While the rally in cryptocurrencies from the beginning of the year made investors happy, we see that the momentum weakened with the second quarter.

With the decrease in trading volumes on the stock exchanges, the upward trend in Bitcoin left its place to a horizontal and downward market.

While the decrease in trading volumes allows for stronger movements (up or down) to be seen with less liquidity, the volume drops are considered to be related to the regulatory pressure in the USA.

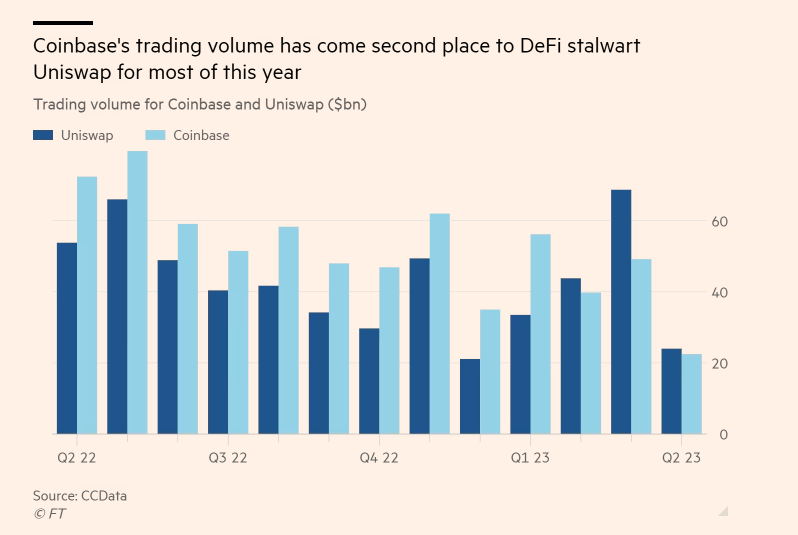

According to the report prepared by the Financial Times, according to the data obtained from CCData, it was stated that Coinbase's transaction volumes have dropped seriously since the beginning of the year and there has been no increase in volumes in line with the price.

According to data from CCData, transaction volume on Coinbase has lagged behind Uniswap in the last 3 months. In the process, Uniswap's trading volume has surpassed many Coinbase competitors, including OKX and Kraken.

It is considered that the decrease in Coinbase's trading volume may be related to the pressure of the SEC and CFTC on cryptocurrencies. Investors are hesitant to trade on these exchanges, fearing that if the pressure continues, the cryptocurrency industry will leave the United States.

With the effect of this regulatory pressure in the USA, it is seen that interest in decentralized exchanges has increased.

JP Morgan analyst Nikolaos Panigirtzoglou said regulatory pressure in the US has set a new, slow-moving background trend on decentralized exchanges.

“I see a high probability of losing against decentralized exchanges or foreign exchanges for all centralized exchanges in the US due to regulatory pressure. This will be a slow-moving background trend rather than a sudden transition.”

The above data from CCData shows that the trend in question has started to form as of 2023.

Further regulatory pressure in the coming period may accelerate the shift of US investors towards decentralized exchanges. This may contribute to the positive separation of decentralized exchange tokens from the market.