Bitcoin, which rose to $48,000 after the SEC's spot ETF approval, stayed there for a short time and fell to $38,500 due to the sales pressure it experienced.

BTC, which started to recover afterwards and consolidated between $ 42,000-43,000 for a while, made a strong debut last night.

BTC, which first rose above $44,000 with this rise, today exceeded the $45,000 level for the first time after January 12.

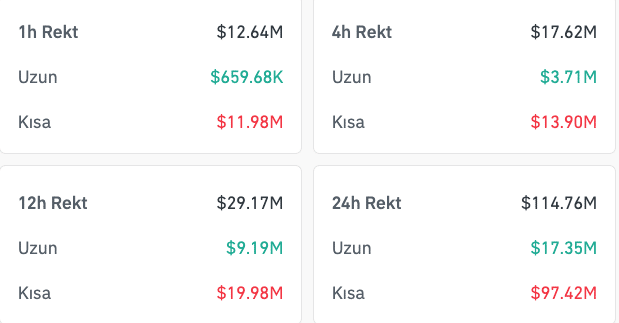

While Bitcoin was at $45,189 at the time of writing, according to data from Coinglass, nearly $114 million in crypto futures positions were liquidated in the last 24 hours.

It was seen that 97 million dollars of this amount consisted of short positions and 17 million dollars consisted of long positions.

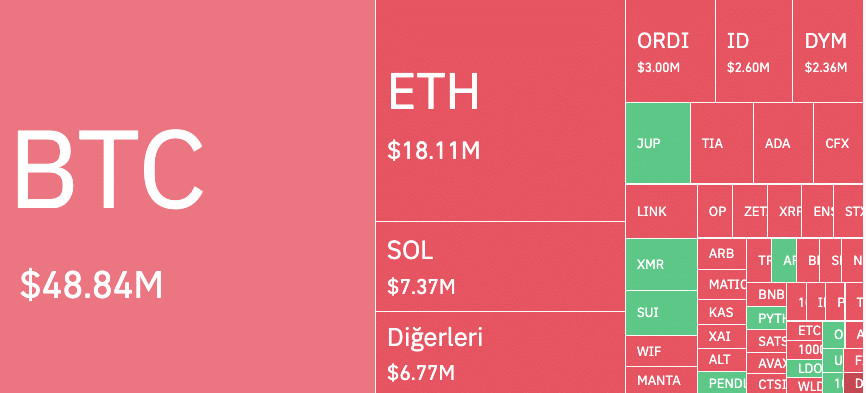

Among liquidated short positions, Bitcoin ranked first with $48.8 million, corresponding to a rate of 50%. After BTC, $57.76 million was liquidated in Ethereum (ETH), followed by Solana (SOL).

Evaluating Bitcoin's rise above $ 45,000, successful analyst Michael van de Poppe said that BTC showed great strength and returned to its organic rise.

Stating that at this point, the positive and negative effects of spot ETF approval in BTC are also priced, the analyst said:

“Bitcoin is above $45,000 and showing great strength!

The defined range and the expectation we will consolidate are between 38-50 thousand dollars.

ETF's positive impact = priced in. Negative impact of ETF = priced in.

“We are now back to regular, organic growth of markets.”

#Bitcoin is above $45K and showing a lot of strength!

Between $38-50K is the defined range and the expectance that we'll consolidate.

Positive impact of the ETF = priced in.

Negative impact of the ETF = priced in.Now we're back to regular, organic growth of the markets. pic.twitter.com/DBNqARPeRW

— Michaël van de Poppe (@CryptoMichNL) February 8, 2024

While analysts, including Poppe, generally expect the rise in Bitcoin to continue according to many on-chain data, time will tell whether BTC will move in line with this expectation.

*This is not investment advice.