While Bitcoin dropped to $67,400 due to Mt.Gox transfers, it rose above $68,000 after it was announced that these transfers were not a sale.

At this point, while a general upward expectation prevails in the market, Coinshares published its weekly cryptocurrency report.

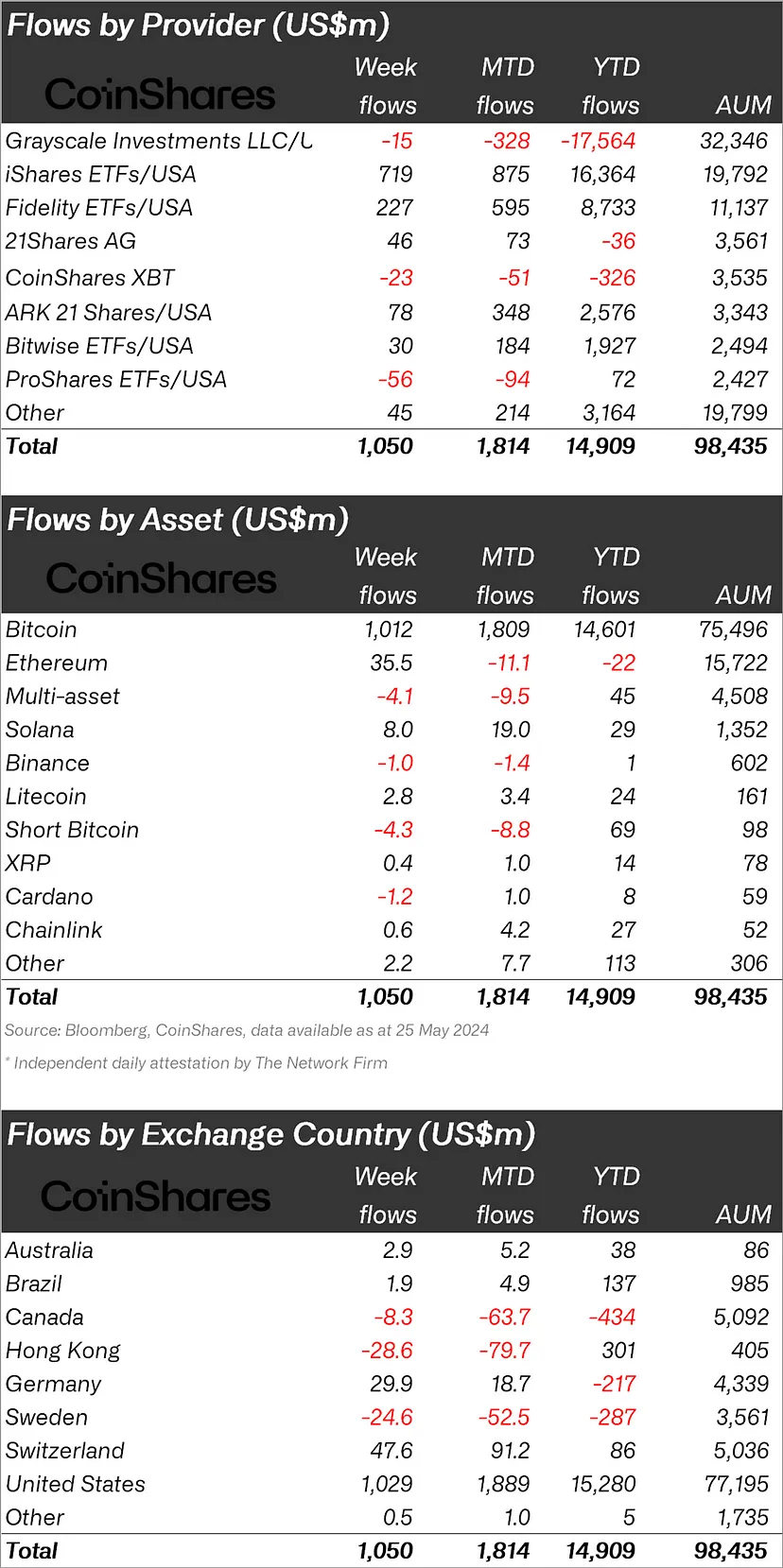

Stating that there was an inflow of $1.05 billion in cryptocurrency investment products last week, Coinshares said that the majority of these inflows were to Bitcoin ETFs, which saw an inflow of $1.01 billion last week.

“Cryptocurrency investment products saw total inflows of $1.05 billion for the third week in a row, with cumulative flows representing an all-time record of $14.9 billion for the year.”

Ethereum (ETH) is Back!

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $1 billion, the largest altcoin Ethereum (ETH) experienced a major turnaround and experienced an outflow of $35.5 million.

The short BTC fund, which is indexed to the decline of Bitcoin, saw an outflow of $4.3 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $ 8 million, Chainlink (LINK) $ 0.6 million, Litecoin (LTC) experienced an inflow of $ 2.8 million, while Cardano (ADA) experienced an outflow of $ 1.2 million.

“The majority of inflows were into Bitcoin ETFs, which saw inflows of $1.01 billion last week, while the short-bitcoin fund experienced outflows of $4.3 million this week.

This shows that sentiment has generally turned positive. This is likely because investors interpreted the FOMC minutes and recent macro data as dovish.

Ethereum saw inflows of $36 million during the week, its highest level since March, likely an early reaction to the approval of ETH ETFs in the US.

“Last week, Solana saw an inflow of $8 million.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 1 billion dollars.

After the USA, Switzerland ranked second with 47.6 million dollars.

Against these inflows, Hong Kong received 28.6 million dollars; Sweden, on the other hand, experienced an outflow of 24.6 million dollars.

*This is not investment advice.