This week has been an important week for Bitcoin (BTC) and cryptocurrencies. Because this week, US inflation data and PPI data, which are closely followed in BTC, were announced.

Even though the US inflation data came in below expectations, BTC experienced a sharp decline afterwards. However, Bitcoin recovered afterwards and rose again to the level of $ 37,000.

While analysts state that they expect the rise in BTC to continue at this point, BTC has experienced a 2.25% increase in the last 24 hours.

Although Bitcoin experienced a nice rise in the last 24 hours, the sharp decline it experienced during the week caused the weekly rise to remain at low levels.

When we look at the weekly change of the largest altcoin Ethereum (ETH), it is seen that it is better than BTC and there is a 6.8% increase on a weekly basis.

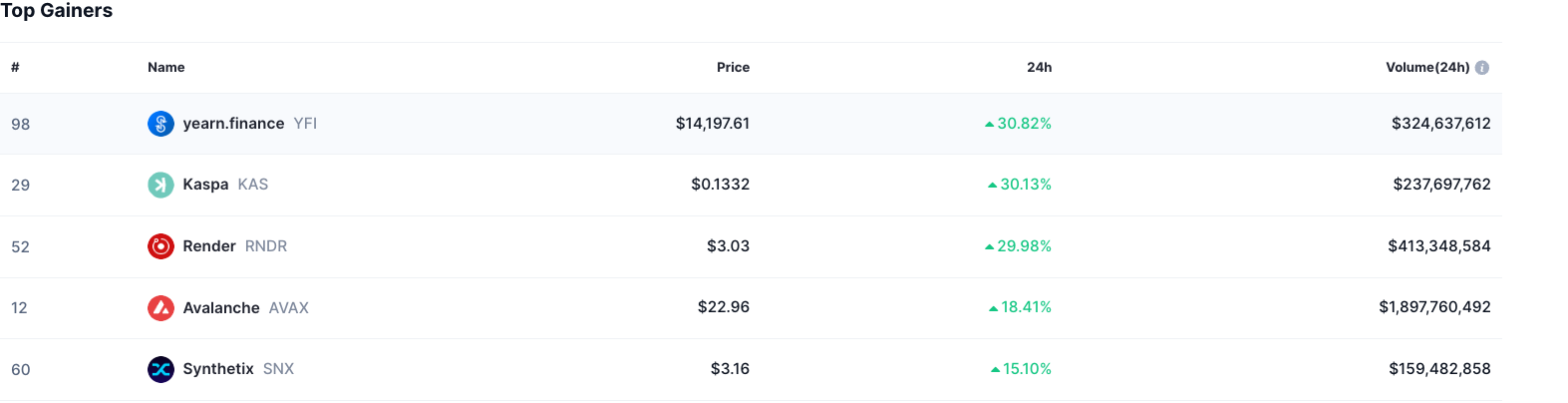

At this point, according to Coinmarketcap data, when we look at the altcoins that gained the most in the last 24 hours, Synthetix (SNX) ranked 5th with an increase of 17%, Avalanche (AVAX) ranked 4th with an increase of 20.1%, and Kaspa (with an increase of 28.9%) ranked 3rd. KAS), Render (RNDR) ranked second with an increase of 30.5%, and yearn.finance (YFI) ranked first with an increase of 32.2%.

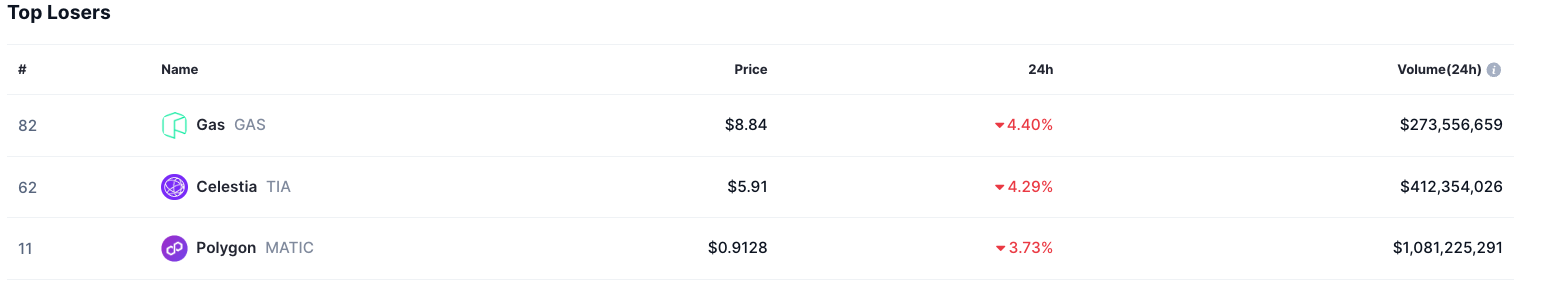

According to Coinmarketcap data, the biggest losers in the last 24 hours are as follows: Polygon (MATIC) in the 3rd place with a loss of 3.73%, Celestia (TIA) in the 2nd place with a loss of 4.29% and Gas in the 1st place with a loss of 4.4%. (GAS) is available.

The “fear and greed index” calculated by the popular analysis company, which tries to measure the emotional reflexes of cryptocurrency investors, based on the trends of market volatility, market volume acceleration, social media interest, Bitcoin dominance chart and types of research on cryptocurrencies on the internet, is today 70 points out of 100. It was calculated as .

*This is not investment advice.