Pedro Hererra, research manager of DappRadar, the common market platform for applications operating in the decentralized digital world, claimed that under the banking crisis and regulation pressures that have occurred in recent weeks, traditional financial institutions can direct their customers to DeFi applications.

Participating in the program of a crypto media outlet, Herrera emphasized that a cyclically advantageous environment has emerged for DeFi:

“Decentralized finance offers a more liberal environment for investors to manage their assets. The resilience of autonomous DeFi initiatives to government pressure could lead to increased interest in the field.”

DeFi TVL Value Increases!

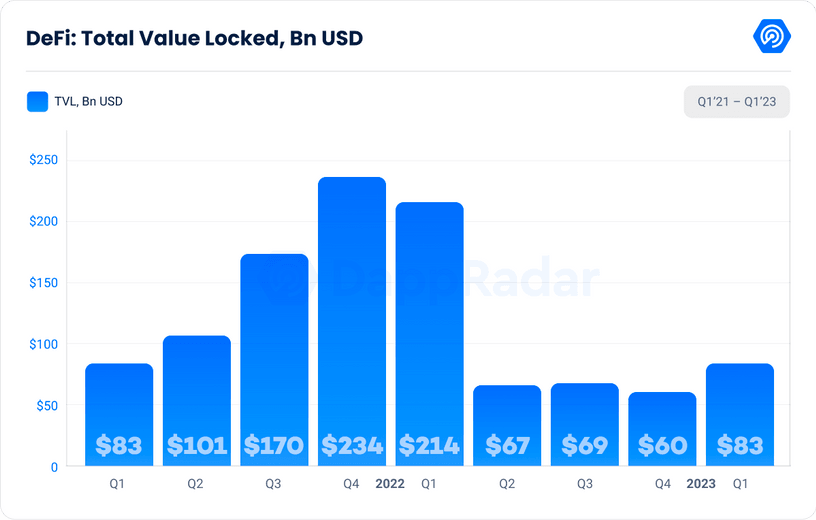

According to a recent report by DappRadar, the total value of cryptocurrencies locked on DeFi platforms increased by 37% to $83 billion in the first quarter of 2023.

Even though the TVL value, which was locked in decentralized finance platforms, reached $234 billion in the first months of 2022, breaking a record, the bear season caused a great loss to the sector.

Arbitrum Made a Big Impact!

Crypto experts mentioned Arbitrum, which airdropped in the past period, in their research report. Investors showed great interest in ARB, the native token of the Ethereum layer-2 solution. The token distribution played an important role in raising the total locked value.