Bitcoin, which rose after FED Chairman Jerome Powell's statements on Friday, rose above $64,000.

While BTC has experienced some pullback in the new week, Coinshares has released its weekly cryptocurrency report.

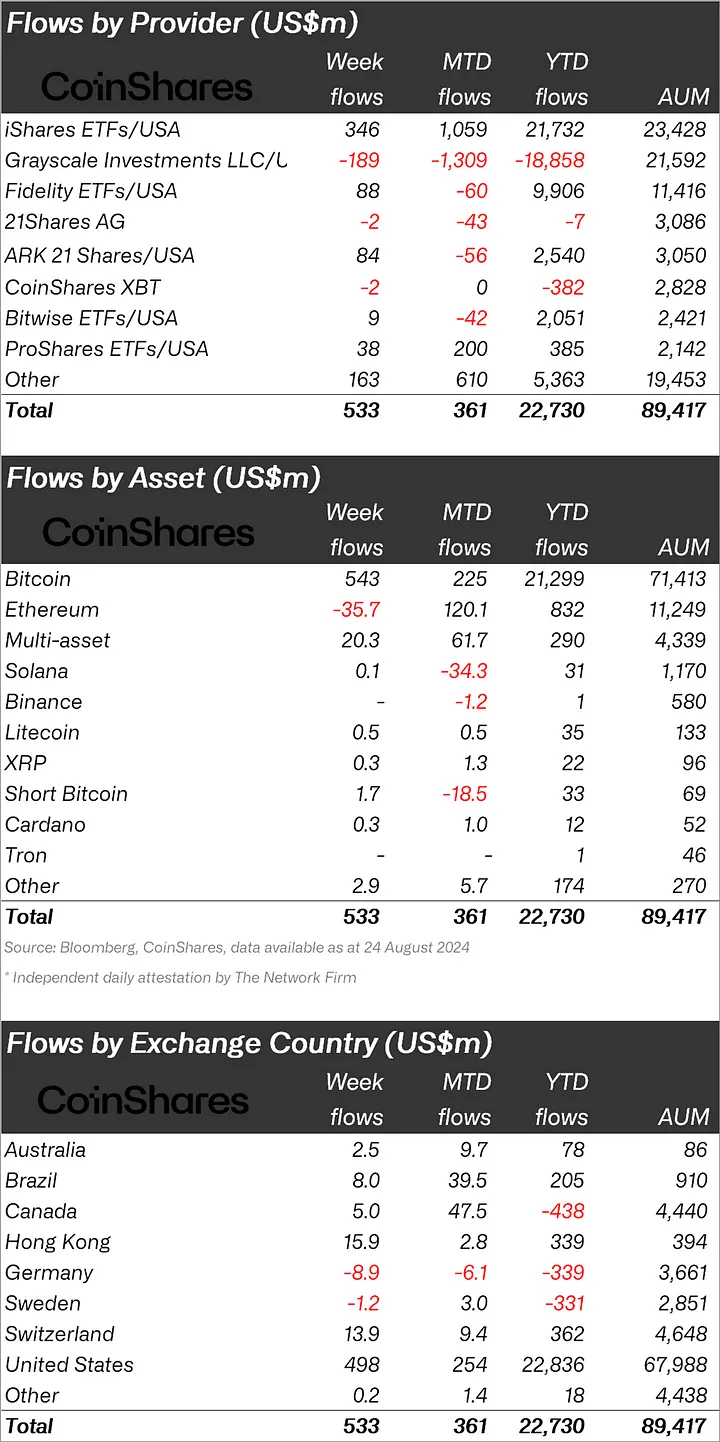

Coinshares stated that there was an inflow of $533 million into cryptocurrency investment products last week, and that these inflows were the largest in five weeks.

“Last week, cryptocurrency investment products saw a total inflow of $533 million, the largest inflow in five weeks.

This increase followed Fed Chairman Jerome Powell's remarks at the Jackson Hole Symposium.”

Solana (SOL) Returned to Normal, Ethereum Gained an Explosion!

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $543 million, Ethereum (ETH) experienced an outflow of $35.7 million.

There was an inflow of $1.7 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, Solana (SOL), which had an outflow of $38.9 million last week, had a small inflow of $0.1 million, while XRP saw an inflow of $0.3 million and Litecoin (LTC) saw an inflow of $0.5 million.

“Bitcoin was the main focus, seeing $543 million in inflows. Interestingly, most of these inflows occurred on Friday, following Jerome Powell’s lukewarm comments that indicated Bitcoin’s sensitivity to interest rate expectations.

Ethereum saw outflows totaling $36 million last week, but new issuers continue to see inflows, with the Grayscale Ethereum trust making up for this with outflows of $118 million.

“One month after their ETH ETF launch, new Ethereum ETFs saw inflows of $3.1 billion, dwarfed by Grayscale Trust’s $2.5 billion outflows.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 498 million dollars.

Hong Kong came in second after the US with $15.9 million, and Switzerland came in third with $13.9 million.

Against these inflows, Germany experienced an outflow of $8.9 million and Sweden an outflow of $1.2 million.

*This is not investment advice.