Bitcoin, the world's largest cryptocurrency, experienced a sudden drop in value today, losing approximately 7% of its value. This comes after Matrixport, a leading cryptocurrency analysis company, suggested that Bitcoin Spot ETFs will likely be rejected.

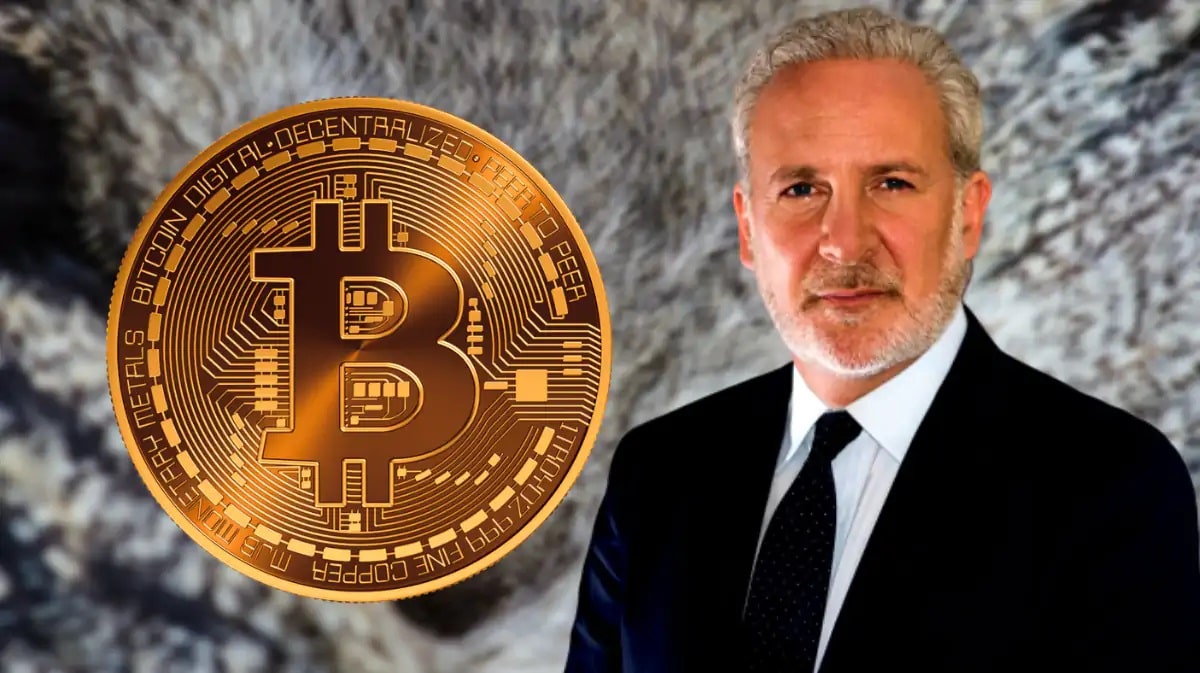

Peter Schiff, one of Bitcoin's well-known critics, commented on this decline. He warned that the BTC ETF may not be a “buy the rumor, sell the news” event, but rather a “buy the rumor, sell the rumor” event. He suggested that those waiting for real news to sell their Bitcoins may find that there are very few speculators left to buy.

Just yesterday, while BTC was trading above $45 thousand, Jim Cramer, one of the leading names in the financial media, claimed that Bitcoin was an unrivaled asset.

Following these comments by Jim Cramer, who has a belief that the opposite of what he says happens in the market, the decrease in the Bitcoin price today also attracted the attention of Peter Schiff.

In addition, the analyst, who opposes constant Bitcoin news in the mainstream media, explained his thoughts as follows:

“CNBC, a major news network, had non-stop coverage of yesterday's BTC rally above $45k. However, today there was noticeably less news about Bitcoin falling below $42,000. They haven't mentioned Bitcoin once in the past half hour. “They eventually started talking about how stock market futures are traded, but completely ignored Bitcoin.”

*This is not investment advice.