While the Bitcoin price continues its horizontal course, according to CCData data, the August transaction volume of the cryptocurrency spot market reached its lowest level in 4.5 years.

According to Coindesk, total crypto spot and derivative transaction volume decreased by 11.5% in August to $2.09 trillion.

At this point, CCData stated that the volatility caused by Grayscale's court victory against the SEC at the end of August was not reflected in the transaction volumes on central exchanges.

Spot trading volumes on centralized exchanges fell 7.78% to $475 billion, the lowest level since March 2019, according to CCData data.

There was also a decrease in derivative transaction volume. Accordingly, derivative transaction volume decreased by over 12% to $1.62 trillion, its second lowest level since 2021.

Evaluating the declines in transaction volumes, CCData analysts told CoinDesk:

“The volatility that emerged after Grayscale's victory over the SEC did not translate into trading volumes on centralized exchanges, and spot and derivatives trading volumes on centralized exchanges fell.

Low spot trading volume and fluctuations in open interest data suggest that the market is currently driven by speculation.”

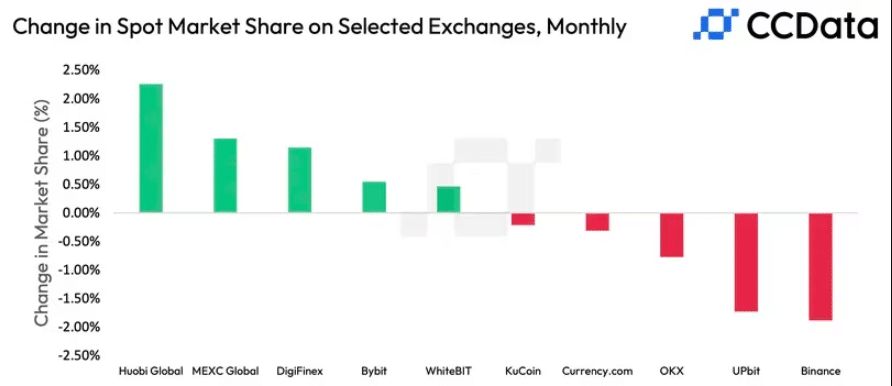

Again, according to CCData data, the spot market share of Binance, the world's largest cryptocurrency exchange, also decreased in August and fell to its lowest level since August 2022.

In addition, Huobi's global spot market share increased by 2.26%.

*This is not investment advice.