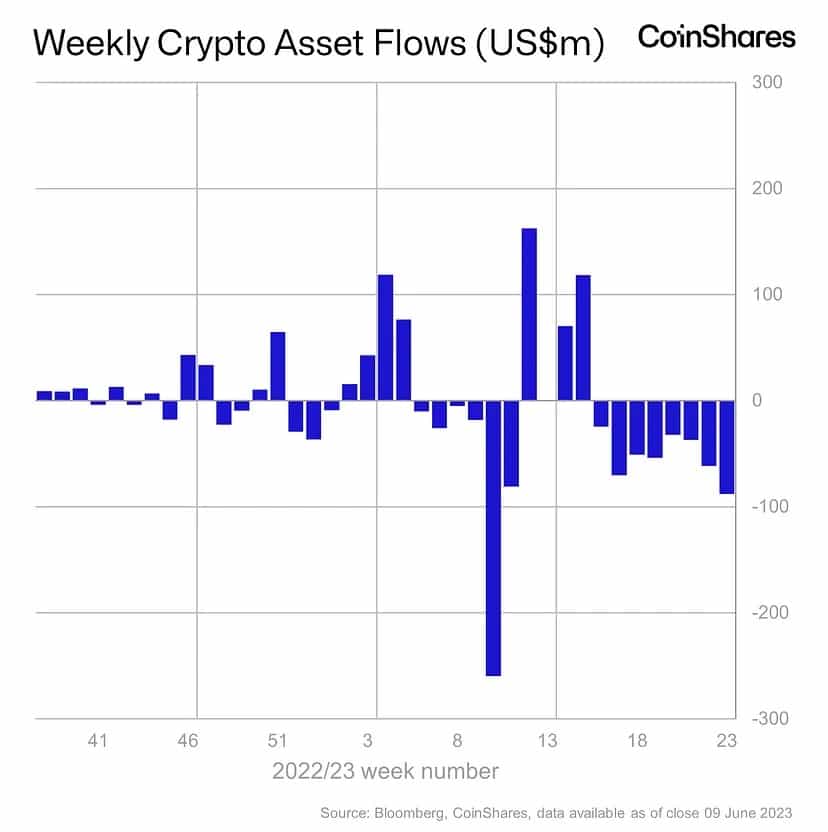

According to the report by CoinShares, crypto investors continued to withdraw funds from digital asset investment products for the eighth week in a row.

Total exits reached US$88 million last week, bringing total exits to US$417 million since mid-April.

Three Altcoins Are in Positive Zone as Bitcoin and Ethereum Exit Heavy

The report attributed the continued outflows to uncertainty around monetary policy as central banks around the world raise interest rates to curb inflation. This has dampened the appetite for riskier assets such as cryptocurrencies, which are known for their high volatility and low correlation with traditional markets.

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have suffered heavily from exits with $52 million and $36 million respectively. Bitcoin saw exits representing 1.2% of its total assets under management (AuM), while Ethereum only saw 0.6% of its AuM.

The report noted that most of the outflows were concentrated in a North American-based organization, while small-scale inflows were seen in some European countries such as Switzerland. The report also highlighted that some altcoins have outperformed Bitcoin and Ethereum this year, attracting investors looking for diversification and innovation.

Litecoin, XRP, and Solana were among the altcoins that debuted last week, while Polygon saw the exit. The report stated that unlike Bitcoin and Ethereum, altcoins have seen net inflows (excluding Tron) year-to-date.

*Not investment advice.