Cryptocurrency analysis company Santiment evaluated the recent high volatility in Bitcoin prices in its latest analysis.

According to company analysts, Bitcoin, which experienced a sudden decline, experienced its most fearful week since August 5, 2024, but this situation also brought with it a signal that cannot be ignored.

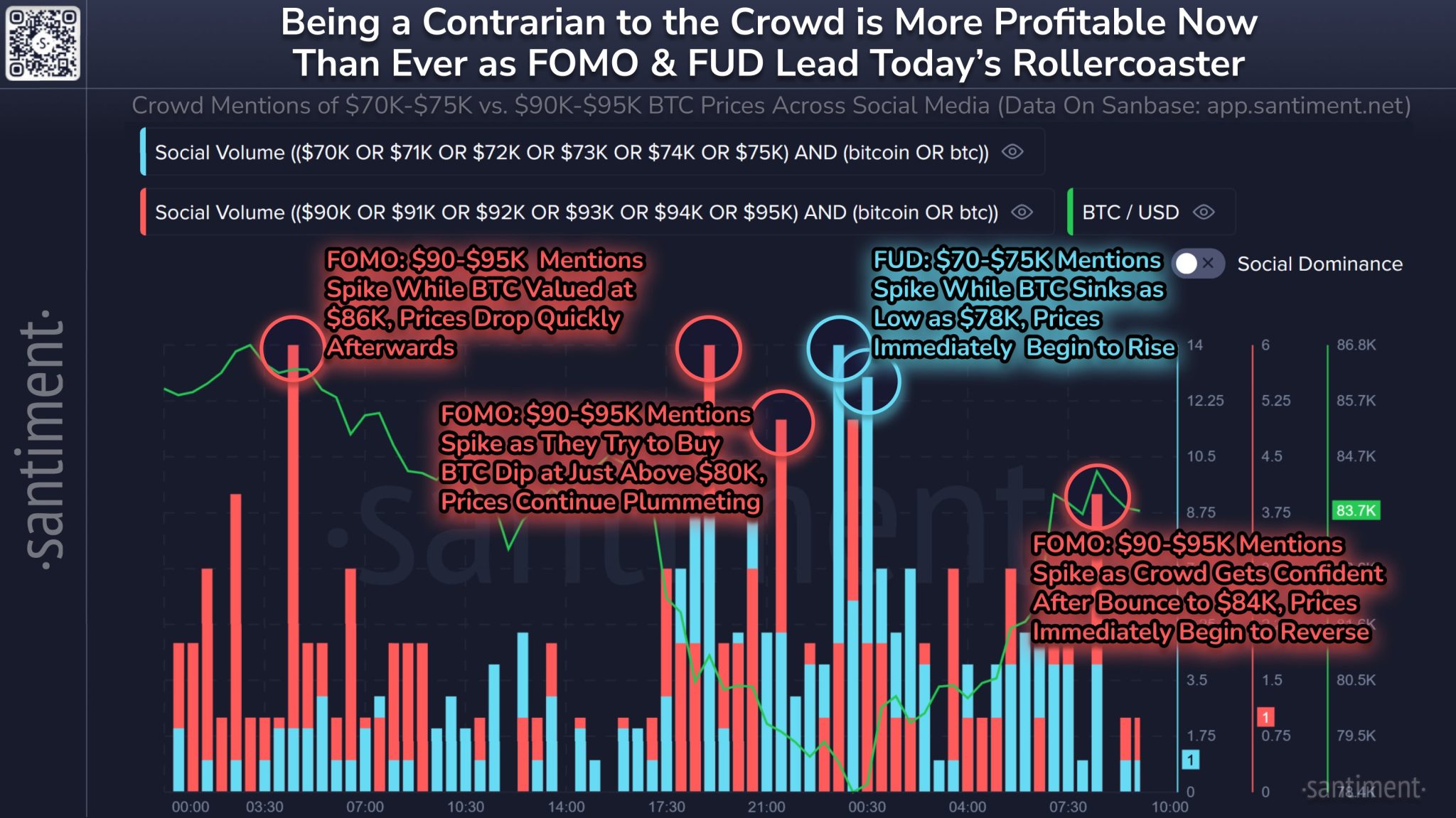

According to Santiment, the crypto community gets it wrong every time Bitcoin goes up and down, while price predictions on social media continue to give traders valuable tips (in a way that is counterintuitive).

While the Bitcoin price is currently hovering around $80,000, the current chart shared by the analysis company measures the mention rates on social media platforms of $70,000 to $75,000, which is lower than the BTC price, and $90,000 to $95,000, which is higher than the BTC price.

According to the chart data, if traders on social media platforms think that the BTC price will rise further, the cryptocurrency market is experiencing a decline. However, when traders start talking more about the Bitcoin price falling further, the cryptocurrency market is experiencing an increase.

Recent data shows that as the BTC price has recovered from around $79,000, the rate of mentions of the $90,000 to $95,000 price levels on social media platforms has jumped.

*This is not investment advice.