption of XRP hinges on two key factors: regulatory clarity and reduced volatility. While banks remain cautious, the underlying demand for faster, cheaper, and more transparent cross-border payments continues to grow.

If regulatory frameworks mature and institutional confidence improves, XRP could play a pivotal role in bridging traditional finance with blockchain efficiency. Such a move would mark a major milestone in crypto adoption — positioning XRP as a cornerstone of the future global payment system.

For investors and institutions alike, XRP is increasingly becoming an asset worth watching closely as 2026 approaches.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.