Bitcoin is consolidating in a narrow range as it continues to be negatively affected by the debt ceiling problems in the US.

Publishing its weekly crypto money report, Coinshares stated that fund outflows in crypto money products continued in the fifth week.

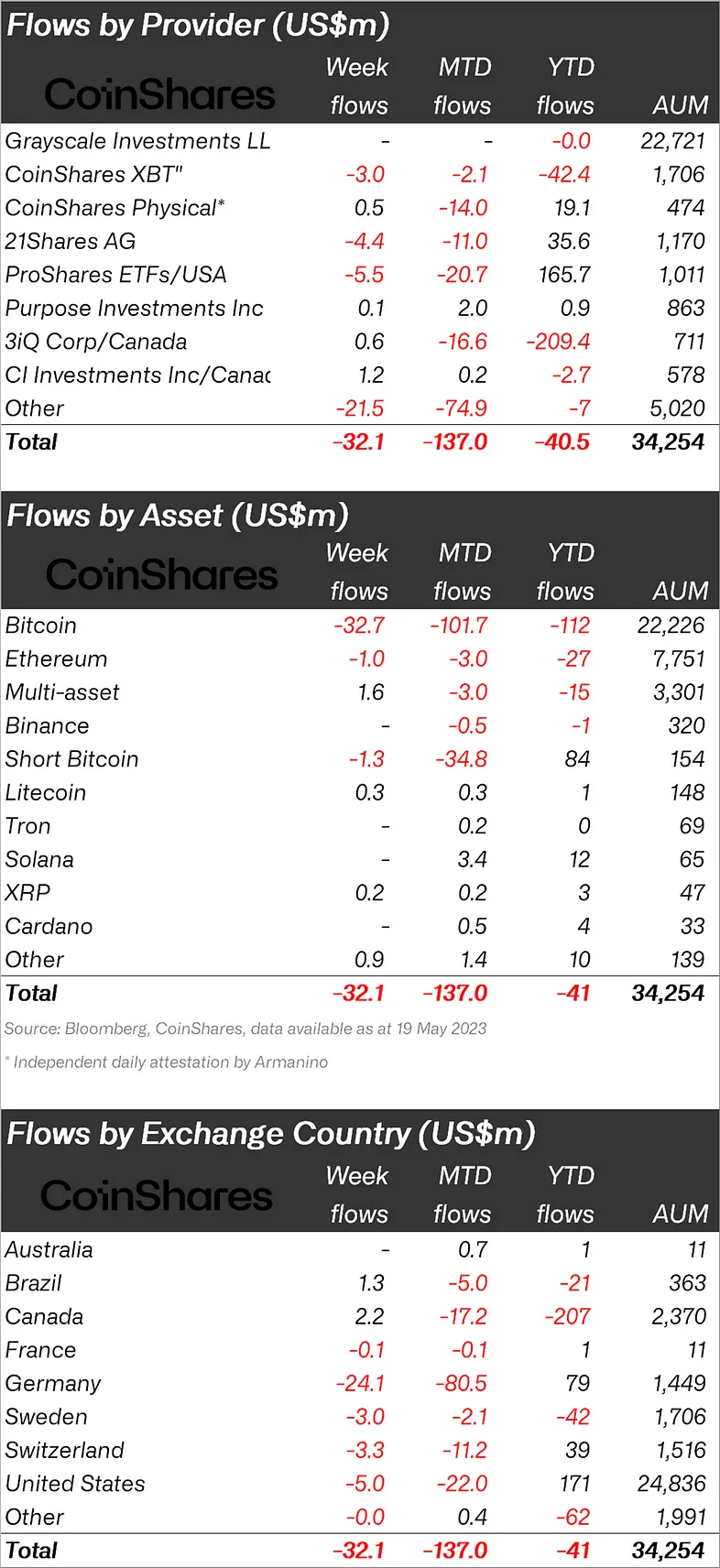

Stating that there was a total outflow of $32 million in crypto products last week, Coinshares wrote:

“Cryptocurrency investment products saw a total outflow of $32M, representing the 5th consecutive week of outflows of $232M.”

Looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While Bitcoin (BTC) experienced an outflow of $ 32.7 million last week, the largest altcoin Ethereum (ETH) also saw an outflow of $ 1 million.

There was an outflow of $ 1.3 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

“The outflows of around $33 million in Bitcoin represented most of the negative sentiment this week, as they did in the last 5 weeks.

Altcoins other than Ethereum ($1 million outflows) have seen inflows, most notably Ripple and Litecoin."

Ripple (XRP) $ 0.2 million, Litecoin (LTC) $ 0.3 million entry in the face of the exits experienced in Ethereum.

Looking at the regional fund inflows and outflows, Germany ranked first with a fund outflow of 24.1 million dollars, while the USA ranked second with 5.0 million dollars, and Switzerland took the third place with 3.3 million dollars.

Germany, USA and Switzerland were followed by Sweden with 3.0 million dollars and France with 0.1 million dollars.

Against these outflows, it was seen that there was an inflow of 1.3 million dollars in Brazil and 2.2 million dollars in Canada.

*Not investment advice.