The Shapella upgrade, following the Merge update completed last September, officially completed the transition to Ethereum's Proof-of-Stake system. Investors who locked ETH on the network with Merge had the right to withdraw after Shapella.

Contrary to the majority expectation, the Shapella update did not have a negative impact on the Ethereum price.

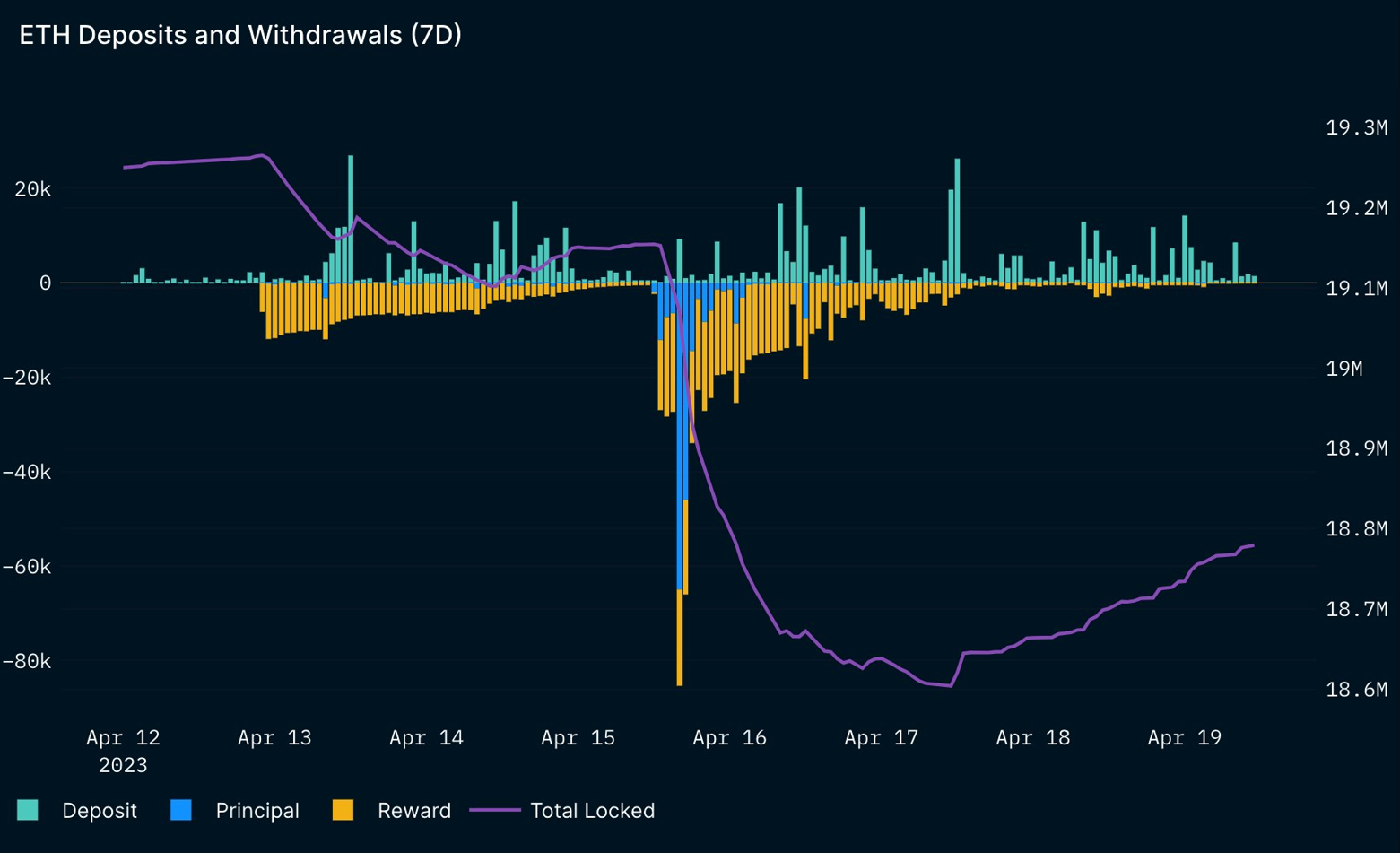

After the Shapella upgrade, some of the investors lined up to withdraw the Ethereums they had locked into the system. However, blockchain tracker Nansen has found that the amount of ETH entering the staking system is higher than the withdrawal requests as of now.

According to the data, the amount of tokens staked on the ETH network bottomed out with 18.6 million on April 17, while this figure has reached 18.8 million today.

Another on-chain tracker, CryptoQuant, has published staking rates. The percentage of staked tokens rose as high as 14.61%, according to the blockchain tracker.

ETH Price

Ethereum, the largest smart contract network, corrected with the overall market after its local top of $2,125.

If the selling continues in ETH, which is currently trying to hold above the support of $ 1,940, the decline may continue to $ 1,840.