While Bitcoin and altcoins started the week in red, the BTC price dropped below $ 61,000.

While wondering whether this decline will continue in the BTC and cryptocurrency markets, Coinshares published its weekly cryptocurrency report.

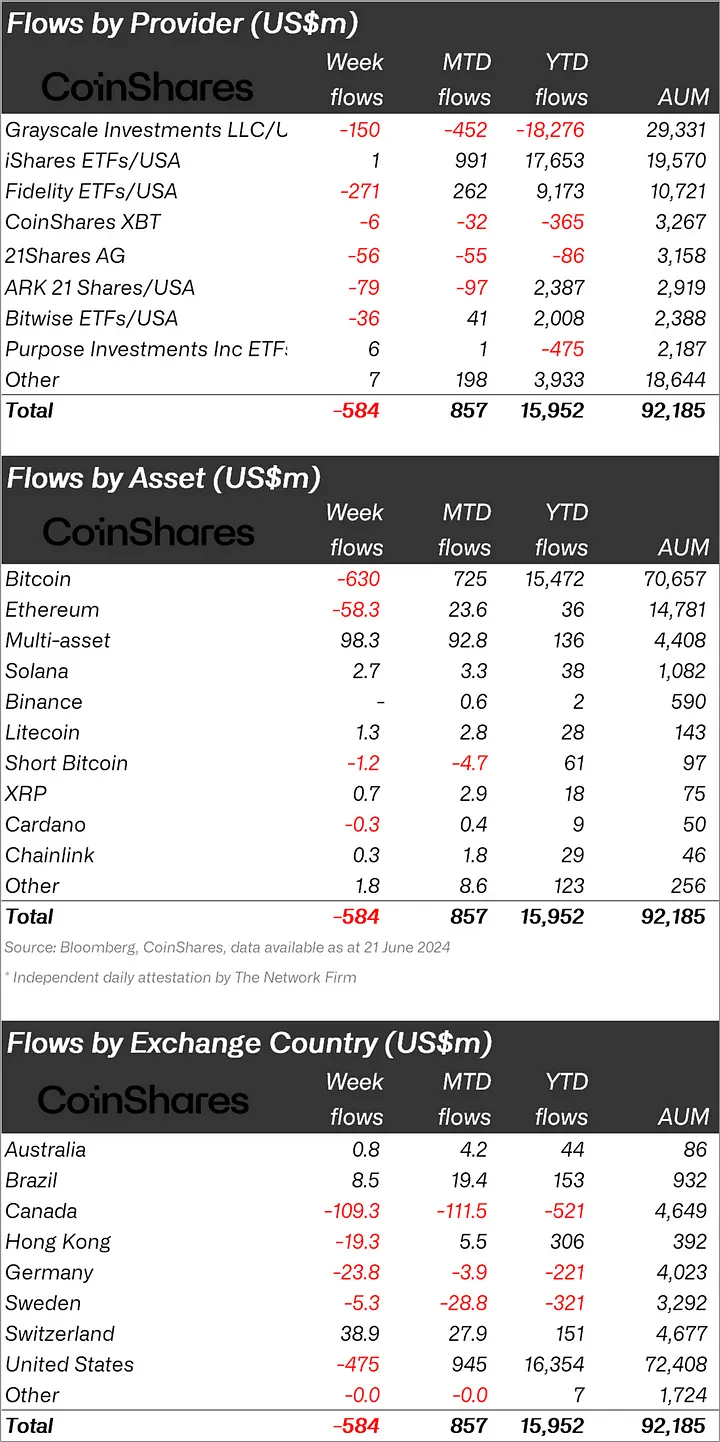

Stating that there was an outflow of $584 million in cryptocurrency investment products last week, Coinshares said that these outflows show that a real correction is on the way.

“Last week, there was an outflow of 584 million dollars in cryptocurrency investment products. For the second week in a row, the total outflow reached 1.2 billion dollars.

We think this is a reaction to investors' pessimism that the FED will cut interest rates this year.

“Additional outflows of $584 million also show that a real correction is on the way.”

Bitcoin (BTC) is in Focus Again!

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $630 million, the largest altcoin Ethereum (ETH) also experienced an outflow of $58.3 million.

Looking at other altcoins, Solana (SOL) experienced an inflow of $2.7 million, Litecoin (LTC) $1.3 million and Polygon (MATIC) $1 million, while Cardano (ADA) experienced a small outflow of $0.3 million.

“Bitcoin was the main focus and saw outflows of $630 million, but recent negative sentiment has seen investors not contribute to short positions as short Bitcoin also saw outflows of $1.2 million.

Ethereum could not escape the negative atmosphere, seeing an outflow of $ 58 million. While a number of altcoins have seen inflows following recent price weakness, the most notable are Solana, Litecoin and Polygon at $2.7 million, $1.3 million and $1 million respectively.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 475 million dollars.

After the USA, Canada ranked second with 109.3 million dollars, and Germany ranked third with 23.8 million dollars.

Against these outflows, Switzerland experienced an inflow of 38.9 million dollars.

*This is not investment advice.