While inflation in the US is moving towards the FED's 2% target, the FED made its first rate cut in September. The FED, which made its first rate cut aggressively by 50 basis points, will announce its next decision in November.

As markets await the Fed's decision in November, Goldman Sachs analysts said they expect the Fed to cut interest rates by 25 basis points in a row from November 2024 to June 2025, bringing the final interest rate to the 3.25-3.5% range, Reuters reported.

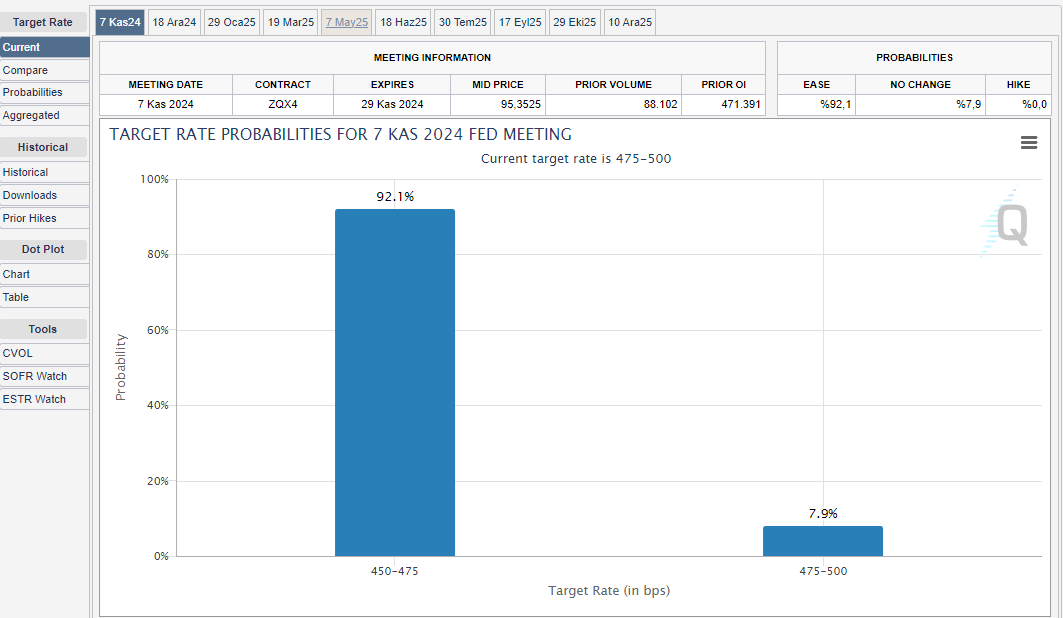

According to CME's Fedwatch tool, markets are not currently expecting the Fed to cut rates by 50 basis points at its next November meeting. In contrast, the probability of the Fed cutting rates by 25 basis points is priced in at 92.1%, while the probability of leaving rates unchanged is priced in at just 7.9%.

How Could Fed's Rate Cuts Affect Bitcoin and Cryptocurrencies?

Experts say Fed rate cuts have historically reduced the appeal of traditional financial products while driving investors into higher-risk assets, including cryptocurrencies like Bitcoin (BTC).

It is thought that lower interest rates could weaken the dollar, which could increase investors' interest in assets such as cryptocurrencies.

At this point, experts state that if the projected interest rate cuts occur, Bitcoin and other major cryptocurrencies could benefit from this and support the potential price increase in the coming months.

*This is not investment advice.