According to a study, MicroStrategy, which owns a large amount of Bitcoin (BTC), buys BTC, it has a short-term negative effect on the price.

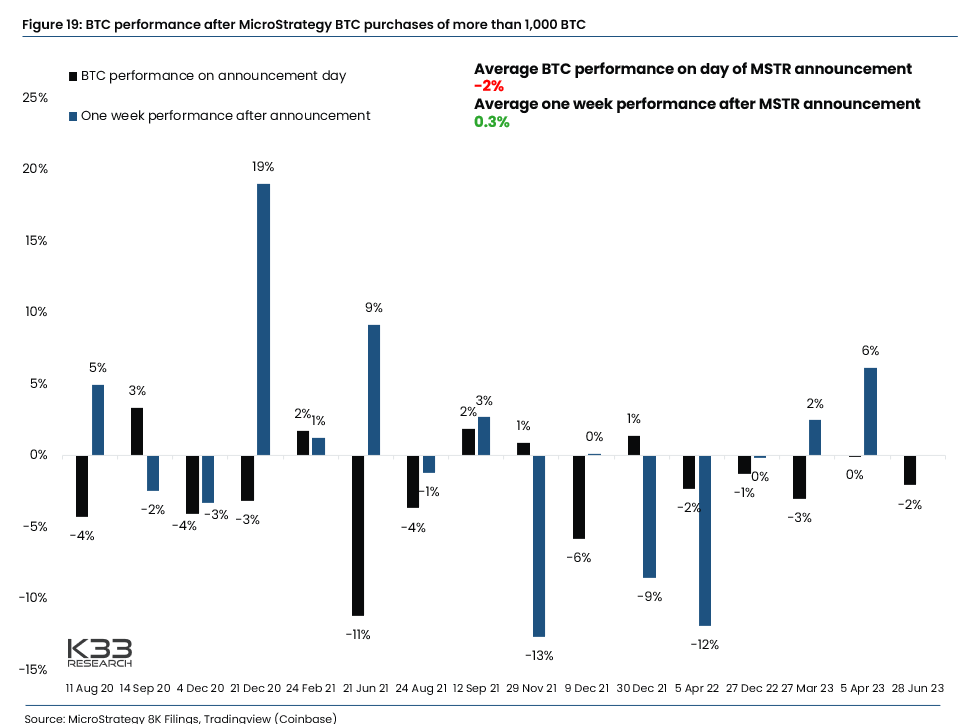

K33, a data analytics company, found that Bitcoin posted an average daily return of minus 2% on the days MicroStrategy announced its purchases of coins since 2020.

The analyst attributed this to the decline in buyer-side liquidity in the market following MicroStrategy's buying spree.

“BTC tends to see short-term negative price movements following MicroStrategy BTC buy announcements, as the market digests the fact that certain liquidity on the buyer side has left the market,” said K33 research analyst Vetle Lunde.

However, the analyst also noted that the negative effect tends to fade in the following days and there is no clear evidence of a long-term negative impact on Bitcoin's price due to MicroStrategy's announcements.

In fact, according to data from K33, Bitcoin's average weekly return has been slightly positive after MicroStrategy's purchases.

*Not investment advice.