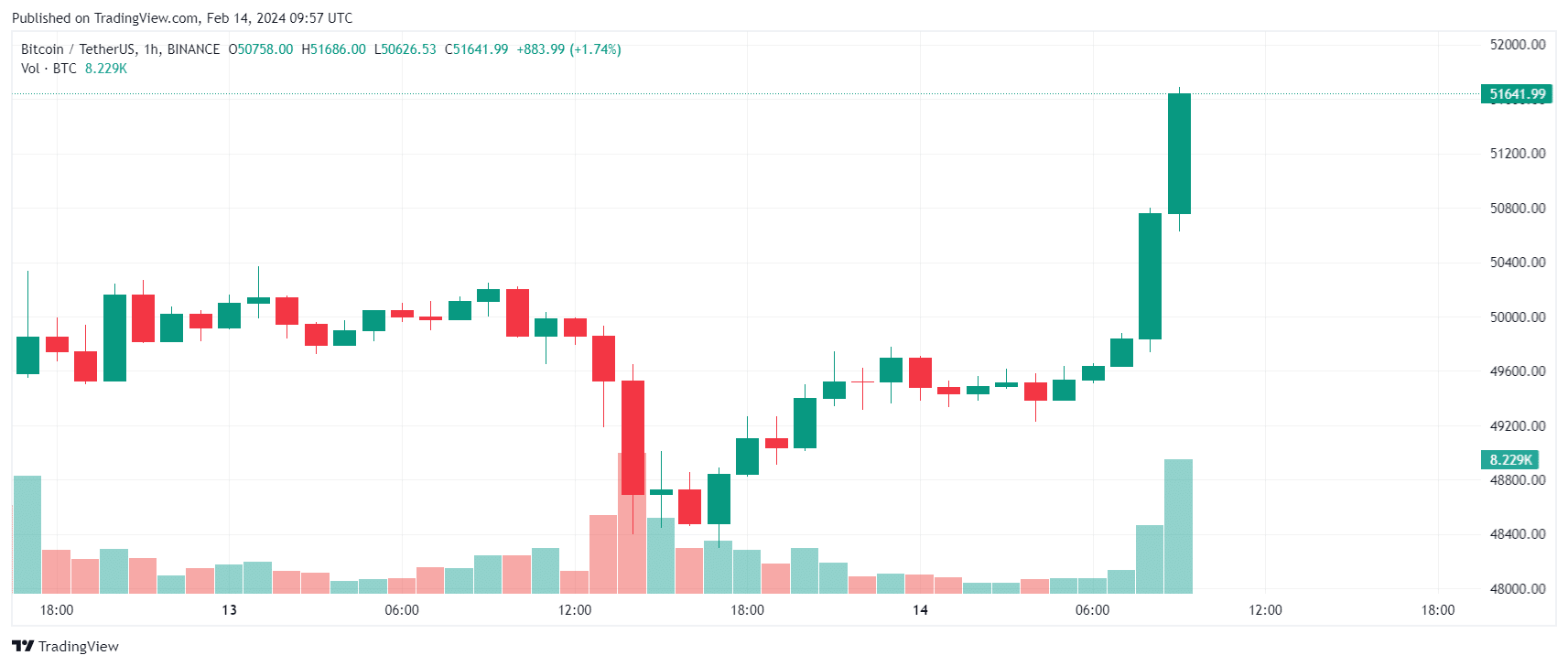

Bitcoin, the leading cryptocurrency, continues its rise today, although it took a short break in its rise with the US inflation data announced yesterday.

At this point, BTC surpassed $51,000, reaching a market value of $1 trillion for the first time since December 2021.

This increase comes amid continued bullish sentiment that Bitcoin's growth is continuing, with options traders betting that prices will rise as high as $75,000 in the coming months.

Analysts stated that call options at this level indicate that investors have bullish expectations, while bulk call options at high levels reflect the upward trend among experienced investors. At this point, analysts are divided into two, some think that the rise will continue, while others warn investors that a correction may come from these levels.

While this rise in Bitcoin also stimulated altcoins, this rise left bearish investors expecting a decline in a tailspin.

Because, according to data from Coinglass, $217 million in leveraged positions were liquidated in the last 24 hours.

Of these, $125 million consisted of short positions, while $92 million consisted of long positions.

Specifically, while $920 million worth of short positions in Bitcoin were liquidated, BTC was followed by Ethereum (ETH) and Solana (SOL).

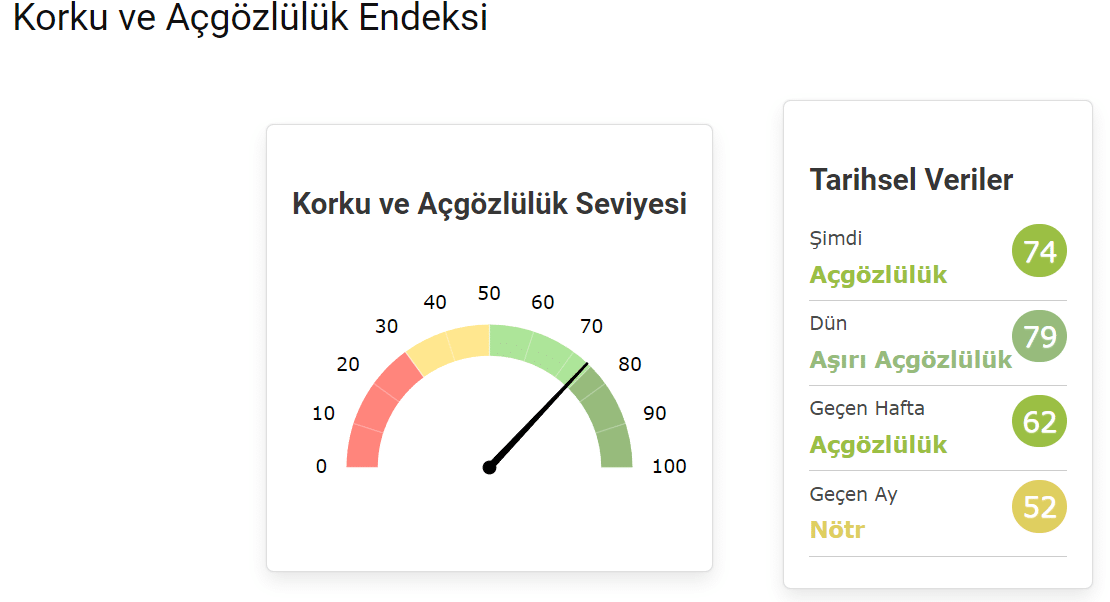

While the rise in Bitcoin and altcoins continues, the popular analysis company, which tries to measure the emotional reflexes of cryptocurrency investors, calculates the “fear and greed index” based on market volatility, market volume acceleration, social media interest, Bitcoin dominance chart and the trends of research types about cryptocurrencies on the internet. ” calculated today as 74 points out of 100.

*This is not investment advice.