Many companies have launched Ethereum futures ETFs today.

Bloomberg ETF analyst Eric Balchunas stated in his post on his social media account that the interest in Ethereum ETFs is at normal levels, but it remains quite low compared to Bitcoin.

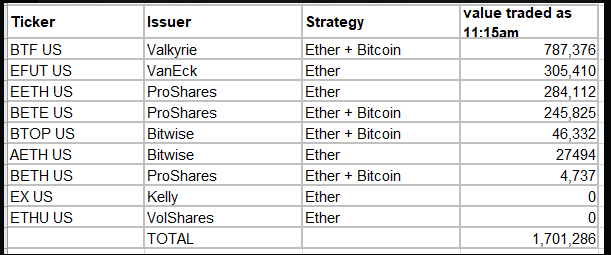

“Initial volume for Ethereum futures ETFs is quite high at just under $2 million. This is normal for a new ETF. However, it seems low compared to BITO (the first Bitcoin futures ETF did $200 million in volume in the first 15 minutes) “The race continues between VanEck and ProShares.”

Comparing the Ethereum ETF with the Bitcoin ETF, the famous analyst emphasized the importance of the time factor and said that Bitcoin futures were launched near the peak of the bull market, which affected the volume.

“BITO was launched at the peak of the bull market. Besides, Bitcoin is much more popular than Ethereum. If you look at the overall volume, the total volume for ETH is $6-7 million. If this were a real ETF, it would be in the top 10. It is positive for ETH, but “It doesn't compare to the BITO craze.”

$BITO launched at height of bull market. Bitcoin is also much more popular among casual/normies/advisors. Also if you add up total volume they prob will hit like $6-7m by EOD, which would be a Top 10 launch if it were one ETF. So it's healthy but not nowhere near BITO mania. https://t.co/E9tx9h4lv8

— Eric Balchunas (@EricBalchunas) October 2, 2023