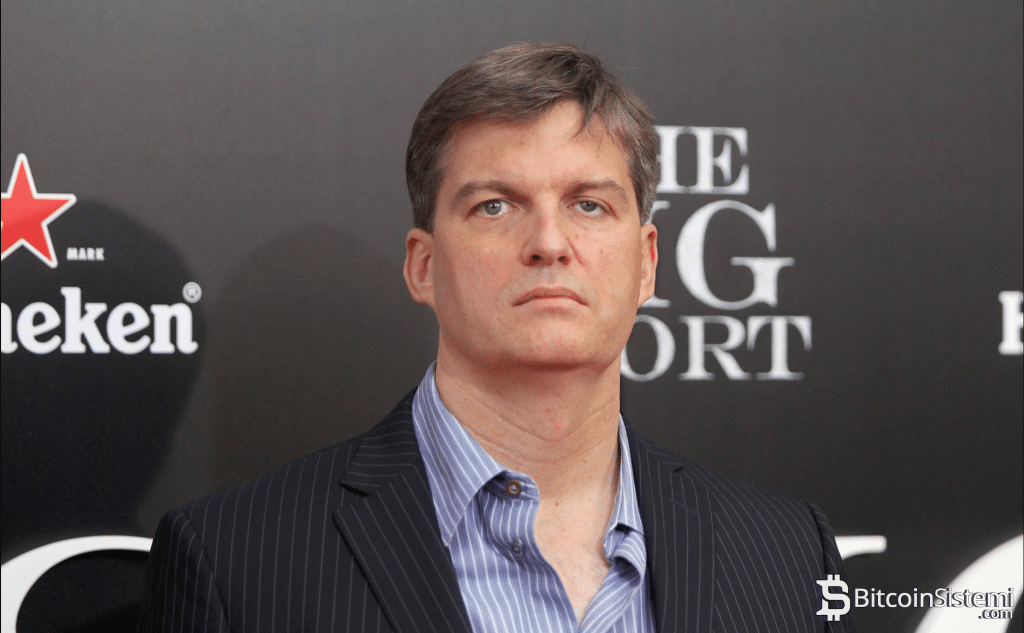

Michael Burry, who gained fame in 2008 for predicting and profiting from the high-interest mortgage crisis, has made new statements regarding Bitcoin (BTC).

Michael Burry, whose story is told in the film “The Big Short” and who is known as a major short seller in the market, has issued a warning about the future of Bitcoin.

Burry, whose primary profession is medicine, warned of the risk of bankruptcy for companies holding BTC in an article published on Substack on Monday.

Burry warned that the risk goes beyond a simple Bitcoin price drop, potentially leading to a chain reaction of bankruptcies among companies with large BTC holdings, and this could result in a systemic crisis in the broader financial market.

Burry stated that “a bad scenario is approaching” for Bitcoin and all markets on the blockchain, arguing that Bitcoin falling below key support levels would lead to a significant drop in value.

At this point, Burry noted that Bitcoin’s sharp decline could force institutional investors and treasury companies to sell up to $1 billion in gold and silver to offset cryptocurrency losses.

Burry added that it was difficult to view the decline as simply a price correction.

“Even if Bitcoin falls by only 10% from its current level, companies holding large amounts of Bitcoin could experience losses of tens of billions of dollars.”

This situation could effectively block their access to capital markets. As a result, the financial stability of companies holding Bitcoin could be shaken, posing a risk to the wider financial market. This would negatively impact gold, silver, and other assets.”

Bitcoin Has Lost Its Functionality!

Burry also stated that Bitcoin has lost its function as digital gold and could bankrupt its institutional holders, creating ripple effects across the market.

“We see that Bitcoin has failed in its claim to be a digital safe haven and an alternative to gold.”

He noted that recent geopolitical tensions and concerns about the weakening dollar have driven gold and silver to record highs, but Bitcoin has underperformed in the same environment.

Burry acknowledged that Bitcoin’s rise in 2025 is supported by the launch of spot ETFs and strong interest from institutional investors, but said these are temporary forces rather than signs of true adoption.

According to Burry, Bitcoin is still a speculative asset and has no intrinsic value or widespread use.

*This is not investment advice.