Glassnode examined the latest developments in the chain and the correction movement in BTC in its weekly Bitcoin analysis.

It was stated that BTC, which entered the year 2023 quite successfully, faced a resistance at $ 30500 with the increase in the profitability of the wallets, and the price fell to $ 27,000 while investors were taking profits.

According to the report, breaking the $33,000 level will be a sign of a real bull market.

The notable graphics and analysts' evaluations in the Glassnode report are as follows:

"Price is between $19,900 and $33,000

Bitcoin spot price is currently moving between two on-chain pricing models. This is the Realized Price crossing $19,900 and the Realized-to-Liveliness Ratio level crossing $33,000.

This data indicates that the market has completed its trading below the actual price and has returned to its fair value. Profit-taking behavior may increase in Bitcoins bought at low prices in this region.

Market Decision Stage

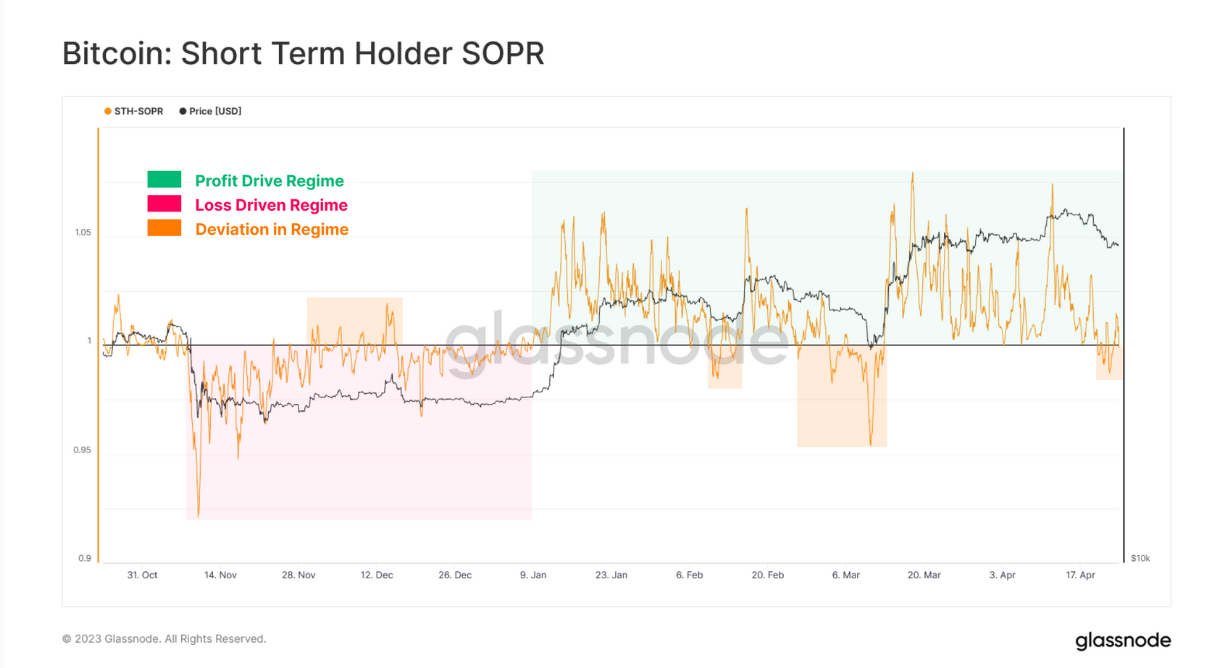

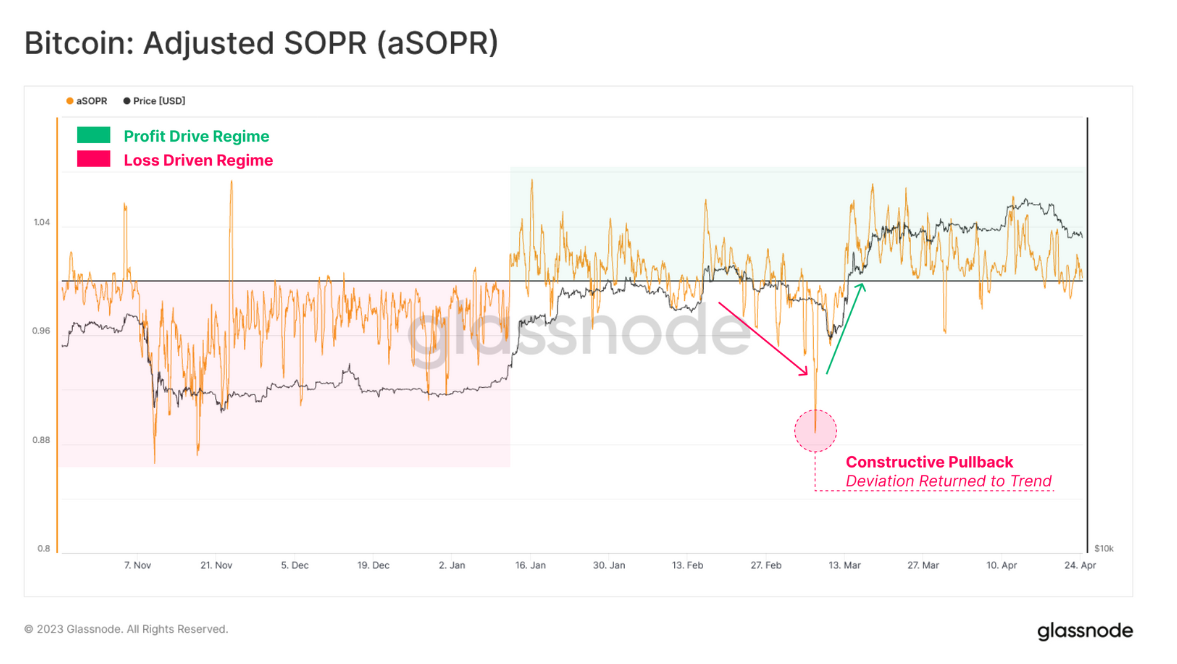

The SOPR Metric is used to track the size of profit and loss events across the market. Loss sales dominate when SOPR goes down to 1 gold, and profitable sales dominate when it goes above 1. The breakeven level of 1 is effective in determining market behavior. With the last drop, we see a retest of 1 in SOPR. This shows that the market is at a decision stage.

We see a similar picture in short-term SOPR. Here, a drop below 1 indicates that the market has started to panic, increasing sales at a loss. If this happens, we can see sales increase.

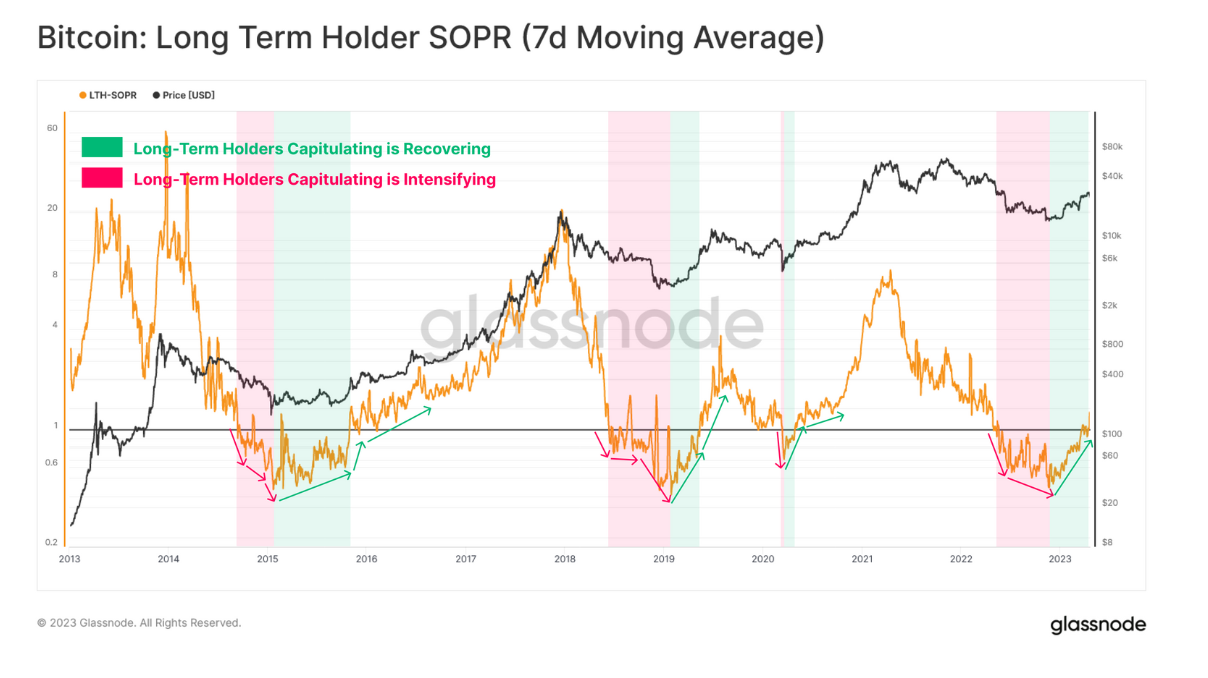

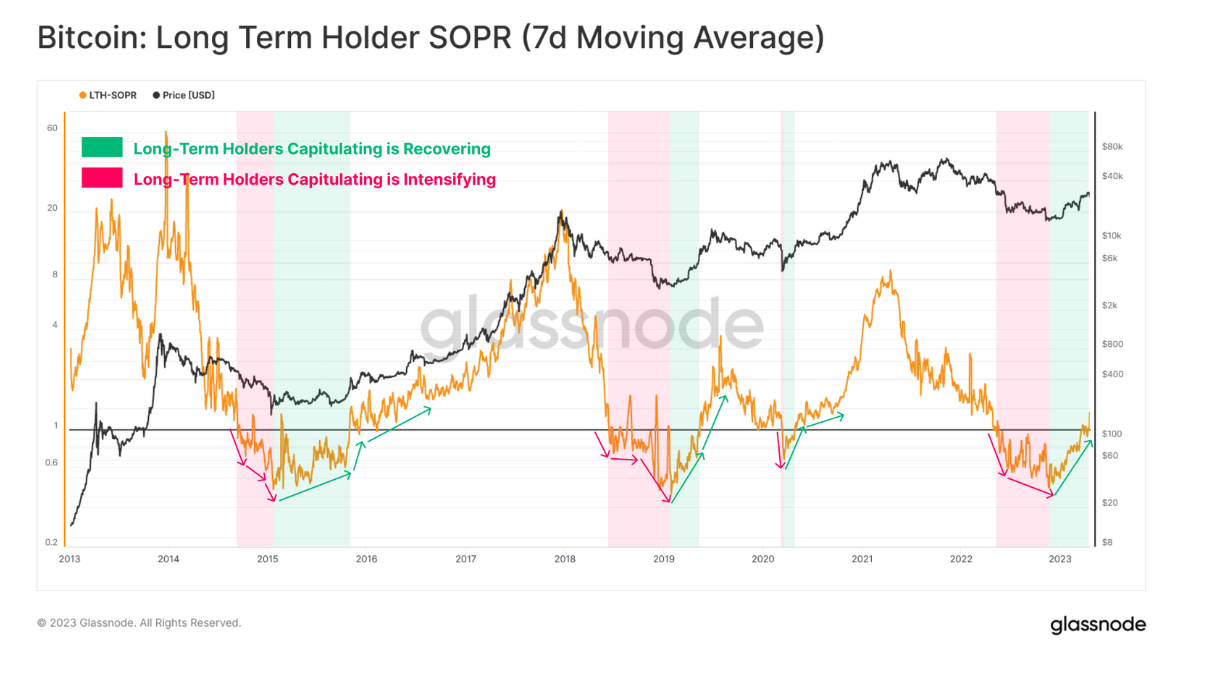

Long-term SOPR helps us better understand macro market shifts. After a long period of losses, this metric has finally climbed above 1, signaling a recovery for long-term investors.

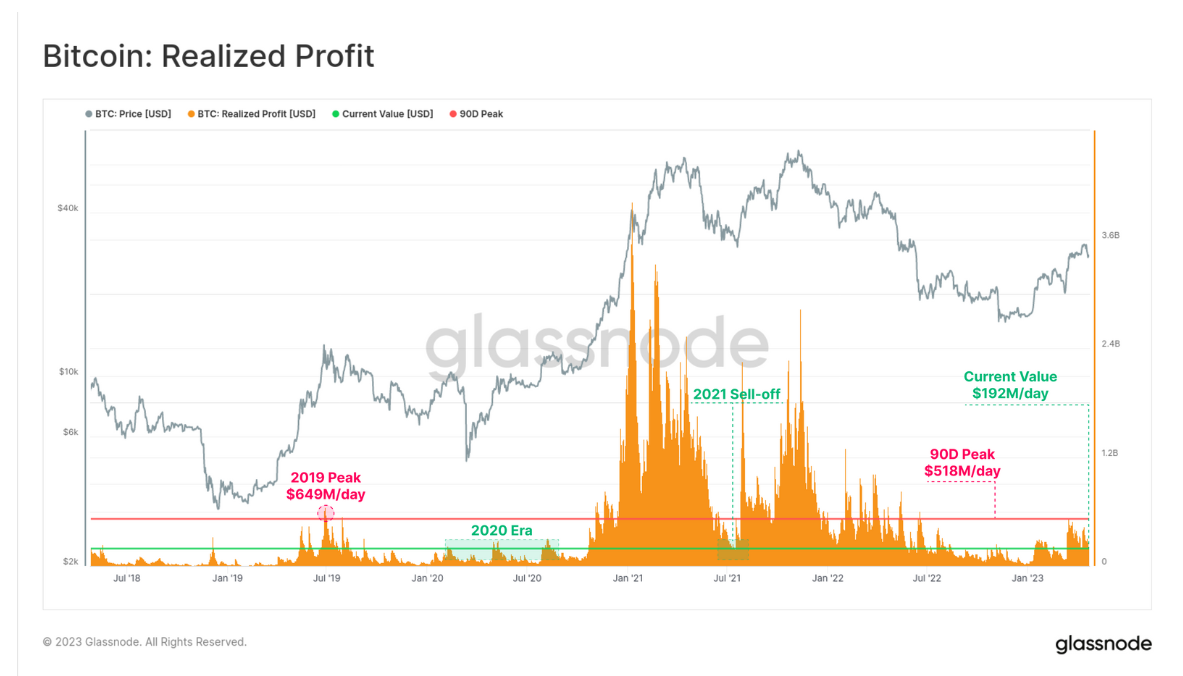

The chart below shows the profits in USD this year. Although this is quite small compared to 2021, it is at similar levels to 2019.

As a result, BTC, which made a strong start to 2023 and rose as high as $30,000, encountered its first significant resistance and pulled back a bit. This situation came with the increase in profitability of a large segment.

Although the size of realized profits is small compared to the value of the asset, it is seen as equivalent to the rally in 2019.

The accumulation and distribution behavior in wallets looks more volatile than in the first quarter of the year."

You can find the full report here.

We see a similar picture in short-term SOPR. Here, a drop below 1 indicates that the market has started to panic, increasing sales at a loss. If this happens, we can see sales increase.

We see a similar picture in short-term SOPR. Here, a drop below 1 indicates that the market has started to panic, increasing sales at a loss. If this happens, we can see sales increase.