The SEC's continued pressure on cryptocurrencies and the Fed's chairman Jerome Powell's announcement that there will be an increase in interest rates this year caused sharp declines in cryptocurrencies, especially Bitcoin and Ethereum.

In this context, BTC fell below $25,000 and ETH below $1,700. However, BTC and altcoins had a nice rise over the weekend.

Despite the short-term decline in ETH, ETH still offers profitability to its investors in the long-term.

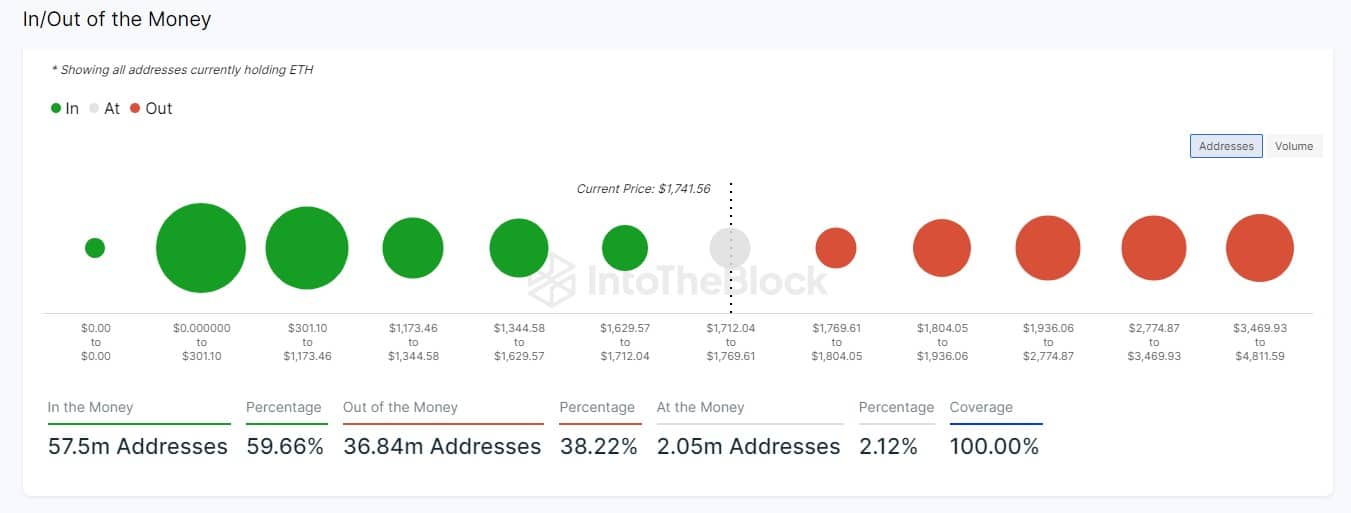

According to data from IntoTheBlock, despite the turmoil in the cryptocurrency market in recent weeks, the vast majority of Ethereum addresses are still in profit.

“Despite the price drops, 57.5 million addresses, which make up 59.66% of the total active ETH addresses, are in profit.

Likewise, the losers make up 38.22% of the total wallets holding Ethereum, with a total of 36.84 million addresses.”

Stating that ETH profitability data reflects Ethereum's resilience, IntoTheBlock said, "The delisting of Cardano (ADA), Solana (SOL) and Polygon (MATIC) by exchanges and the regulatory turmoil that threatens other altcoins that the SEC qualifies as securities provide a boost for Ethereum. expected to happen.” said.

Ethereum, which went up to $ 1,770 in the rise over the weekend, is trading at $ 1,723 with the pullback experienced at the time of writing.

*Not investment advice