While Bitcoin continues to maintain $ 25,000, CoinShares published its weekly cryptocurrency report.

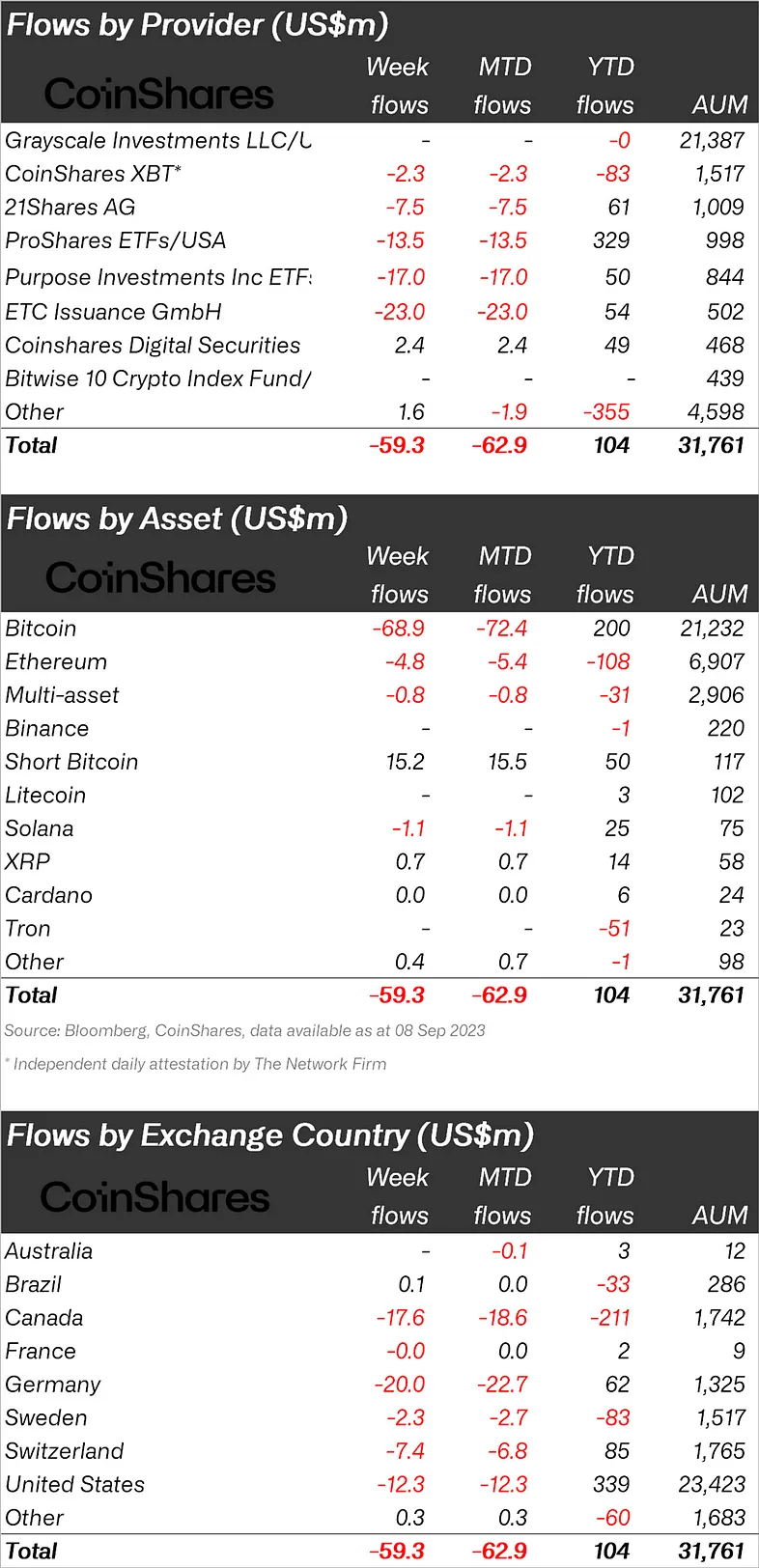

CoinShares stated that there were outflows of $59.3 million in cryptocurrency products last week.

“Cryptocurrency investment products saw total outflows of $59 million last week, with total outflows now reaching $294 million.”

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $68.9 million last week, the largest altcoin Ethereum (ETH) also saw an outflow of $4.8 million and Solana (SOL) $1.1 million.

In the Bitcoin Short fund, which is indexed to the fall of BTC, there was an entry of $ 15.2 million.

In response to last week's outflows, XRP experienced an inflow of $0.7 million.

“Bitcoin suffered the most last week, seeing outflows of $69 million, while the Bitcoin short fund saw its largest single-week inflow totaling $15 million since March 2023.”

Looking at the regional fund inflows and outflows, it was seen that there was a general outflow in the countries.

Germany ranked first with a fund outflow of $20 million, while Canada ranked second with $17.6 million, while the United States was third with $12.3 million.

Germany, Canada and the USA were followed by Switzerland with 7.4 million dollars; Sweden followed with $2.3 million.

Against these outflows, Brazil experienced an inflow of 0.1 million dollars.

*Not investment advice.