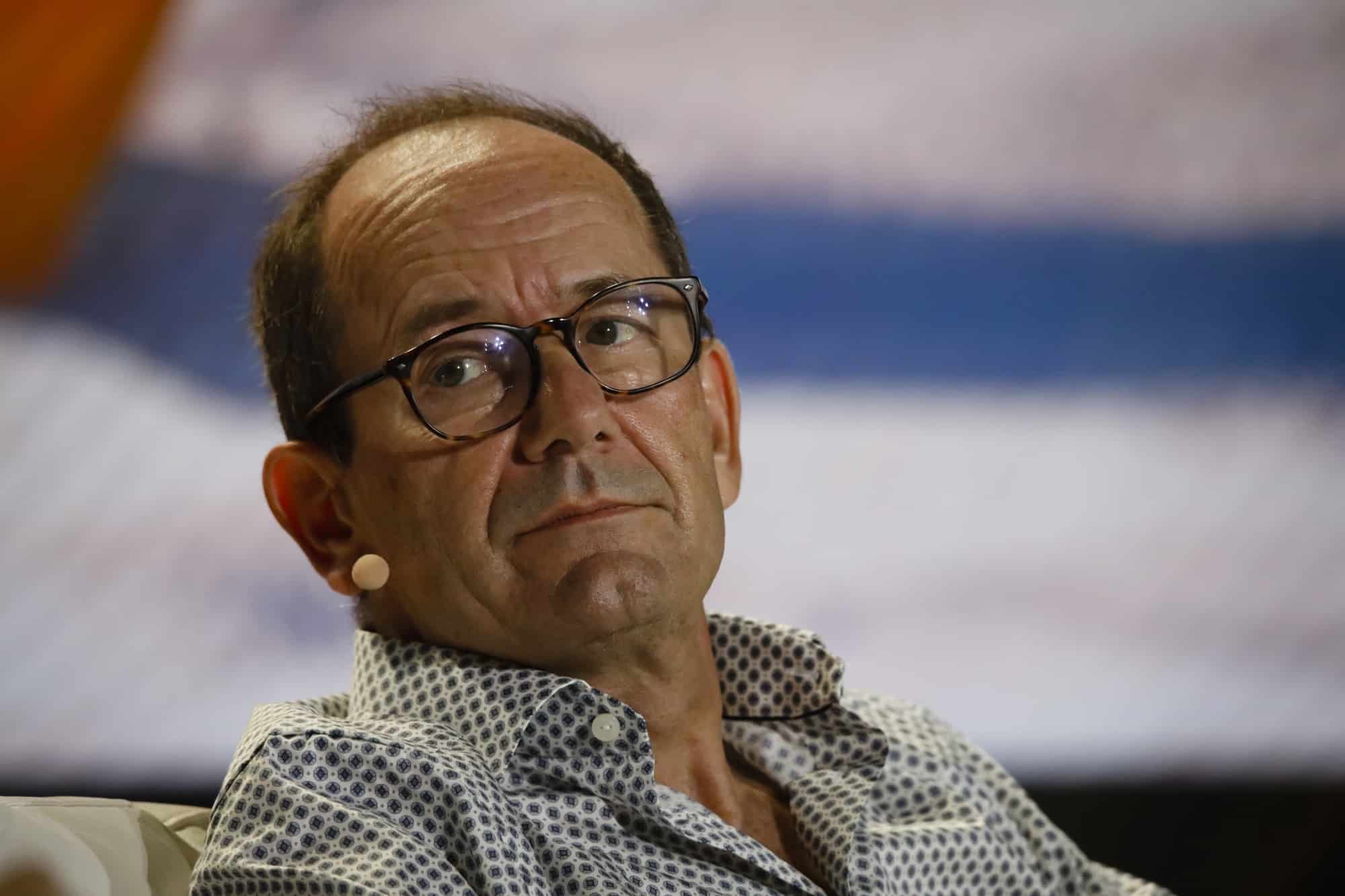

Fred Thiel, CEO of Marathon Digital, one of North America's largest Bitcoin (BTC) mining companies, recently shared his views on the Bitcoin halving, which is expected to take place in March 2024.

A halving is defined as an event that reduces the amount of new BTC created by the network every 10 minutes by half, introducing a supply shock that some analysts believe will increase the price of the coin.

Thiel Says Bitcoin Halving Will Have No Effect on the Market

However, Thiel disagrees with this view. In a recent interview, Thiel said he doesn't think the reduction in supply will have a significant impact on the market. He also criticized the technical analysis and charting methods used by some traders and influencers to predict Bitcoin's price movements based on historical patterns.

Thiel argued that as a miner it is necessary to be optimistic and hope for the best, but also prepare for the worst. He stated that if the dollar collapses or inflation increases, Bitcoin could benefit as a store of value and a hedge against the depreciation of fiat currencies.

But if that doesn't happen, according to Thiel, Marathon has a large stash of BTC to sell for a while to cover its operational costs and maintain profitability.

The company's corporate treasury holds 13,000 BTC worth approximately $335 million at current prices.

*This is not investment advice.