The second quarter of 2023 is coming to an end and with that, a large amount of options contracts on Bitcoin and Ethereum will expire today at 8 pm.

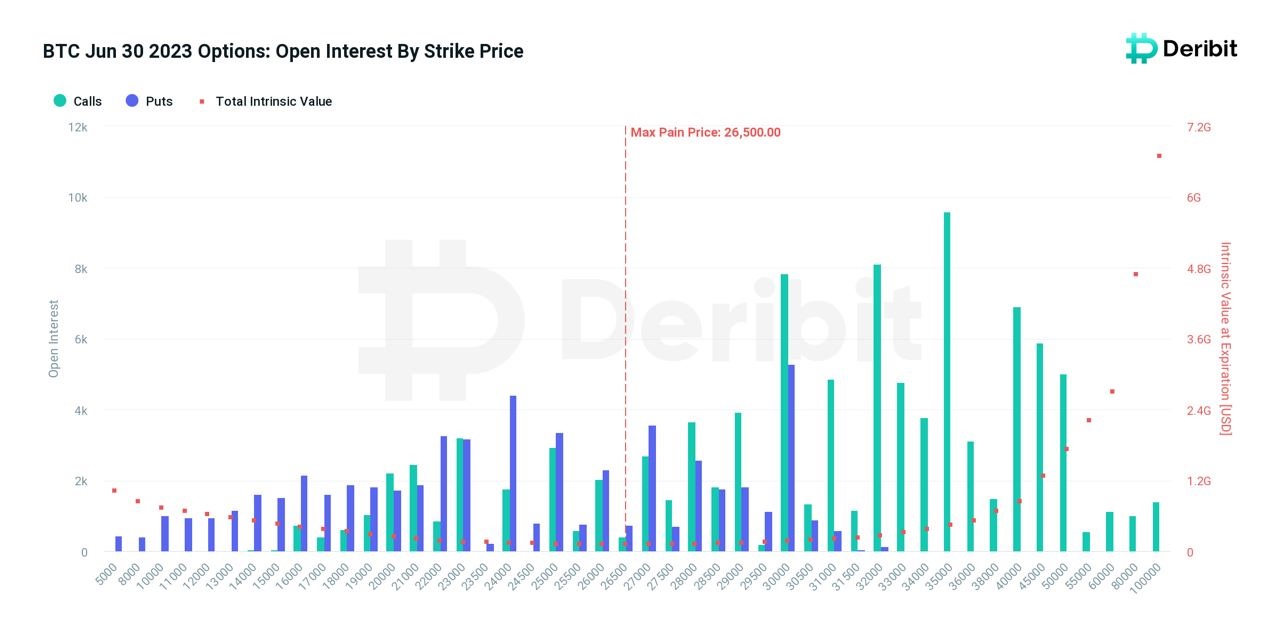

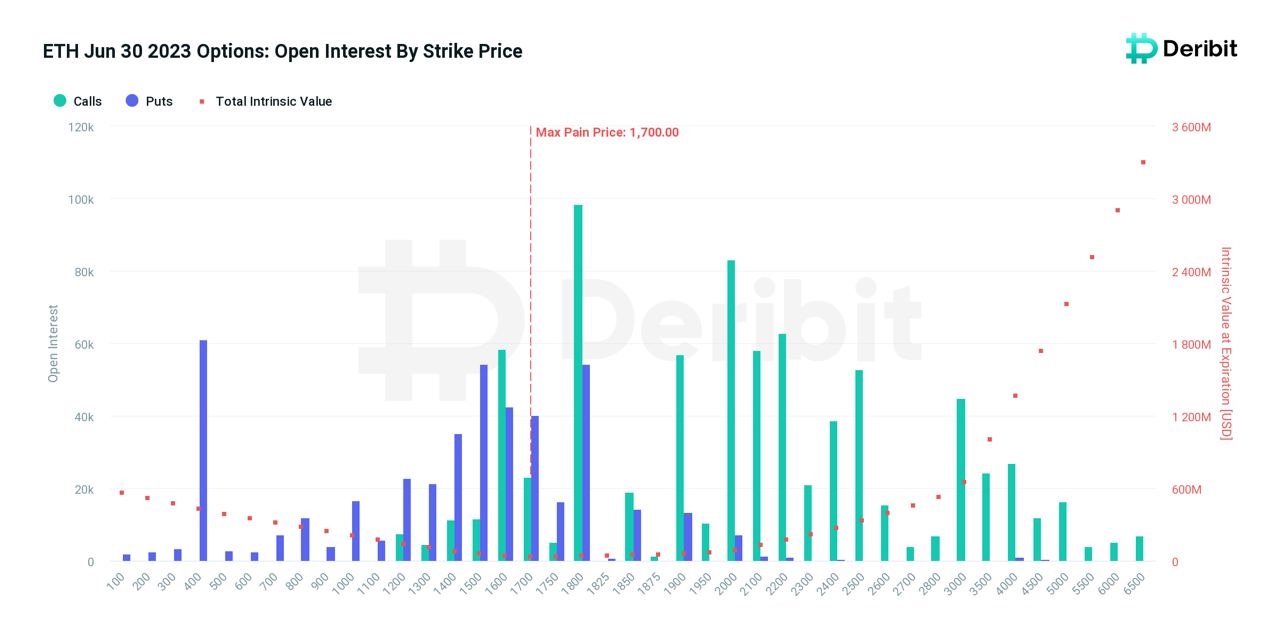

According to the largest cryptocurrency derivatives exchange Deribit, 158.6 thousand Bitcoin options contracts with a nominal value of 4.86 billion dollars and 1.2 million Ethereum options contracts with a nominal value of 2.3 billion dollars will expire on June 30.

Options are financial instruments that give the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price and date. The expiration of options contracts can have a significant impact on the price of the underlying asset, as traders may try to push the price in their desired direction or hold their positions.

One of the indicators traders use to gauge potential price action is the Max Pain price, which is the price at which most options contracts expire worthless and causes the most financial loss to option holders.

According to Deribit, the Max Pain price for Bitcoin is $26,500 and for Ethereum $1700, both lower than the current market prices of $30,716 and $1874, respectively.

Another indicator is the put/call ratio, which measures the ratio of put options (which gives the right to sell) to call options (which gives the right to buy). A higher put/call ratio indicates a downtrend, while a lower one indicates an uptrend. According to Deribit, the sell/buy ratio for Bitcoin is 0.56 and for Ethereum 0.57, indicating a slight bullish trend among option holders.

Shaun Fernando, Deribit's chief risk officer, said in a statement:

“BTC Max Pain at a significantly low $26,000 could ease the downward pressure on prices after expiry.

With an impressive open interest of over $350 million on the $30,000 strike, the upcoming quarterly expiration promises an exciting result with the potential for price turbulence among various gamma hedging strategies.”

*Not investment advice.