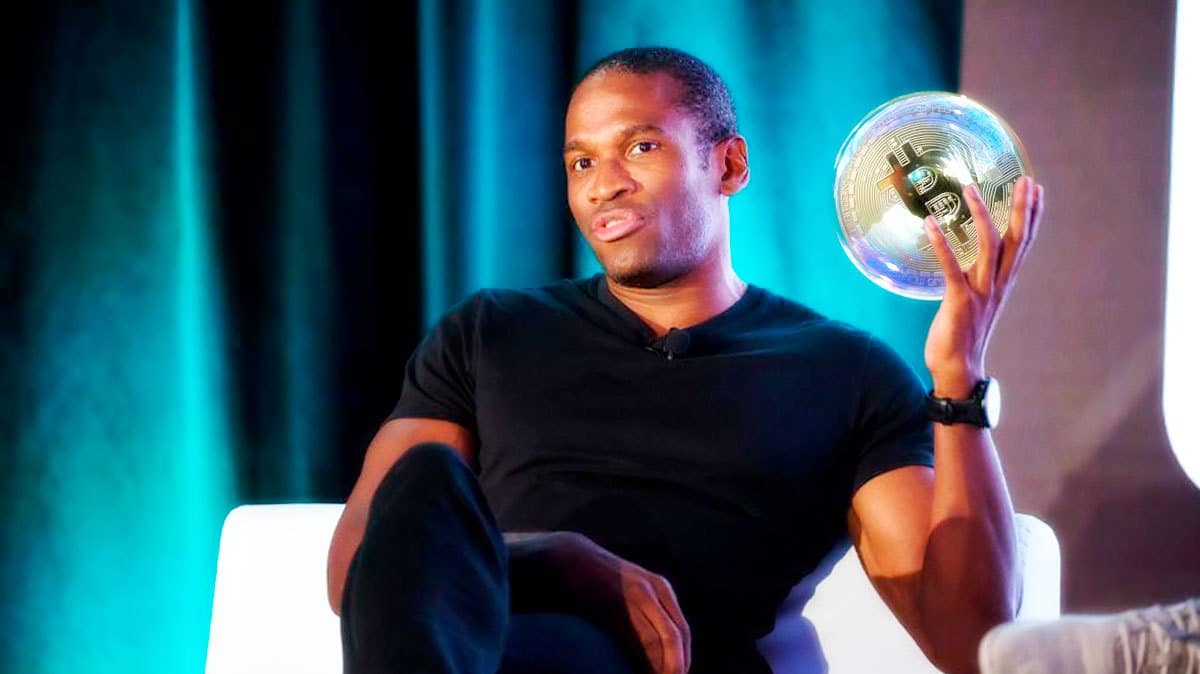

Criticizing the current monetary policy of the United States, former BitMEX CEO Arthur Hayes published a new article and said that Bitcoin could rise if the FED lowers interest rates.

Hayes stated that the US economy does not actually need to lower interest rates, and he thinks that these interest rate cuts will not last long and will only be a short-term incentive.

At this point, Arthur Hayes said in his article that many people see the FED's interest rate cuts as a sign of a possible recession.

If these recession fears prove true, the Fed could print significant amounts of money, which could increase inflation, according to Hayes.

This could ultimately increase the value of Bitcoin due to its limited supply.

Hayes lastly stated that global central banks, including the FED, are turning to interest rate cuts without reaching inflation targets and said that this is support for the rise of BTC and cryptocurrencies.

“I'm a crypto guy, I don't do shows. So I don't know if the stocks are going to go up or not.

Some fear a recession in the US and therefore global markets after the Fed cuts interest rates.

That may be true. If the Fed were to cut interest rates when inflation was above target and growth was strong, and there was actually a recession in the US, imagine what they would do. They would accelerate money printing and significantly increase the money supply.

This leads to increased inflation.

But for assets with limited supply, like Bitcoin, it will provide a lightning-fast rally.”

*This is not investment advice.