The new week began with tensions surrounding the investigation between US President Donald Trump and Federal Reserve Chairman Jerome Powell.

Despite this tension, Bitcoin (BTC) and altcoins experienced a slight recovery, with privacy-focused altcoins like XMR and ZEC attracting attention with their gains.

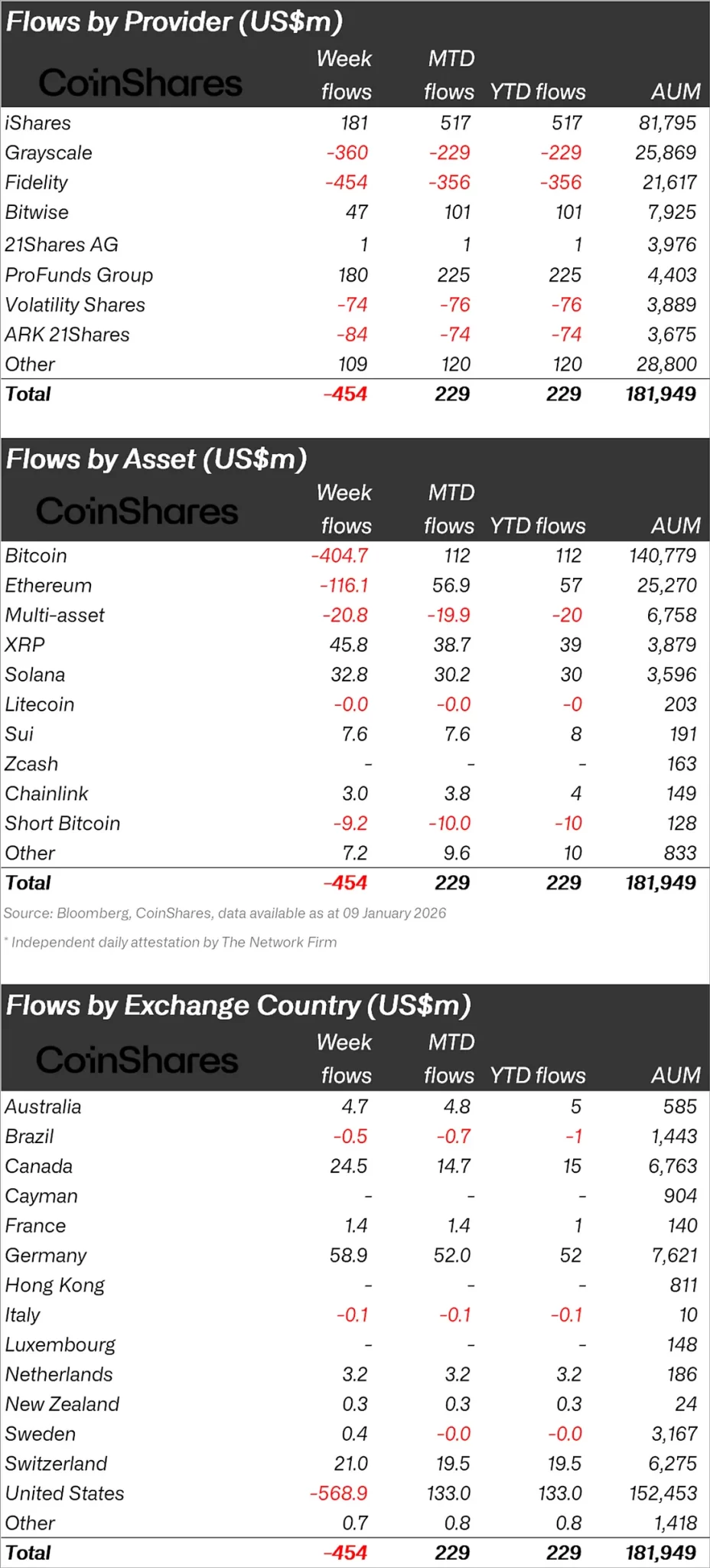

This week, while Bitcoin and altcoins were being monitored due to the Trump-Powell tension and US CPI figures, Coinshares released its cryptocurrency report, stating that there was a $454 million outflow last week.

“Last week, outflows amounting to $454 million occurred.”

The $1.3 billion in outflows over four days almost completely wiped out the $1.5 billion inflows from the first two days of the year, especially given the low expectations for a March Fed rate cut.

Exits Concentrated in Bitcoin!

Looking at crypto funds individually, it was observed that the majority of outflows were in Bitcoin.

On a weekly basis, Bitcoin experienced an outflow of $404.7 million, while Ethereum (ETH) saw an outflow of $116.1 million.

Looking at other altcoins, inflows continued, with Solana (SOL) seeing $32.8 million, XRP $45.8 million, Sui (SUI) $7.6 million, and Chainlink (LINK) $3 million in inflows.

“Bitcoin was the asset most affected by negative market sentiment, experiencing outflows of $405 million last week.”

Ethereum saw a total outflow of $116 million last week, while Binance and Aave products recorded smaller outflows of $3.7 million and $1.7 million respectively.

Positive expectations continued for XRP, Solana, and Sui, resulting in inflows of $45.8 million, $32.8 million, and $7.6 million respectively.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $568.9 million.

After the US, Germany experienced inflows of $58.9 billion, while Canada received $24.5 billion.

In response to these inflows, Italy and Brazil experienced very small outflows.

*This is not investment advice.