The US Federal Reserve (FED) announced its critical interest rate decision last night. While the 25 basis point cut was in line with expectations, FED Chair Jerome Powell maintained a hawkish stance.

Powell said most Fed officials want to delay rate cuts. He noted that after two consecutive rate cuts, some members are inclined to adopt a wait-and-see approach, adding, “A December rate cut is not a certainty.”

At this point, while interest rate cut expectations for December have decreased sharply, Japanese giant Nomura has revised its December expectations.

At this point, Nomura said he expects the Fed to leave interest rates unchanged, that is, unchanged, at its December policy meeting.

Niomura had previously expected a 25 basis point rate cut in December.

“Data is likely to be mildly dovish in the coming months, but we doubt the weakness will be enough to revive the FOMC's concerns about a worsening labor market,” Nomura said in a note, according to Reuters.

However, Nomura maintained its interest rate cut expectations for 2026, stating that it expects three 25 basis point rate cuts in March, June and September 2026.

As a result, Fed Chair Powell's unexpectedly hawkish remarks dealt a major blow to the market, which had been expecting more interest rate cuts this year.

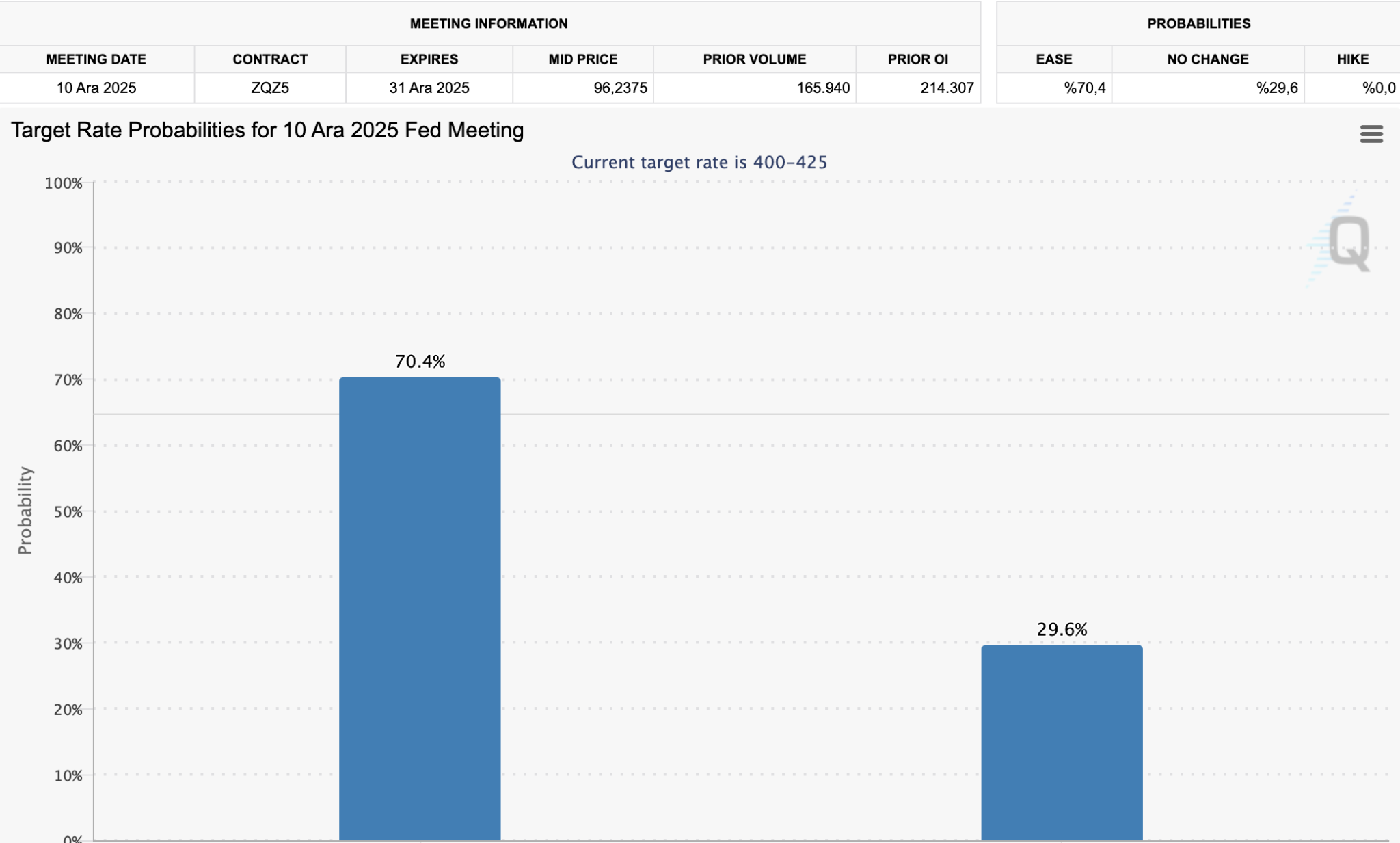

At this point, according to Chicago Mercantile Exchange (CME) FedWatch, the probability of interest rates remaining stable in the 3.75%-4.00% range at the December FOMC meeting is priced in at 70.4%, and even the probability of a rate hike is priced in at 29.6%.

*This is not investment advice.