Bitcoin and altcoins started the week and the second half of the year positively, with the BTC price rising above $63,000.

While wondering whether the upward trend in the BTC and cryptocurrency markets will continue, Coinshares published its weekly cryptocurrency report.

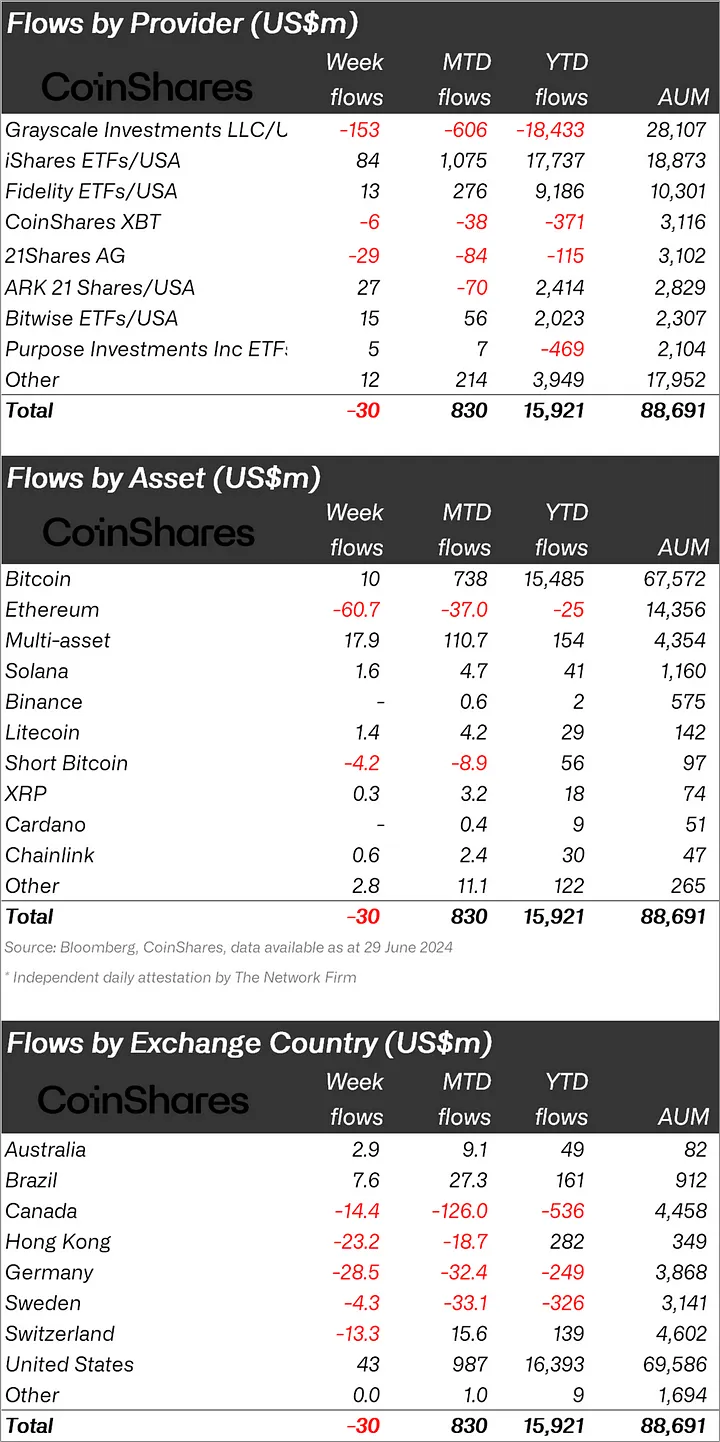

Stating that there was an outflow of $30 million in cryptocurrency investment products last week, Coinshares said that there was a significant decrease in outflows last week.

“Cryptocurrency investment products saw outflows totaling $30 million for the third week in a row, with a significant decrease in outflows last week.

“As Ethereum outflows move into the 3rd week, it indicates that sentiment towards Bitcoin has changed.”

The Focus Became Ethereum (ETH)!

When looking at crypto funds individually, it was seen that the majority of fund outflows were in Ethereum rather than Bitcoin.

While BTC experienced an inflow of 10 million dollars, contrary to outflows, the largest altcoin, Ethereum (ETH), experienced an outflow of 60.7 million dollars.

When we look at other altcoins, Solana (SOL) experienced an inflow of $1.6 million, Litecoin (LTC) $1.4 million and Chainlink (LINK) $0.6 million.

“Ethereum saw the largest outflow since August 2022, totaling $61 million, with outflows in the last two weeks reaching $119 million.

This has made it the worst-performing asset year-to-date in terms of net flows.

In contrast, while Bitcoin led with an inflow of $10 million, a total outflow of $4.2 million was seen from the short-Bitcoin fund, which was indexed to the decline of Bitcoin. This shows that the sentiment in BTC may turn.

A number of altcoins have seen inflows; The most notable of these were Solana – $1.6 million and Litecoin – $1.4 million.”

When looking at regional fund inflows and outflows, it was seen that Germany ranked first with an outflow of 28.5 million dollars.

After Germany, Hong Kong ranked second with 23.2 million dollars, and Canada ranked third with 14.4 million dollars.

In response to these outflows, the USA experienced an inflow of 43 million dollars.

*This is not investment advice.