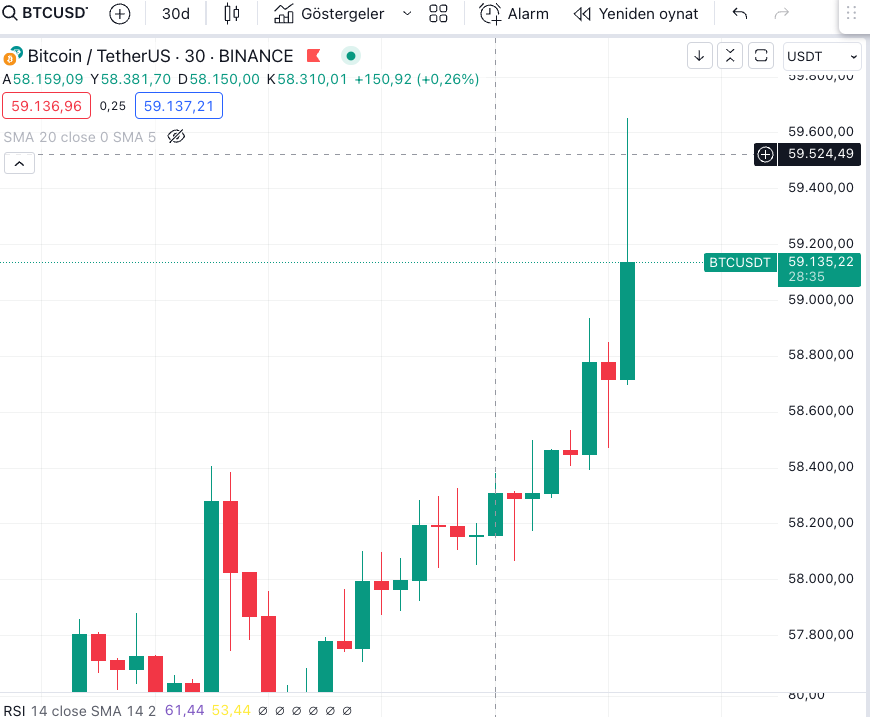

The leading cryptocurrency Bitcoin has fallen to $ 53,500 in recent weeks due to sales pressure caused by Mt.Gox refunds and German government sales. However, with the upward momentum that started over the weekend, BTC rose above $ 59,000 this week.

While BTC moved above $ 58,000, critical inflation data expected from the USA and applications for unemployment benefits were announced.

Here is the announced data:

Consumer Price Index Monthly: Announced -0.1% Expected 0.1% – Previous 0.0%

Consumer Price Index Annual: Announced 3.0% – Expected 3.1% – Previous 3.3%

Core Consumer Price Index Monthly: Announced 0.1% – Expected 0.2% – Previous 0.2%

Core Consumer Price Index Annual: Announced 3.3% – Expected 3.4% – Previous 3.4%

Applications for Unemployment Benefits: Announced 222k – Expected 236k – Previous 238k

The consumer price index is an important variable used to measure changes in consumer purchasing trends and US inflation.

A higher than expected value means a positive/bull market for the USD, and a lower than expected value means a negative/bear market for the USD.

First Reaction of Bitcoin and Dollar After CPI Data!

*This is not investment advice.