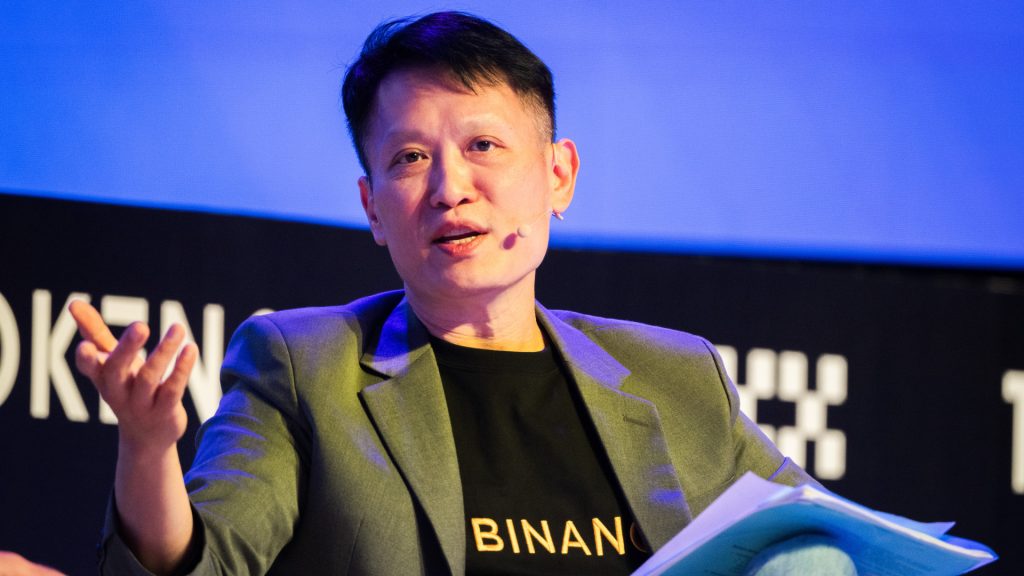

Richard Teng, who took over as Binance CEO after founder CZ stepped down, spoke about the massive “10.10 crash” that occurred last October. Teng denied allegations that Binance was responsible for the mass liquidation that rocked the crypto market.

Speaking at the Consensus Hong Kong event, Binance CEO Richard Teng said that Binance was not directly responsible for the massive cryptocurrency liquidation on October 10, and that the mass liquidations affected all exchanges.

Richard Teng stated that the historic mass liquidation event that occurred on October 10 last year was not limited to Binance alone.

Following China’s implementation of controls on rare earth elements and the US’s announcement of new tariffs, the market experienced massive declines, leading to large-scale liquidations across all exchanges.

At this point, Teng emphasized that, unlike other exchanges, Binance provided some support to affected users.

“During the mass liquidations in October, selling pressure emerged in cryptocurrencies across all exchanges. As a result of the mass liquidations, some users suffered losses, and Binance provided support to these users. In contrast, other exchanges did not take such measures.”

Teng noted that approximately 75% of liquidations stem from issues such as stablecoins losing their stable value and delays in asset transfers, with most occurring within a narrow timeframe.

That day, while $150 billion worth of liquidations occurred in the US stock market, the figure for the cryptocurrency market was $19 billion.

Binance CEO noted that macroeconomic uncertainty and geopolitical tensions continue to impact the market, but institutional demand remains strong.

“Despite recent market downturns, institutional investors are still entering the crypto space. This means that smart investors are putting money into the market.”

Retail demand for crypto is slightly weaker than last year, but investments by institutions and companies remain strong.

*This is not investment advice.