Bitcoin and altcoins experienced a sharp bounce, shaking off the ongoing selling pressure.

While the BTC price rose by nearly 5% to above $71,000, altcoins also saw major increases.

The largest altcoin, Ethereum (ETH), rose 5.4% to surpass $2,600. Solana (SOL) rose 4% to $180, while Dogecoin (DOGE) rose 16.2% to $0.165.

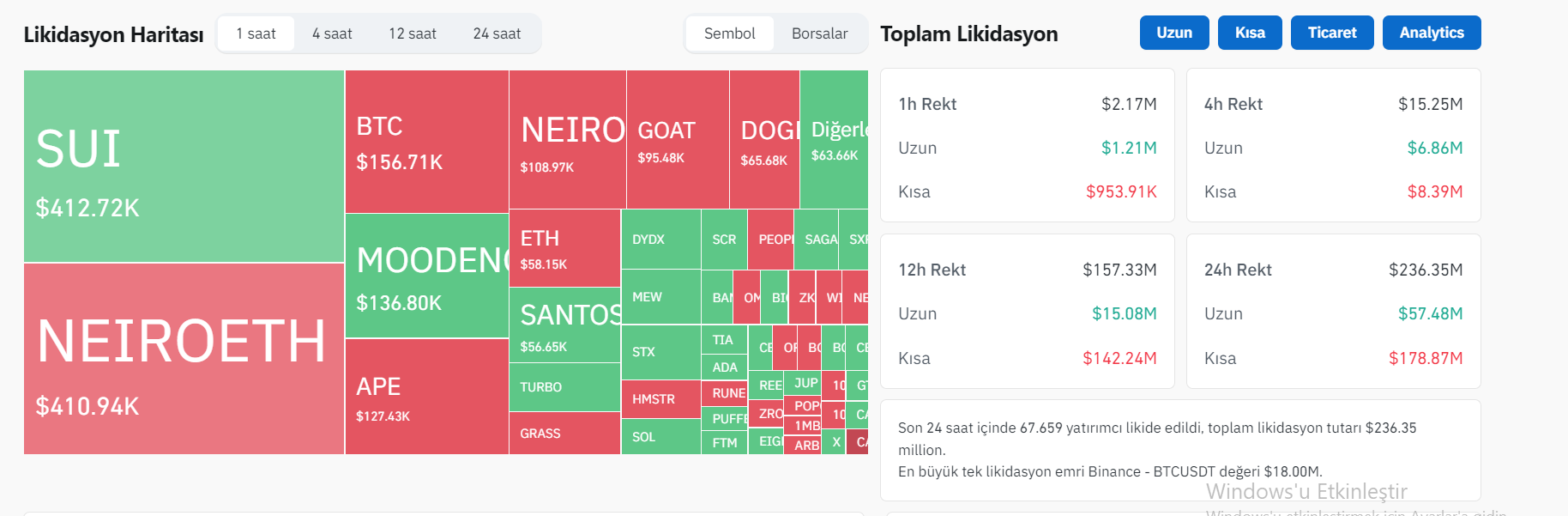

While this rise left short-positioned investors in a bind, according to Coinglass data, $236 million worth of leveraged transactions were liquidated in the last 24 hours. $57.4 million of these were long positions and $178.8 million were short positions.

The largest liquidation was in Bitcoin with $88.5 million, followed by ETH and Solana.

While 67,659 investors liquidated in the last 24 hours, the largest liquidation was in a BTC/USDT transaction on Binance. The value of the transaction was $18 million.

What Causes the Rise in Bitcoin?

It was stated that this rise was driven by the fact that Donald Trump is almost certain to win the US presidential elections, which are only a week away.

“The market is pricing in increased certainty of a Trump victory. Bitcoin has crossed $70,000 and we are seeing some short positions being liquidated,” QCP Capital co-founder Darius Sit told Coindesk.

CryptoQuant analyst Mignolet also attributed the rise to increased whale buying. Noting that some of the buying demand came from Binance whales, the analyst said that whales were net buyers of Bitcoin during Asian hours.

Analysts stated that inflows into spot Bitcoin ETFs also contributed to this rise.

Analyst Tony Sycamore, who stated that Trump's possible victory was behind the recent rise, said that the latest rise shows that Bitcoin is now a Trump trade.

“Bitcoin has been fueled by an overnight rally in stocks and continues to price in Donald Trump's election victory.”

As is known, investors have long viewed Donald Trump's victory as a bullish catalyst for BTC and the cryptocurrency market due to his pro-cryptocurrency stance and promises to make the US a Bitcoin giant.

*This is not investment advice.