The Ethereum Shapella upgrade, which allows validators to withdraw tokens locked on the network, took place within the week. After the update, the price of ETH increased contrary to expectations, which confused the investors. With the Merge that took place in September, a significant decrease was seen in the Ethereum price.

In this article, let’s take a closer look at the latest ETH price with the Shapella update…

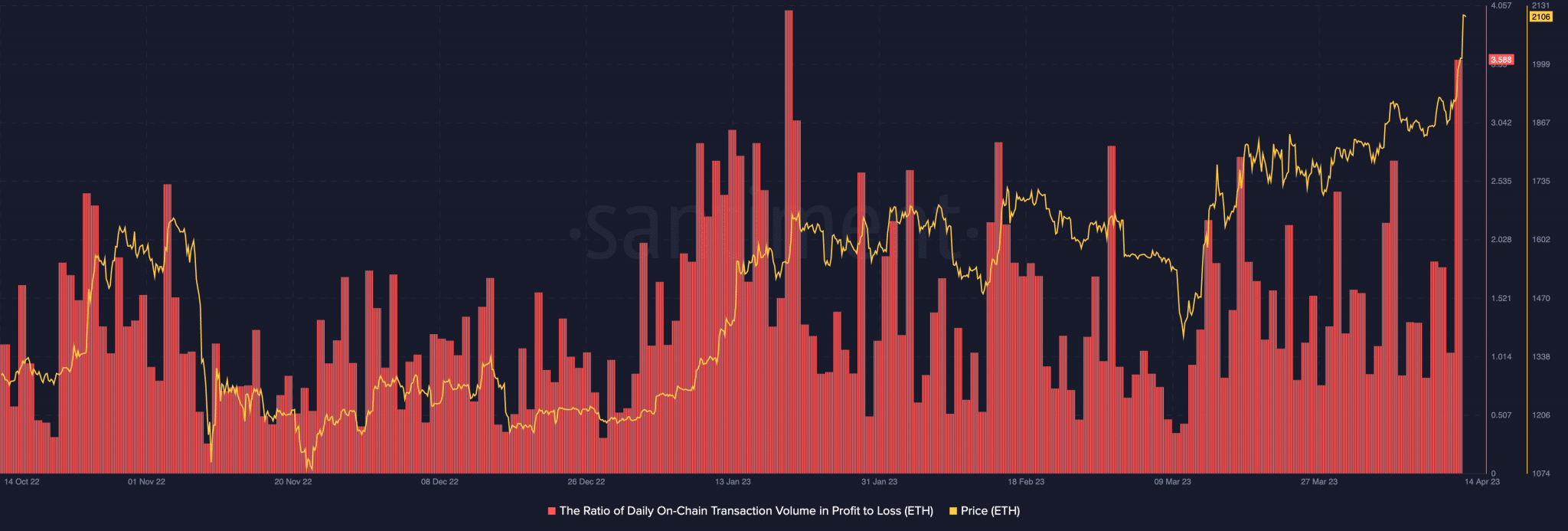

Daily Traders Profit!

According to on-chain data tracker Santiment, intraday traders have achieved profit margins that they haven’t earned in a long time. The P/L index metric rose to 3.58, its highest level since Jan. 20.

The fact that daily traders are in profit actually increases the possibility of selling pressure. However, the fact that people who previously locked their Ethereums were in loss by half, reduced the possibility of selling pressure on ETHs that were unlocked after the Shapella update.

Because half of the investors locked ETHs in the system in the past, but did so at a higher cost than the current price. For this reason, they did not go to sell even if the locks were opened.

Are Whales Selling?

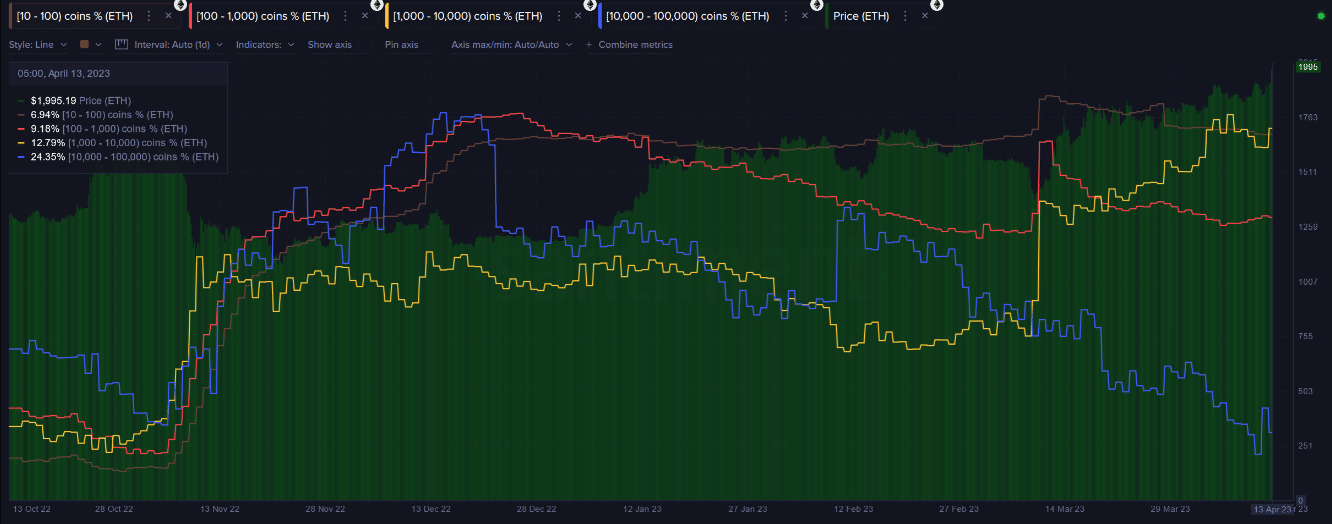

After the Shapella update, market followers carefully examine how ETH whales are moving. According to on-chain data, large whales holding between 10,000 and 100,000 ETH have made sales since February.

Despite the sale of giant whales, medium-sized (1,000 – 10,000 ETH) whales continue to buy Ethereum, preventing the price from falling so far.

ETH Price

ETH, the native token of the largest smart contract platform, is trading at an 8-month high.

If Ethereum, which broke the resistance of $ 2,028 the other day, can hold above this level, it can continue to rise up to $ 2,300.