In its latest report, cryptocurrency analysis company Alphractal evaluated both whale and individual investor behavior in the altcoin market and the increase in uncertainty in the US economy.

According to the report, large investors, known as “whales,” are more likely to close long positions and open short positions in many altcoins. This trend suggests that small investors are still in the market with long positions.

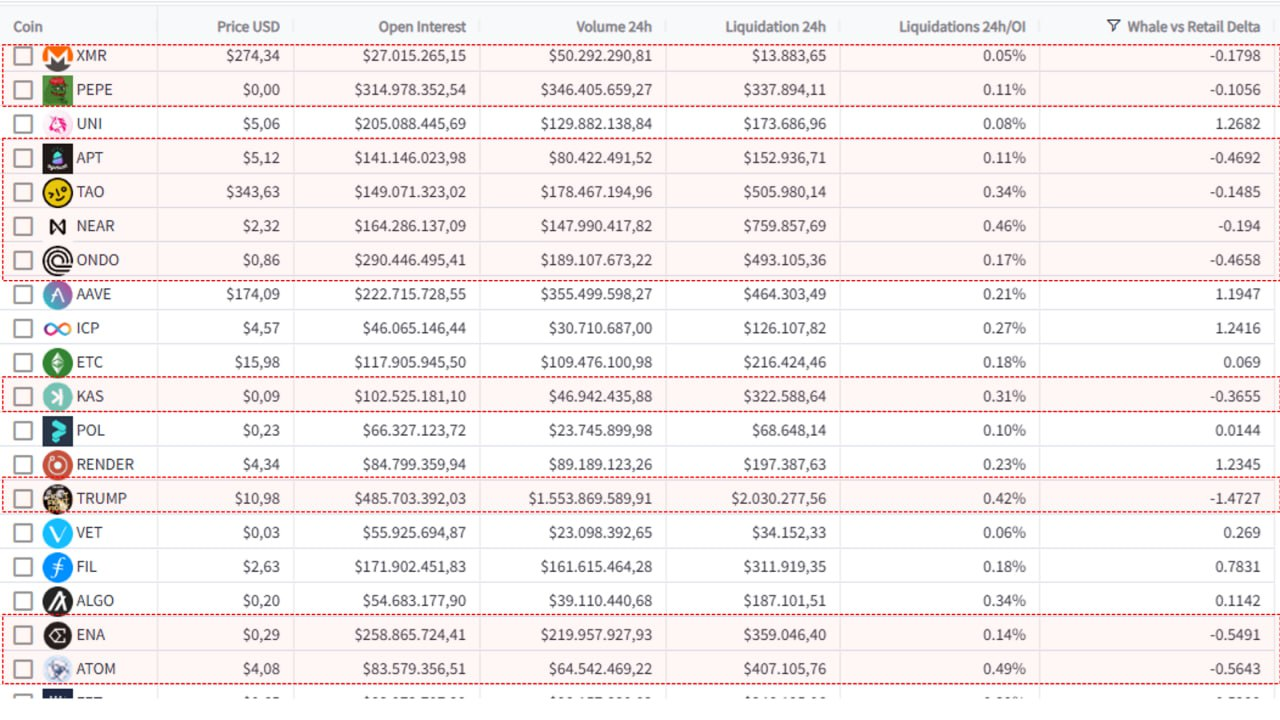

Alphractal’s specially developed “Whale vs. Individual Delta” metric shows the proportional difference in the positions of large and small investors. Negative values of the metric indicate that whales tend to close long positions and open short positions, while positive values indicate the opposite, that is, a tendency to close short positions and open long positions.

The analysis also included this warning: “Understanding what whales are doing may be critical to avoid swimming against the market.”

Another notable section of the report focused on economic uncertainties in the US. Alphractal announced that the US Economic Policy Uncertainty Index reached an all-time high in 2025. There are several critical developments behind this increase:

- Excessive tariffs: The second Trump administration increased tariffs on major trading partners from 10% to 25% and up to 145% in strategic sectors, increasing production costs and making it harder for companies to plan.

- Debt ceiling crises: Debt ceiling raised to $36.1 trillion on January 2, 2025. Congressional discussions on repeal or suspension have triggered fears of technical default.

- Monetary policy uncertainty: The Fed kept interest rates steady at 4.25%–4.50%, while postponing expected rate cuts due to high import inflation.

- Loss of confidence in the dollar: Protectionist trade policies and financial sanctions have damaged the dollar's reputation as a safe haven.

- Regulatory fluctuations: Frequently changing policies in areas such as artificial intelligence, competition law, environmental sustainability and energy have led to business unpredictability.

- Geopolitical risks: The Russia-Ukraine war and new crises in the Middle East have disrupted global supply chains.

- Budget impasses: Microlegal disputes over spending and ad hoc budgets have increased fiscal uncertainty.

*This is not investment advice.