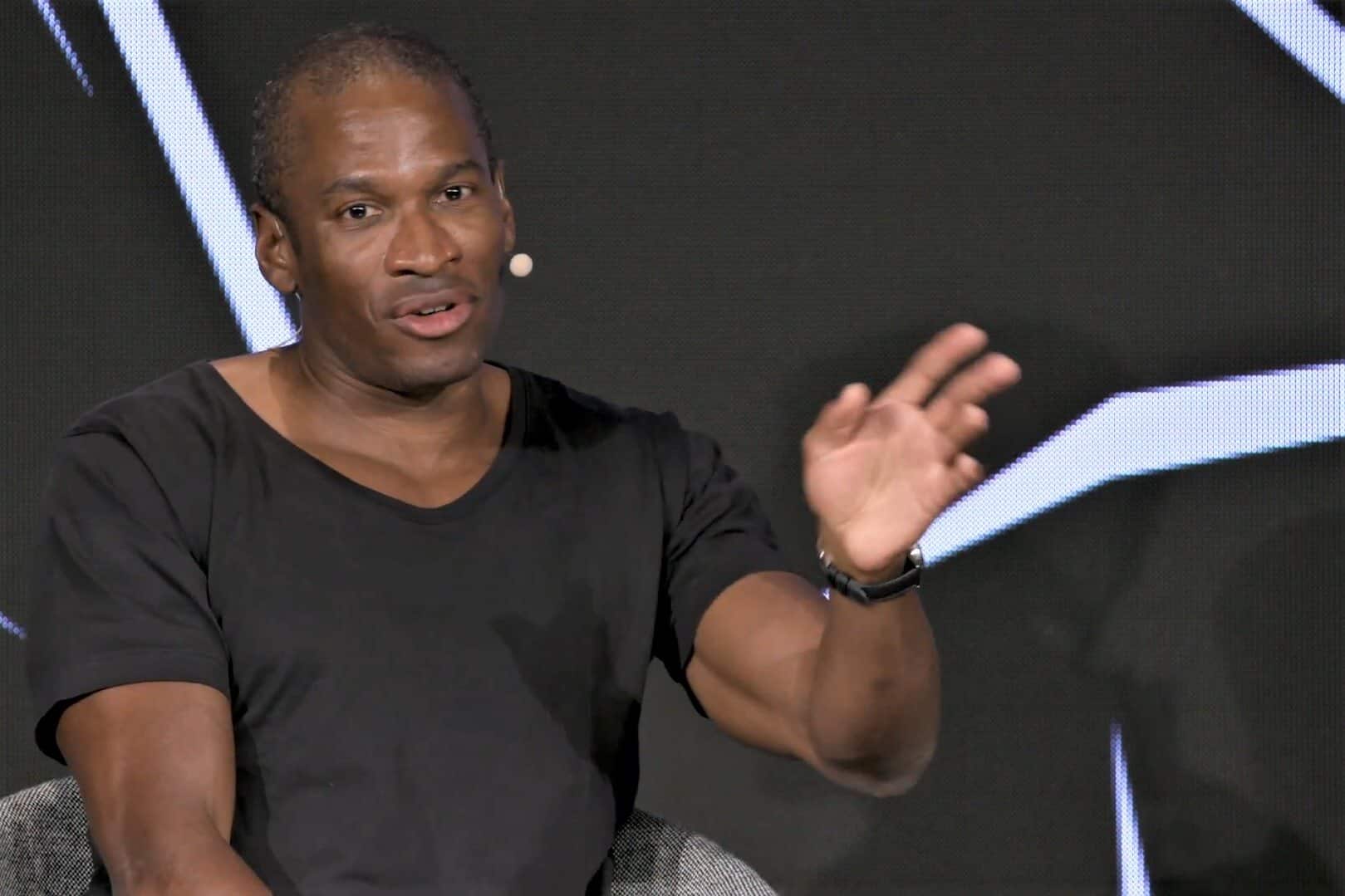

Arthur Hayes, former CEO of Bitmex and a well-known cryptocurrency market analyst, expressed concerns regarding the potential impact of the upcoming spot Bitcoin ETF on the future of BTC.

In his latest blog post, “Expression,” Hayes speculates that the success of these ETF derivatives could lead to all of Bitcoin being concentrated in the hands of a few financial firms like Blackrock. This could lead to a lack of activity on the blockchain, bringing down miners.

Hayes believes that the success of the spot Bitcoin ETF could pose a significant threat to the BTC network. The analyst presented a hypothetical scenario in which Bitcoin is held predominantly by a few financial companies. Hayes predicts that if this were to happen, it could undermine Bitcoin's value as a store of value, given its unique structure compared to other assets traded in financial markets.

Hayes explained his predictions regarding the scenario where all BTCs are taken into the hands of financial institutions and BTC transfers for payment purposes end:

“Bitcoin is the first monetary asset in human history that exists only if it moves. After Bitcoin block rewards reach zero around 2140, miners will only be rewarded for validating transactions through transaction fees.

This means miners will only earn Bitcoin revenue when the network is used. In essence, if Bitcoin moves, it has value. But if another Bitcoin transaction never occurs between two people, miners will not be able to afford the energy needed to secure the network. As a result, they turn off their machines. Without miners, the network dies and Bitcoin disappears.”

However, if Bitcoin shares this fate, Hayes predicts that a similar asset will emerge that will enable people to transact within a financial system that does not belong to countries.

*This is not investment advice.