As it has done for a long time, the FED did not change interest rates in June and left them constant at 5.25-5.50 percent. Following the June decision, markets are now waiting for the July interest rate decision.

When will the July FED Interest Rate Decision be announced?

While the fifth FED interest rate decision of 2024 is expected to have an impact on gold, dollar, oil, Bitcoin (BTC) and crypto currencies, the FED will announce its July decision on July 31, that is, today at 21:00 CET.

After the decision, FED President Jerome Powell will make a statement at 21.30 GMT.

In Which Direction Are Expectations Concentrating?

While the expectations in the market are again focused on the FED keeping interest rates constant, the statements of FED Chairman Jerome Powell are also of great importance.

The FED, which has been struggling with inflation for a long time, is expected to start reducing interest rates in September following the positive economic data it has received in recent months.

While experts argue that a rate cut is almost inevitable despite Powell's reluctance, Glenende investment strategy manager Michael Reynolds said he predicted markets would price in a rate cut in September regardless.

Speaking to CNBC, Michael Reynolds stated that his expectations today are for interest rates to remain unchanged.

“However, there will be a lot of focus on FED Chairman Powell's statements after the meeting. Powell's statement may not make a clear statement about the interest rate cut in September.

Because they do not want investors to start pricing an interest rate cut that will take place in September, but even if they do not want it, this interest rate cut and that pricing will happen. They have no other choice.

They need to understand that opening the door to a rate cut is probably the best thing for them right now. However, the markets are already very excited about this, pricing it with almost 100% probability. They just need to move in that direction.”

Finally, Reynolds added that they expect the FED to cut interest rates in each of the remaining three meetings starting from September.

Barclays analysts also stated in a note sent to their clients that the FED will not be able to defy market expectations and will open the door to a discount for September.

FED May Soften Its Rhetoric!

Goldman Sachs economist David Mericle also said he expects the FED to soften its previous statements and say it now just needs “a little more confidence” to start lowering interest rates.

“The Fed may tone down its rhetoric today that it will 'not cut interest rates until it gains more confidence that they are moving sustainably toward 2 percent.'

In addition, the latest statements of FED officials show that they will remain on hold at today's meetings, but that we are approaching the first interest rate cut.

“The main reason why the FOMC is closer to cutting interest rates is the positive inflation data in May and June.”

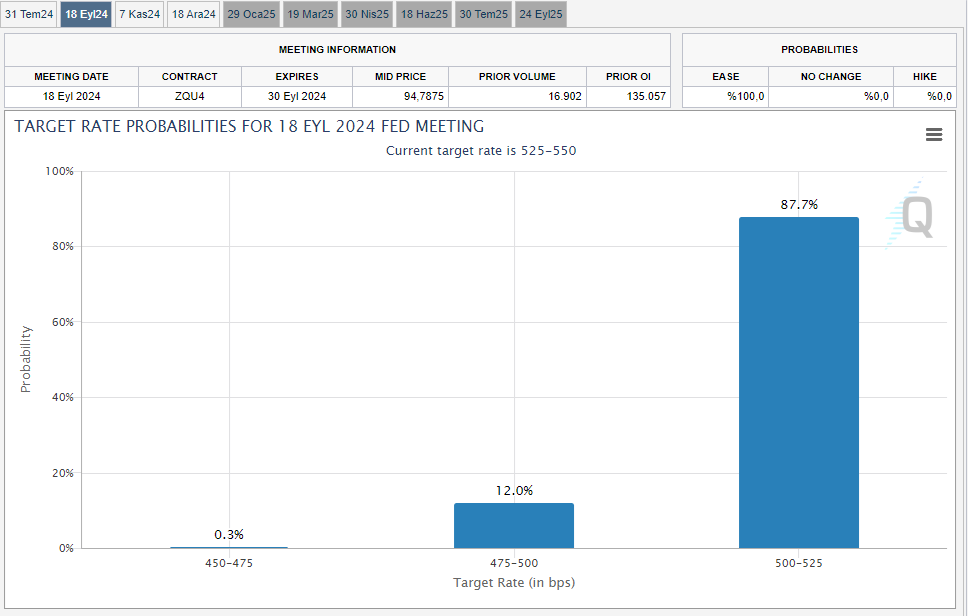

According to CME FedWatch Tool data, which is closely followed in the market, the probability of the FED lowering the interest rate this evening is currently priced at 3.1%, while the probability of keeping it constant is priced at 96.9%.

However, the probability of the FED making a cut at the next meeting on September 18 is priced at almost 100%. The part that differed was the issue of how much the interest rate reduction would be.

*This is not investment advice.