Although Bitcoin started July well, it fell to $ 58,500 with subsequent declines.

While investors who are already at a loss are wondering about the reasons for the decline and whether it will continue, analysts evaluate that the uncertainty in the US economy, Mt.Gox payments and whales' BTC sales are behind the decline.

At this point, Bit.com Marketing Director Toya Zhang, in his statement to The Block, listed the events necessary for Bitcoin to rise:

“While many analysts and experts are predicting a significant increase in July, we believe it is difficult to see a significant increase without the lack of market liquidity and the huge benefit provided by new narratives and rate cuts that will start a new rally in the crypto sector.

We are also seeing many over-the-counter exchanges receiving large sell orders. This shows that family offices and high net worth individuals profited from the last bull cycle.”

Apart from this, BTC whales have also been making large sales recently. According to Lookonchain's post, a giant whale deposited 1,700 BTC worth $99.92 million to Binance within an hour.

While this whale was selling BTC at a loss, he deposited 3,500 BTC worth $206 million to Binance in just 6 hours.

Note that this whale deposited 1,700 $BTC($99.92M) to #Binance again 20 minutes ago.

He deposited 3,500 $BTC($206M) to #Binance in just 5 hours!https://t.co/gq0KtAOQEZ pic.twitter.com/tTKWALqNak

— Lookonchain (@lookonchain) July 4, 2024

Bitcoin Bulls' Losses Increase!

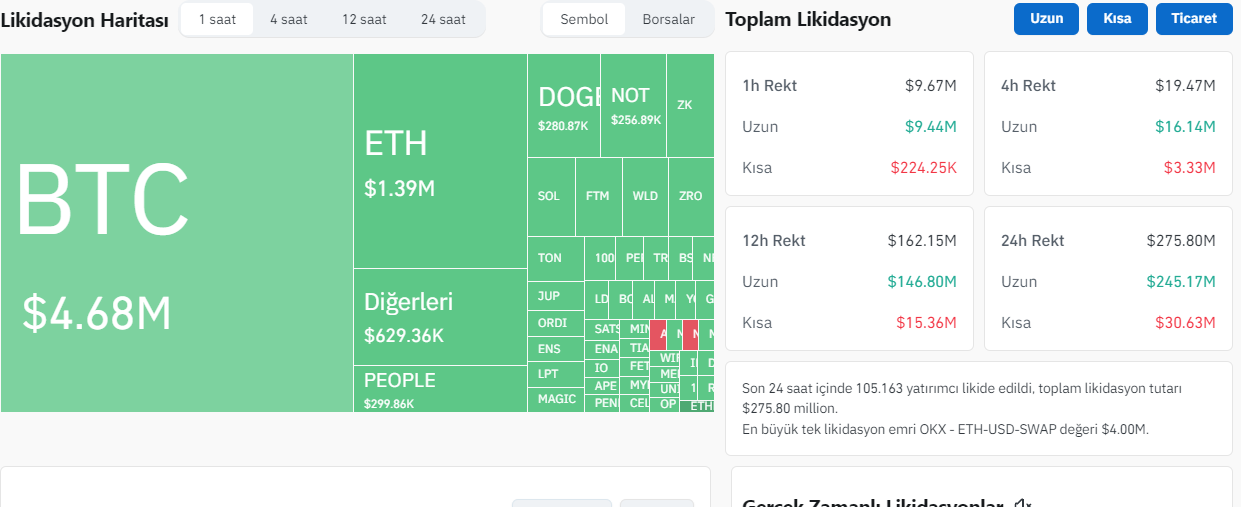

While this sharp decline in Bitcoin left the bulls in reverse, according to Coinglass data, $ 275 million was liquidated in the last 24 hours. Of this, $245 million consisted of long positions and $30 million consisted of short positions.

While $73.5 million was liquidated in Bitcoin, it was followed by Ethereum (ETH) and Solana (SOL) with $66.5 million.

While 105,163 investors liquidated in the last 24 hours, the largest single liquidation order occurred on the ETH-USD trading pair on OKX.

Bitcoin, which has dropped 4.1% in the last 24 hours, continues to trade at $ 58,290.

*This is not investment advice.