Bitcoin (BTC) price has come out of the range of 28,000-30,000, which it has been in for a long time, and is trading at approximately $ 26,000 at the time of this writing.

Many investors wonder how critical the current market situation is and what factors might affect Bitcoin's future direction.

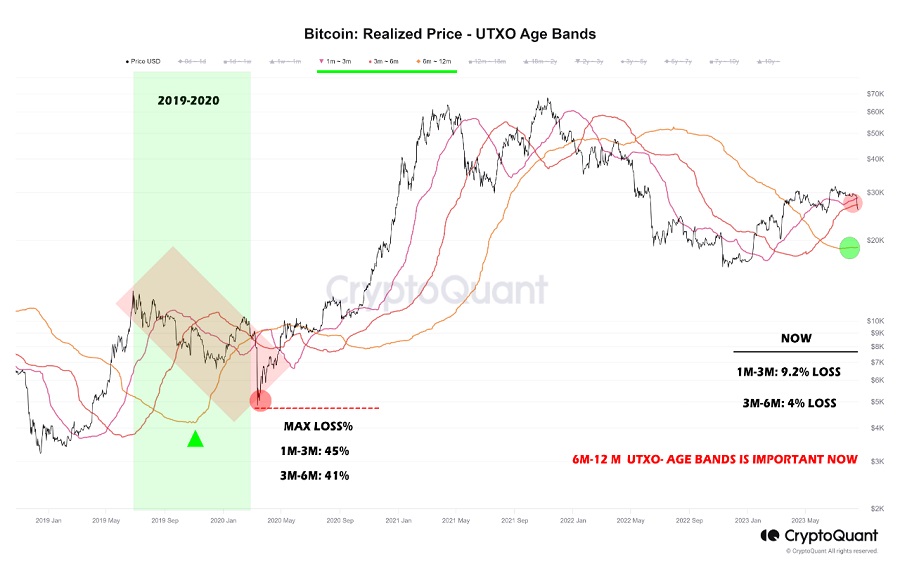

Cryptocurrency analysis company CryptoQuant has released a comprehensive report examining Bitcoin's previous price cycles based on realized prices of short- and long-term holders. The realized price is the average price each Bitcoin unit was last moved to and reflects the cost basis and sensitivity of different types of holders.

According to CryptoQuant, the current cycle is comparable to the 2019 cycle, where Bitcoin faced a significant correction.

The analysis report shows that the maximum loss to short-term investors for 1-6 months in 2019-2020 was around 40-45% due to the market shock caused by the coronavirus pandemic. In contrast, the current loss for the current group in the same range is only between 4-9%, suggesting there is still room for more downside action, according to analysts.

However, the report also points out that the more important metric to compare the current situation with the past is the status of 6-12 month old Bitcoin investors. The report argues that in order for the current market to continue its bullish trend, the actual price of this group must rise even as the price of Bitcoin drops further, which would indicate a high interest in holding Bitcoins for longer maturities despite short-term losses.

*Not investment advice.