FED announced the interest rate decision, which is closely followed by cryptocurrency markets as well as traditional markets.

According to last minute information, the FED did not increase the interest rate and kept it constant between 5.25 and 5.5%.

The expectation was that interest rates would be kept constant.

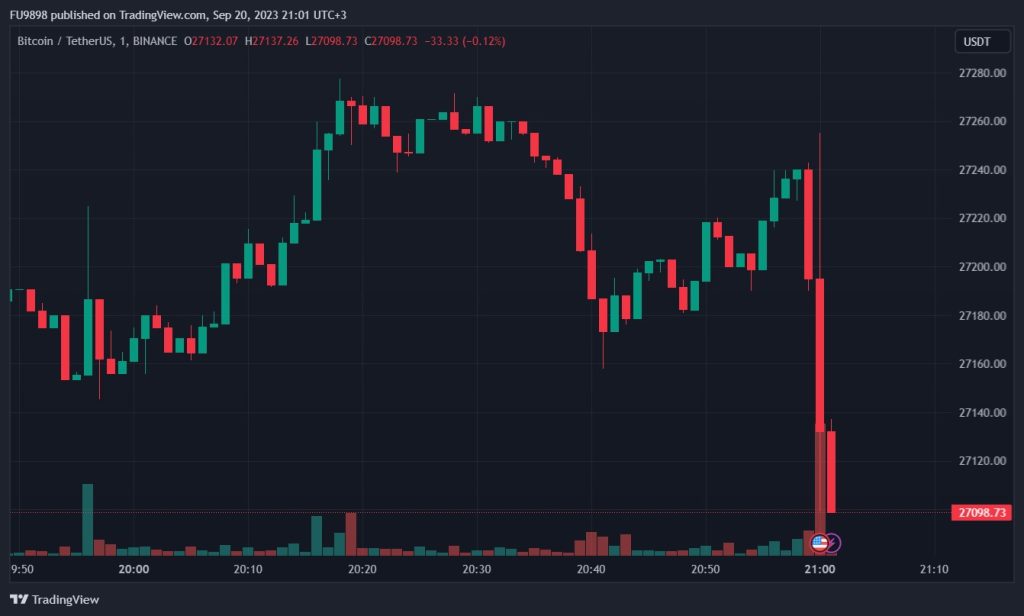

Bitcoin first reacted to the interest rate decision as follows:

- 12 officials predict another increase this year, while 7 remain pending.

- FED officials expect to keep interest rates higher in 2024 and 2025 for longer than June forecasts.

- Most FED officials predict another 25 basis point interest rate increase in 2023.

- The FED expects the policy rate to be 50 basis points higher than predicted in June by 2025.

- FED officials foresee inflation as 3.3% at the end of 2023, 2.5% at the end of 2024, and 2.2% at the end of 2025.

- FED officials estimate core inflation as 3.7% at the end of 2023, 2.6% at the end of 2024, and 2.3% at the end of 2025.

- The FED said that inflation continues to remain high and that the central bank is “extremely careful” against inflation risks.

FED Chairman Jerome Powell will hold a press conference at 21:30 Turkey time. Some important statements are expected to be made at this press conference.

The unemployment rate in the USA rose to 3.8% in August, reaching the highest level since February 2022. June and July added 110,000 fewer jobs to the economy than first reported, suggesting the job market is not as strong as initially thought.

Still, the August increase in the unemployment rate, from 3.5% the previous month, reflected an influx of more people looking for work. There were 187,000 more people employed in the United States in August than in July, according to a separate survey by the U.S. Department of Labor.

*This is not investment advice.