FED Chairman Jerome Powell began his speech at the US House of Representatives Financial Services Committee.

The highlights of Powell's speech are as follows:

“Inflation has fallen, although it is still above 2%. However, we do not think it is appropriate to reduce the policy rate until there is greater confidence that inflation will move sustainably towards 2%.

We will carefully evaluate the incoming data, the evolving outlook and the risk balance. However, it is likely that rates will be lowered at some point this year.

Interest rates are at their peak in the current cycle.

We believe our policy rate is likely at its peak in this tightening cycle.

Lowering interest rates quickly may pose some risks. However, the economic outlook is uncertain and continued progress toward our 2 percent inflation target is not assured.

Reducing policy restrictions too soon or too much could cause the progress we have seen in inflation to reverse, ultimately requiring even tighter policies to return inflation to 2 percent.

We remain committed to pushing inflation back to our 2 percent target and firmly anchoring long-term inflation expectations. “It is essential to re-establish price stability in order to lay the groundwork for achieving maximum employment and stable prices in the long term.”

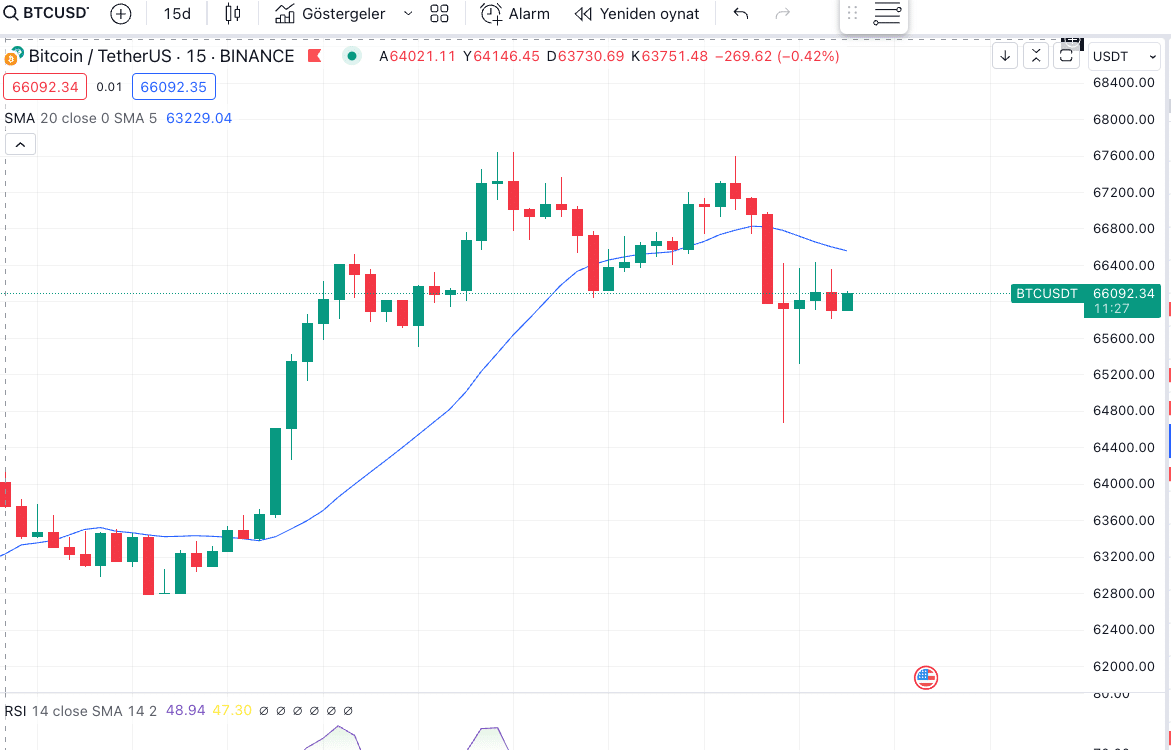

Bitcoin's price action during Powell's speech:

*This is not investment advice.