The decline in Bitcoin and altcoins that started last week continues before the FOMC meeting.

While the weakening of inflows to ETFs and BTC outflows from Grayscale were effective in these declines, BTC fell below $ 61,000 in the morning hours.

At this point, there was an outflow of $444 million from Grayscale's GBTC yesterday, while the BlackRock ETF experienced the weakest inflow of recent times with only $75 million.

Fidelity's ETF FBTC, which ranked second after BlackRock Bitcoin ETF IBIT, experienced an inflow of 39.6 million dollars. While all Bitcoin ETFs recorded almost zero inflows, according to yesterday's ETF data, the total net outflow of $326 million was the largest fund outflow ever recorded for ETFs.

These outflows show that institutional investors are taking a cautious stance before the FOMC decision to be announced today.

While these outflows and weakness on the ETF front affected the price of altcoins along with BTC, Ethereum fell to $ 3,054.

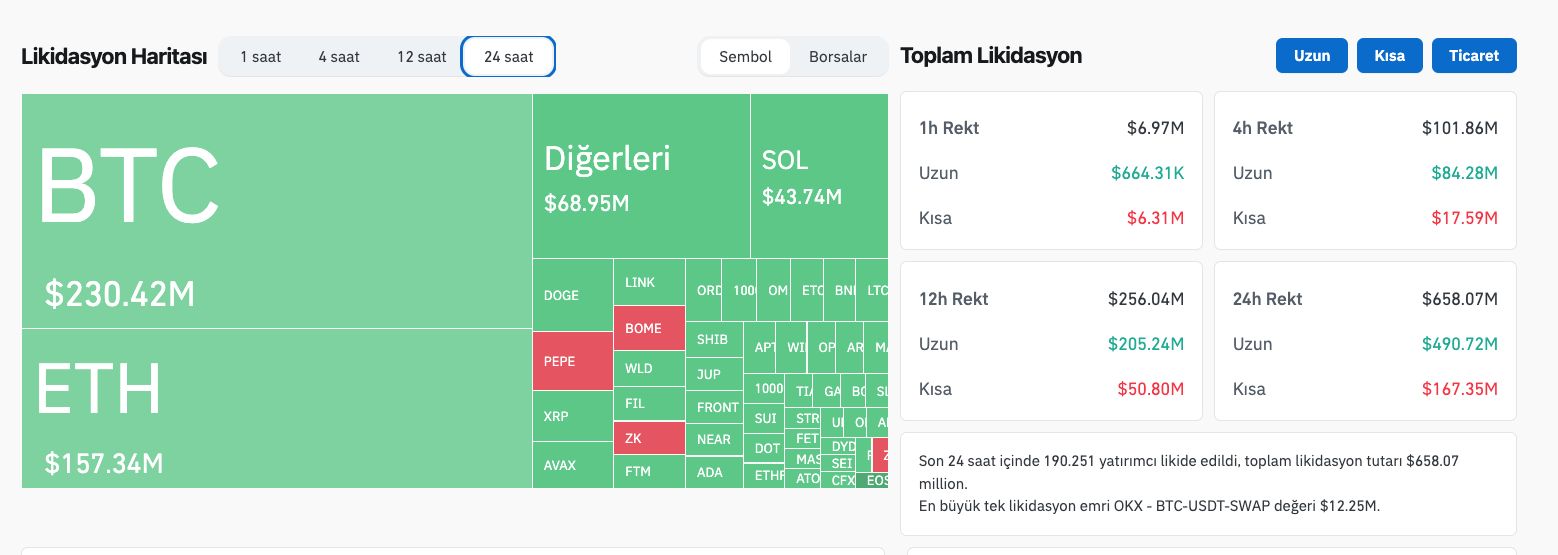

While many leveraged positions were liquidated at this point, according to Coinglass data, $658 million was liquidated in the last 24 hours.

Of these, $490 million consisted of long positions and $167 million consisted of short positions.

*This is not investment advice.