As Bitcoin approaches its halving, analysts from analysis firm Glassnode said one should be prepared for potential volatility.

According to Glassnode, the impact of the halving will likely diminish during this cycle as new institutional demand from Bitcoin ETFs comes into play.

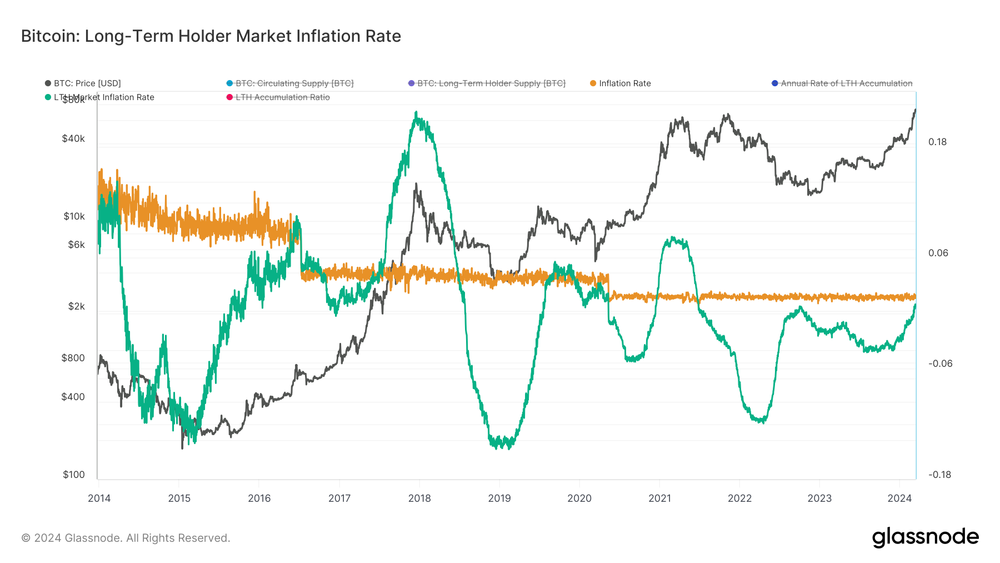

According to analysts, we are approaching the stage of the market cycle where BTC's supply dynamics are increasingly influenced by the actions of long-term holders (LTHs). Their sell or hold decisions can significantly affect market liquidity and sentiment. Therefore, investors should closely monitor the Long Term Investor Market Inflation Rate to anticipate market changes and adapt their strategies accordingly.

According to Glassnode, reaching the All Time High (ATH) before the halving presented an unprecedented new scenario. Still, the progression of the cycle mirrors past trends if aligned from the April 2021 ATH. Although the calming effect of ETFs on corrections indicates stability, a possible decline in ETF demand could increase market volatility and highlight the need for strategic caution in trading approaches, according to analysts.

While the halving is often interpreted as a bullish signal for Bitcoin, its immediate impact on the market is largely influenced by psychological factors, according to analysts. The market has occasionally been seen to interpret news as a sell event where market sentiment and price are gaining momentum towards the halving, only to result in significant price corrections shortly thereafter.

For example, in 2016, the market experienced a sharp sell-off from $760 to $540, with a correction of approximately 30% during the halving. This decline was a classic example of market participants reacting to the event itself rather than long-term supply effects, demonstrating the halving's capacity to trigger sudden market volatility.

As we approach the next halving, the market structure suggests that we may witness another significant correction, according to analysts. Such a correction would not only fit historical patterns but also serve as a reset, shaking off short-term speculative interest and setting the stage for the next growth cycle.

*This is not investment advice.