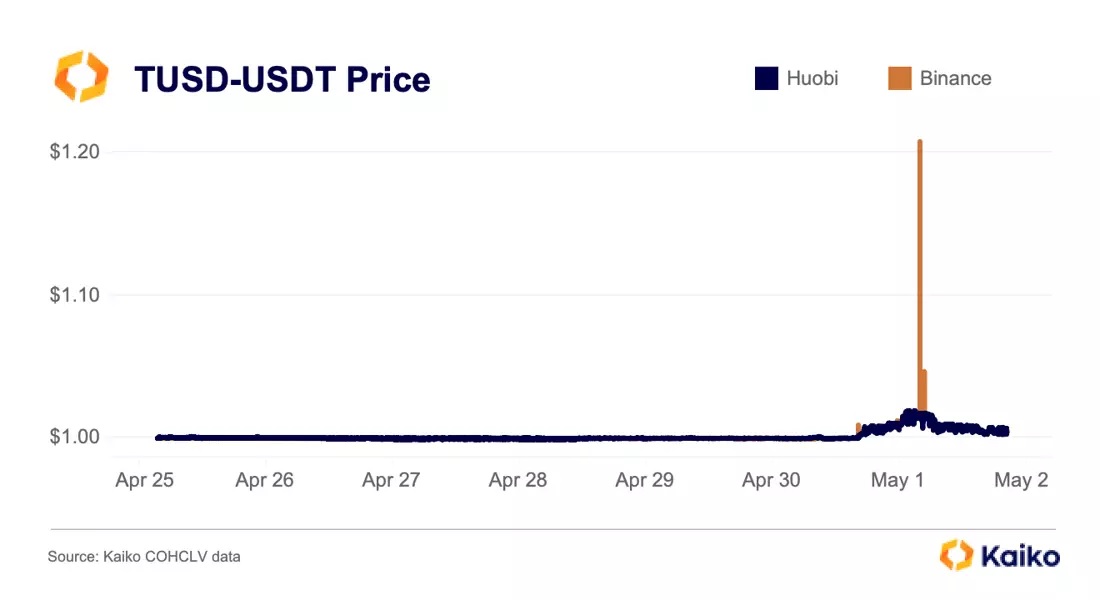

TUSD tumbled across a number of exchanges yesterday, hitting as high as $1.20 versus USDT on Binance.

Binance recently supported TUSD, making BTC-TUSD the only zero-fee pair on the exchange.

Users Who Want to Open a Short Position with the Rising TUSD Price Pay High Fees

This has quickly made Binance BTC-TUSD one of the highest-volume pairs of all cryptocurrencies, despite the fact that TUSD is relatively little known among stablecoins. In addition, TUSD liquidity could not keep up with their volumes, which made such depegging more possible.

Interestingly, when TUSD started to drop, a group of users on both Aave and Compound started borrowing large amounts of this token. Most of these processes seem to be organic rather than bot-driven.

The most common strategy employed was to short TUSD at its higher price by borrowing TUSD and exchanging it for USDC. However, since neither Aave nor Compound has a large supply of TUSD, borrowing rates have skyrocketed, reaching over 100% APR on both protocols.

When TUSD started trading higher, it was seen that Justin Sun sent over $50 million in TUSD to Binance. This has led users to question whether Sun is trying to farm SUI liquidity pools on Binance, which requires users to stake either TUSD or BNB. On top of that, CZ tweeted that Binance will take action against any farming action by Sun.

Sun responded by admitting that one of his team used some of the funds for farming, but claimed that most of the funds would be used for TUSD market making on the exchange.

Looking at the market depth for the TUSD-USDT pair on Binance, it looks like someone has added massive amounts of liquidity. After a massive $200 million injection of orderbook liquidity, the pair is currently the most liquid pair on Binance.

*Not investment advice.