While positive news is expected from the SEC regarding spot Bitcoin ETFs in Bitcoin and altcoins, CoinShares has published its weekly cryptocurrency report.

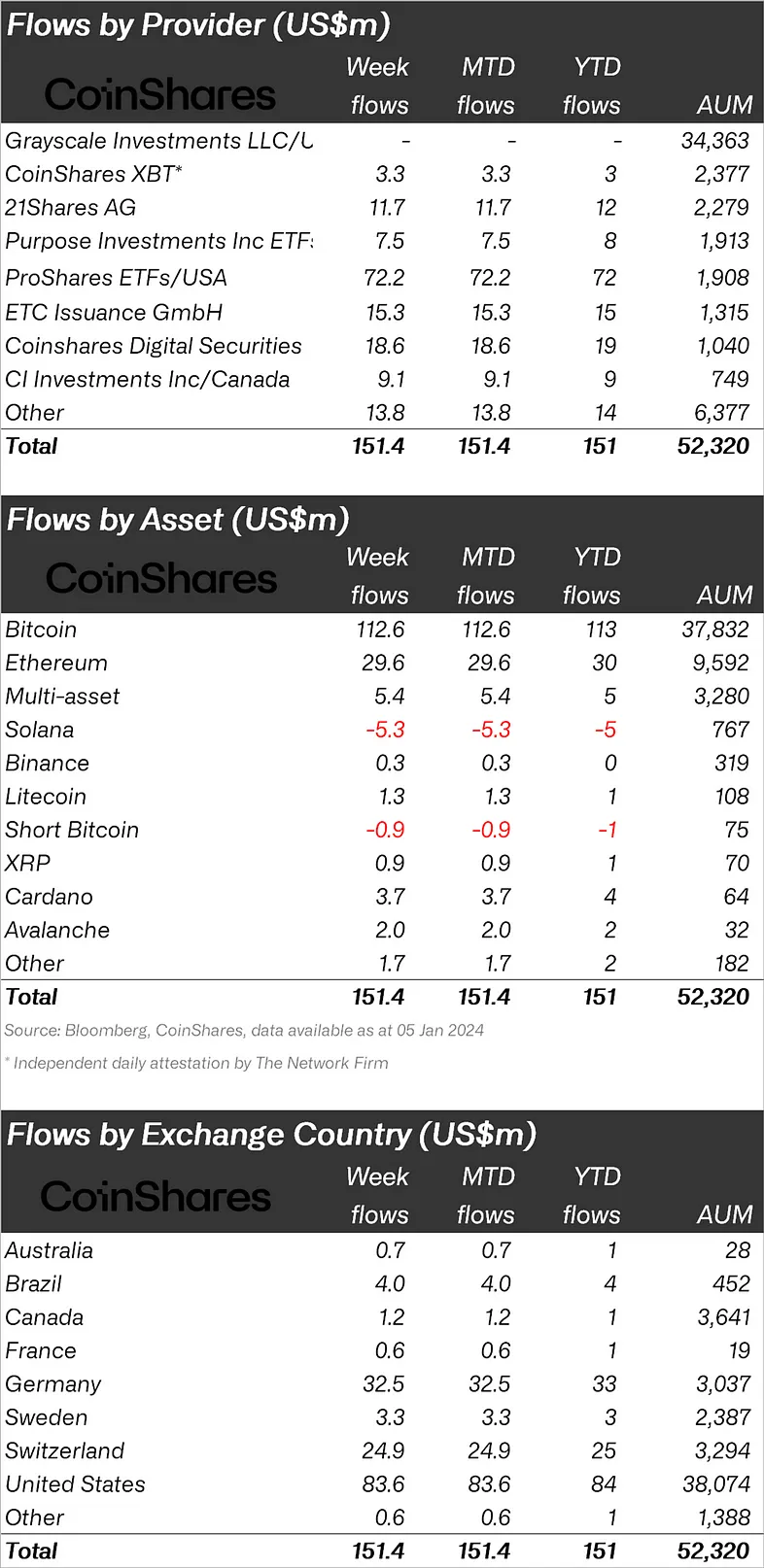

At this point, CoinShares said that there was a total of $151 million inflow to cryptocurrency investment products in the first week of 2024.

“Cryptocurrency investment products saw total inflows of US$151 million in the first week of 2024, with 55% of inflows coming from US exchanges, despite no spot-based ETFs having yet been launched in the US.”

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an inflow of $112.6 million last week, the largest altcoin Ethereum (ETH) saw an inflow of $29.6 million.

There were outflows in the Bitcoin Short fund, which was indexed to the decline of BTC, and an outflow of $0.9 million was observed.

When we look at altcoins, we saw that there were generally inflows. At this point, XRP experienced an entry of $0.9 million, Cardano (ADA) $3.7 million, Litecoin (LTC) $1.3 million and Avalanche (AVAX) $2 million.

In the face of these inflows, Solana (SOL), which was the focus of institutional investors in 2023, experienced an outflow of 5.3 million dollars.

“Bitcoin took the largest share of inflows. If many people truly believed that the launch of an ETF in the US would be a “buy the rumor, sell the news” event, we would certainly expect to see more short Bitcoin funds.

Ethereum has seen total inflows of $29 million, with inflows totaling $215 million over the last 9 weeks, indicating a marked reversal in sentiment. Solana, on the other hand, didn't have a great start to the year with an exit of $5.3 million.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 83.6 million dollars.

After the USA, Germany ranks second with 32.5 million dollars; Switzerland ranked third with 24.9 million dollars.

*This is not investment advice.