S&P Global Ratings, a renowned company in the field of credit rating and risk analysis, has launched a pioneering initiative with the introduction of stablecoin stability assessment.

S&P Global Ratings Introduces Stablecoin Stability Assessment

This new assessment aims to examine a stablecoin's ability to maintain a consistent value compared to fiat currency.

This move represents a significant step in S&P Global Ratings' commitment to use its robust analytics and risk assessment capabilities to support both traditional finance (TradFi) and emerging crypto-native decentralized finance (DeFi) clients.

Stablecoin stability assessment uses an advanced analytical approach to measure the stability of a stablecoin, providing ratings on a scale ranging from 1 (very strong) to 5 (weak).

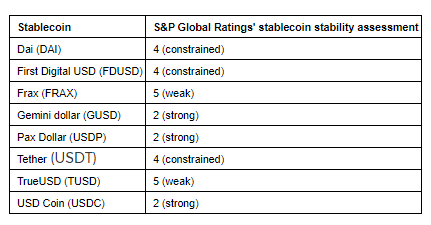

The launch includes public evaluations of eight leading stablecoins: DAI, FDUSD, FRAX, GUSD, USDP, USDT, TUSD and USDC.

These stablecoins received stability assessments ranging from 2 (strong) to 5 (weak), based on S&P Global Ratings' comprehensive analytical approach.

S&P Global Ratings Senior Analyst Lapo Guadagnuolo emphasized the importance of recognizing that stablecoins are sensitive to a variety of factors such as asset quality, governance and liquidity.

“Looking ahead, we see stablecoins becoming even more embedded in the fabric of financial markets, serving as an important bridge between digital and real-world assets,” Guadagnuolo said.

*This is not investment advice.