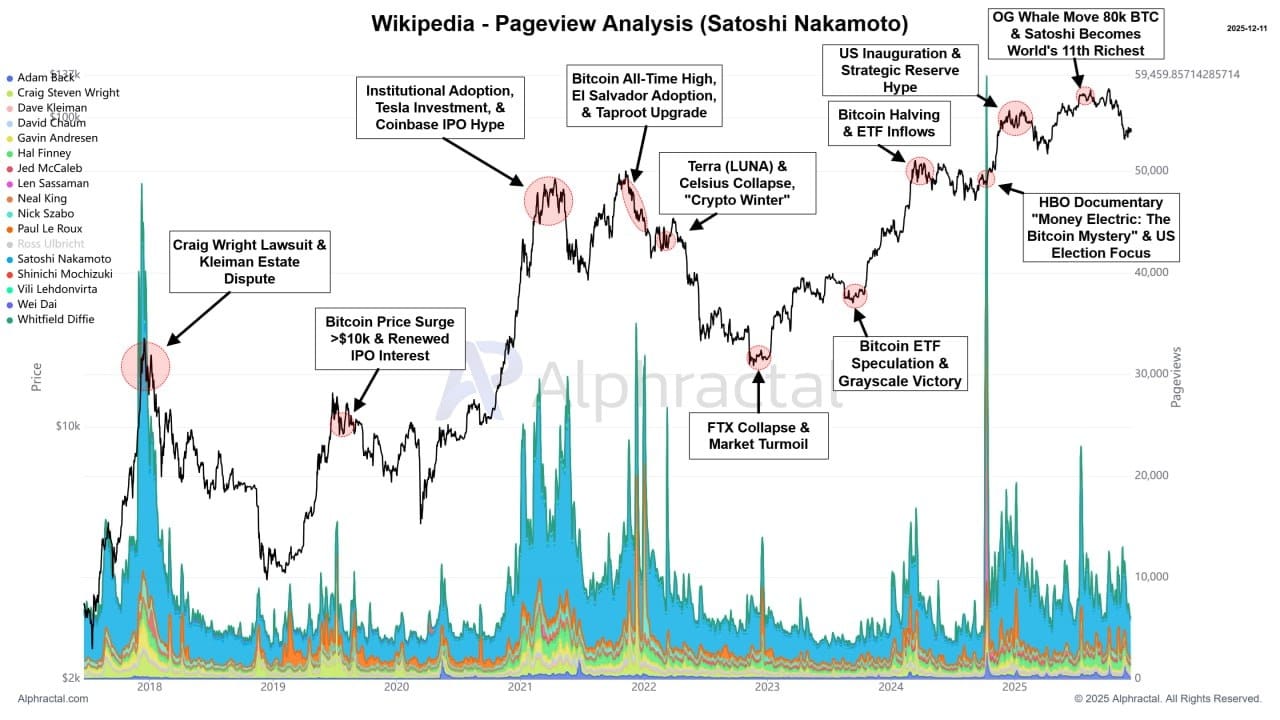

Cryptocurrency analytics company Alphractal has published a noteworthy assessment of how the interest surrounding Bitcoin founder Satoshi Nakamoto intersects with market cycles.

The company compared Wikipedia page view data with BTC price movements to examine a frequently overlooked indicator of investor psychology, and stated that the results revealed a significant relationship between market peaks and troughs.

According to Alphractal's analysis, search interest in Satoshi Nakamoto often peaks during bullish periods, acting as a “bearish signal.” The company stated that such sudden increases in interest typically coincide with periods when market enthusiasm peaks and rallies begin to tire. Examples cited include the legal debates of 2018 and the period of heightened institutional investor interest in 2021 as examples of such peak indicators.

However, Alphractal's research also revealed that some periods of surge in interest gave the opposite signal. A sharp rise in search interest after consolidation following price crashes has historically signaled the formation of a bottom and the end of the market capitulation process. The company cited the panic period following the FTX crash as one of the most prominent examples.

The year 2025 presented an unusual version of this dynamic. Rumors of a US Strategic Reserve and the movement of 80,000 BTC in old wallets reignited global interest, propelling Satoshi Nakamoto into the top 11 richest people in the world. This added a new layer to the relationship between price cycles and the pursuit of knowledge.

Alphractal, in its assessment of the current situation, noted that interest in Satoshi has recently decreased significantly. Whether this decline signifies “market apathy” or is a “silent harbinger of a new narrative” remains unclear. The analysis firm reminded investors that such calm periods in the past have often been precursors to major movements, urging them to closely monitor these indicators.

*This is not investment advice.