While Bitcoin and altcoins continue their rise, Coinshares published its weekly cryptocurrency report.

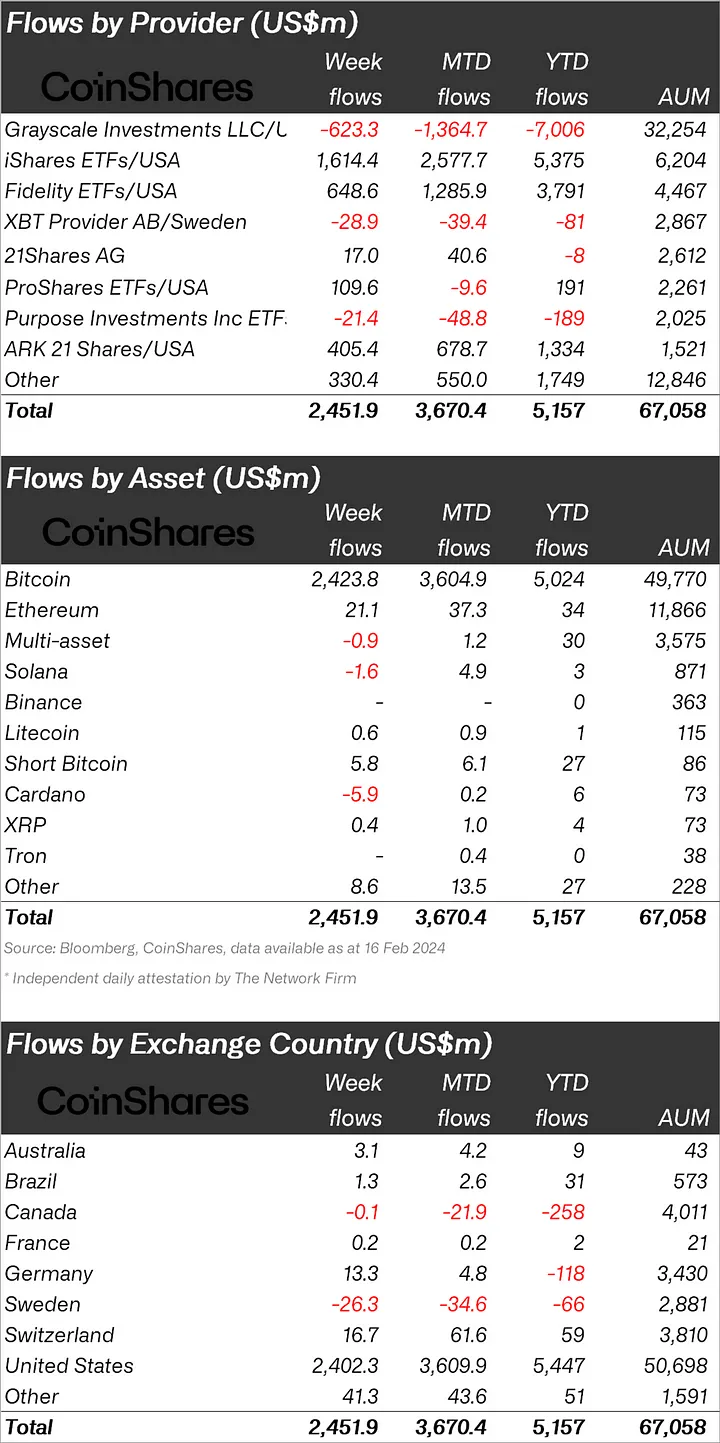

At this point, Coinsares stated that it experienced a record inflow of 2.45 billion dollars into cryptocurrency investment products last week, and announced that the inflows have reached an impressive 5.2 billion dollars since the beginning of the year.

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

BTC experienced inflows of $2.42 billion, representing over 99% of all inflows, while the largest altcoin, Ethereum (ETH), saw inflows of $21.1 million.

The Bitcoin Short fund, which is indexed to the decline of BTC, also experienced an inflow of 5.8 million dollars.

When we look at other altcoins, Litecoin (LTC) experienced an inflow of 0.6 million dollars and XRP experienced an inflow of 0.4 million dollars; Cardano (ADA) had an outflow of $5.9 million and Solana (SOL) had an outflow of $1.6 million.

“Bitcoin saw more than 99% of inflows, but some investors added to short Bitcoin positions, which saw inflows of $5.8 million.

Ethereum also benefited from seeing $21 million worth of inflows. The recent outage at Solana affected sentiment and saw an outflow of $1.6 million.

Avalanche, Chainlink, and Polygon saw inflows of $1 million, $0.9 million, and $0.9 million, respectively, and stood out for consistently seeing weekly inflows this year.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 2.402 billion dollars.

After the USA, Switzerland ranked second with 16.7 million dollars.

Against these inflows, Sweden experienced an outflow of 26.3 million dollars.

*This is not investment advice.