While investors have a constant desire to make money, there are some superstitions among investors about price increases.

According to Coindesk, one of these superstitions is the idea that there will be a decline on Friday, the 13th of the month.

Accordingly, Friday, the 13th, is considered unlucky because the S&P 500 has historically shown a downward trend on this day.

However, the situation is not the same for the leading cryptocurrency Bitcoin. Because BTC has historically performed positively in what has been a terrible date for the S&P 500.

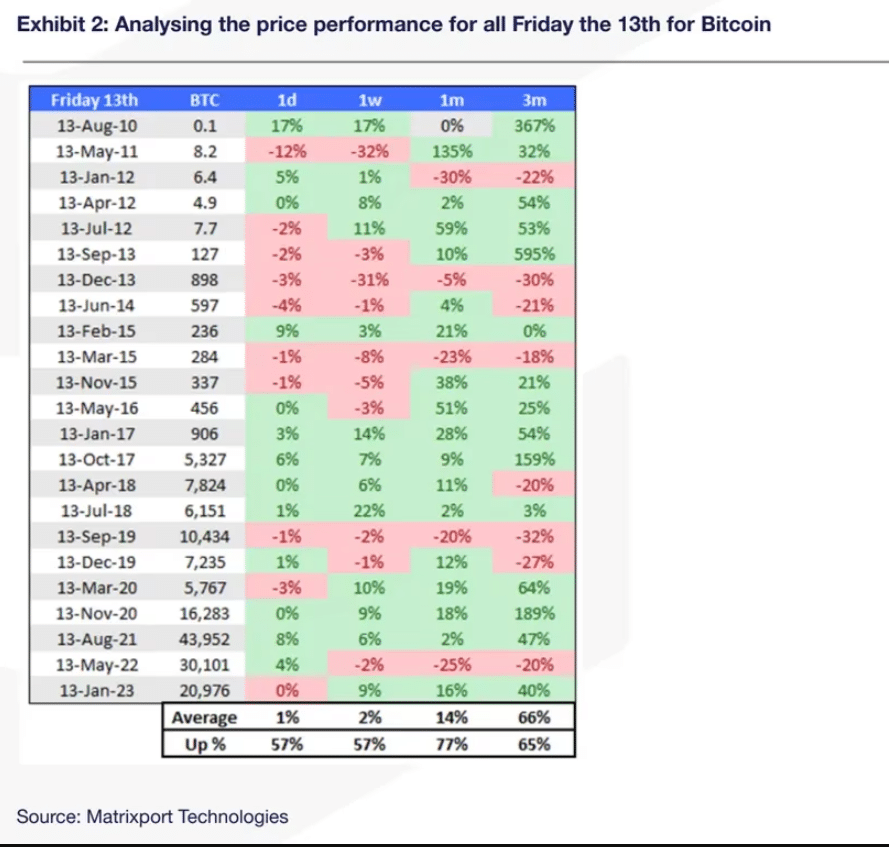

At this point, Matrixport analysts said that according to the historical data they followed, Bitcoin has increased by an average of 1% on Fridays corresponding to the 13th since 2010.

Analysts also pointed out that the data showed that BTC prices increased by an average of 14% and 66% in one and three months, respectively, after Fridays, which coincided with the 13th of the month.

Markus Thielen, head of research at Matrixport, made the following statement on this subject:

“While historical 13th Fridya statistics show that Bitcoin made significant gains on Friday the 13th, a more nuanced assessment points to the potential for a correction in the crypto market.

In particular, the weakness in Ethereum indicates that we are facing challenges due to limited activity in DeFi applications and the significant decline in NFT minting.

Simultaneously, overall crypto markets along with ETH are also showing signs of weakness. “This brings to mind the possibility that Bitcoin and cryptocurrency prices may drop further in the near future.”

Markus Thielen, who also examined Ethereum in detail, pointed out that breaking $ 1,550, which is the key support level for ETH, will significantly liquidate leveraged positions.

“If the key support level on Ethereum cannot be maintained and there is a break below, this will open the doors for a deeper decline towards $1,430 and eventually $1,300.

“This possible decline in ETH could negatively impact the broader crypto market, including Bitcoin, and lead to gradual liquidations.”

At the time of writing, Bitcoin is traded at $26,800 and Ethereum is traded at $1,548.

*This is not investment advice.

Friday