While Bitcoin, the leading cryptocurrency, exceeded $ 41,000 after a long time after its rise, inflows to cryptocurrency investment products continue.

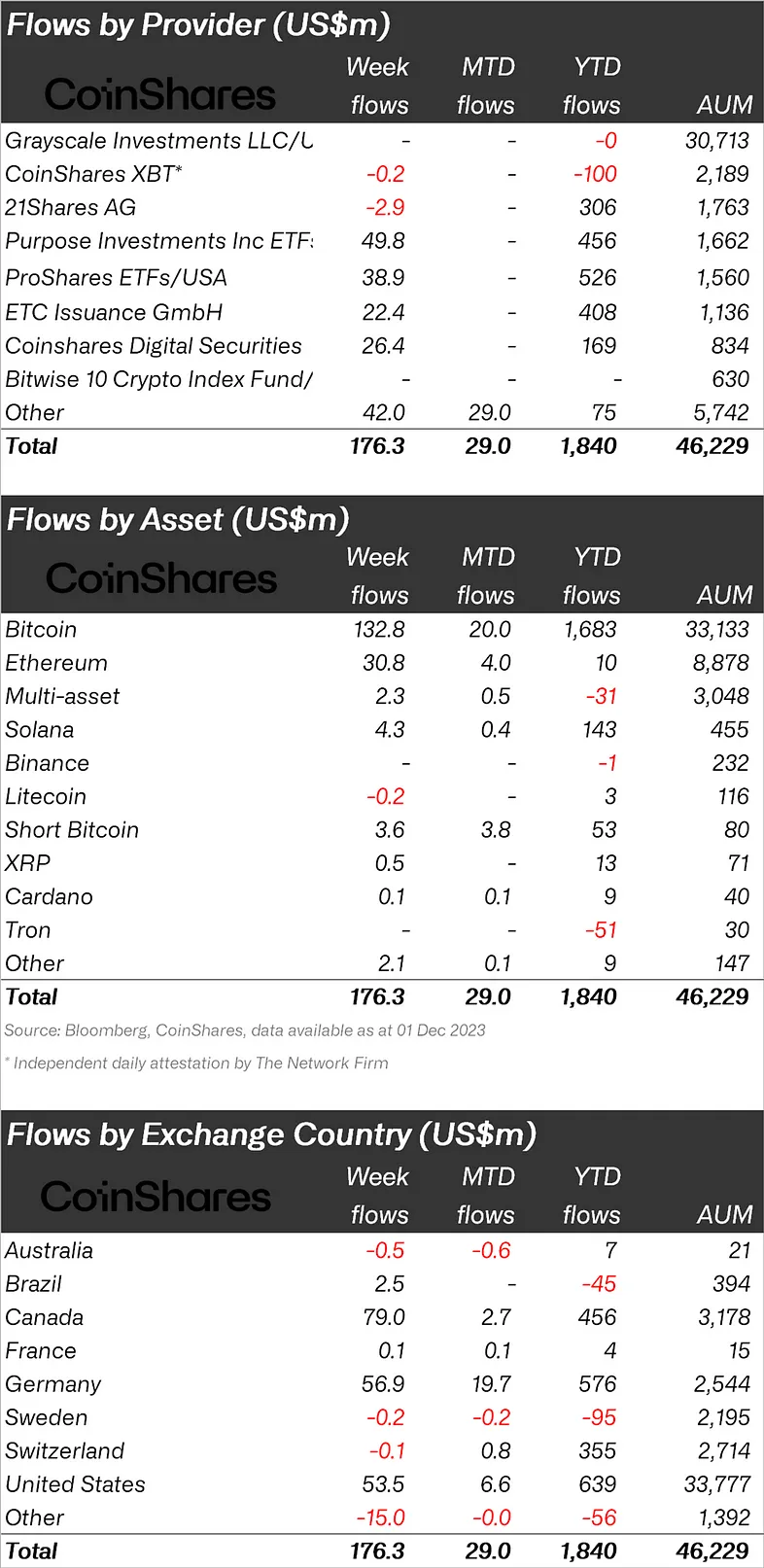

At this point, CoinShares, which publishes its weekly cryptocurrency report, said that there was an inflow of $176 million last week.

“Cryptocurrency investment products reached a total of $176 million last week, bringing the 10-week total to $1.76 billion.

“This is the highest level since the launch of a US futures-based ETF in October 2021.”

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $132.8 million last week, inflows in the largest altcoin Ethereum (ETH) continued this week and saw an inflow of $30.8 million.

The negative sentiment in ETH turned positive with these entries, which shows that investors are interested in ETH.

It was seen that there was an inflow of 3.6 million dollars in the Bitcoin Short fund, which was indexed to the decline of BTC.

When we look at the altcoins, Solana (SOL) continued to inflow with 4.3 million dollars, Cardano (ADA) with 0.1 million dollars, XRP with 0.5 million dollars, while Litecoin (LTC) experienced an outflow of 0.2 million dollars.

“Bitcoin was the crypto with the most inflows, seeing inflows of $133 million. However, the short Bitcoin fund saw inflows of $3.6 million last week, following a 3-week outflow streak.

“Ether saw another inflow of $31 million last week, extending its 5-week inflow streak to $134 million, and for the first time this year net flows were positive at $10 million after a long period of negative sentiment.”

When looking at regional fund inflows and outflows, it was seen that Canada ranked first with an inflow of 79 million dollars.

After Canada, Germany ranked second with 56.9 million dollars; The USA ranked third with 53.5 million dollars.

*This is not investment advice.