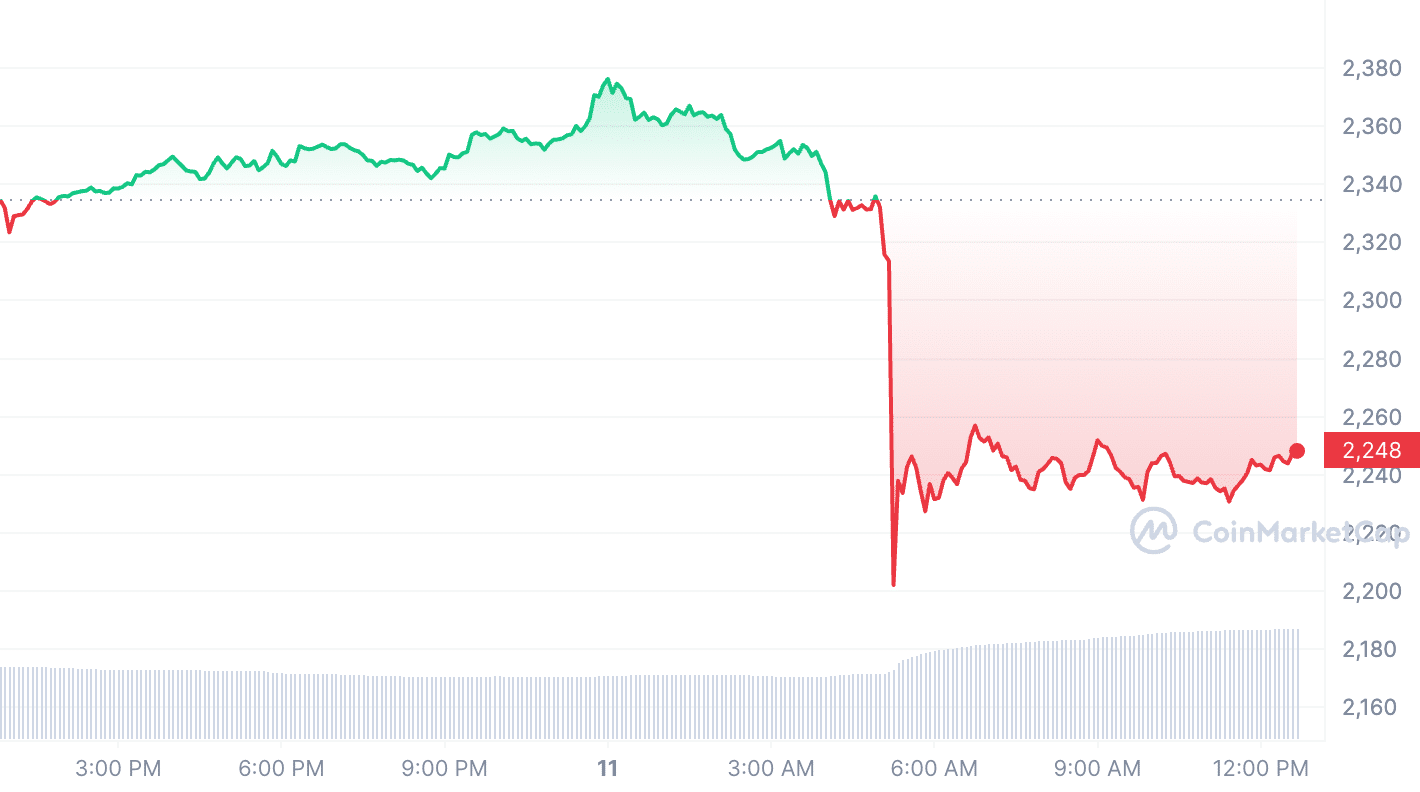

Ethereum, the second largest cryptocurrency by market value, experienced a sudden decline today with the influence of Bitcoin, deleting long positions worth millions of dollars in a few minutes.

Ethereum Suffered a Sudden Drop

The sudden price move, the biggest price swing for Ethereum in nearly two years, triggered a wave of liquidations on leveraged trading platforms where investors used borrowed funds to increase their returns.

According to Bybt data, long positions worth more than $82 million were liquidated in the ETH market, and investors who opened transactions believing that the price would rise had to close their positions at a loss.

The flash crash was likely caused by a combination of factors such as a liquidity crunch and a long squeeze.

A liquidity crunch occurs when there are not enough buyers to absorb the selling pressure in the market, causing the price to drop rapidly until it reaches a level where demand is sufficient.

A long squeeze occurs when the market is overly optimistic about the direction of the price and investors with leveraged long positions are forced to sell to avoid margin calls, while a slight decline triggers a chain liquidation reaction.

At the time of writing this article, the Ethereum (ETH) price was trading at $ 2,250.

*This is not investment advice.