The leading cryptocurrency Bitcoin started the new week by recovering after the declines it experienced. While BTC rose above $ 55,000 today, there were big outflows in cryptocurrency investment products.

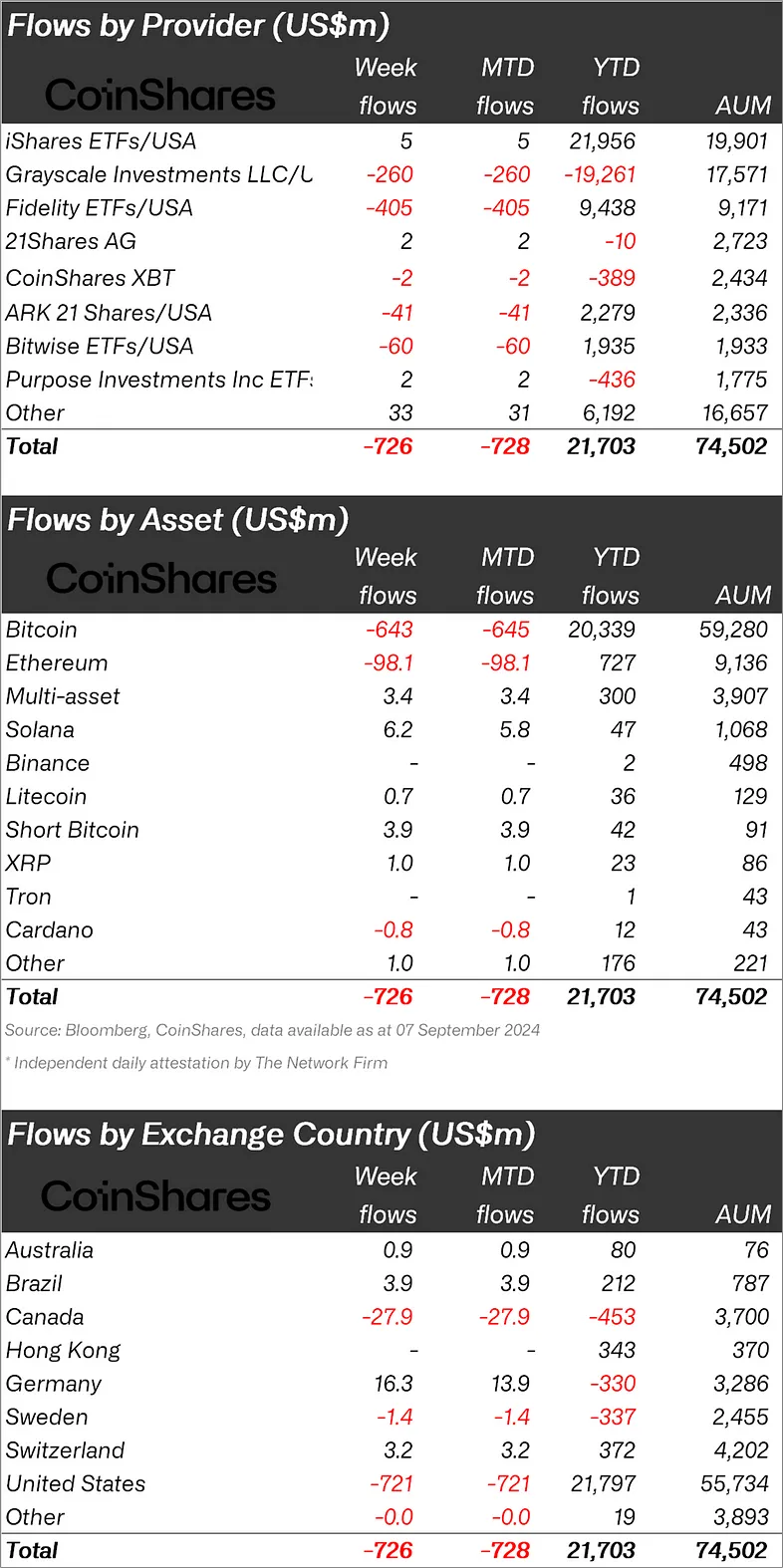

At this point, CoinShares, which publishes its weekly cryptocurrency report, said that there was an outflow of $726 million last week.

“Cryptocurrency investment products experienced a total outflow of $726 million last week due to U.S. Interest Rate Cut Uncertainty.”

Most of the Outflows Happened in Bitcoin!

When looking at individual crypto funds, it was seen that the majority of fund outflows were in Bitcoin.

While BTC experienced an outflow of $643 million, Ethereum (ETH) experienced an outflow of $98.1 million.

There was an inflow of $3.9 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, Solana (SOL) experienced an inflow of $6.2 million and XRP $1 million, while Cardano (ADA) experienced an outflow of $0.8 million.

“We believe this negative sentiment in Bitcoin and altcoins is due to stronger-than-expected macroeconomic data from the previous week, which increased the probability of a 25 basis point (bps) rate cut by the US Federal Reserve.

A total of $643 million worth of outflows were seen in Bitcoin, while a small inflow of $3.9 million was seen in the short Bitcoin fund.

Ethereum saw $98 million in outflows, almost entirely from the existing Grayscale Trust.

Conversely, Solana saw the largest inflow of any asset, totaling $6.2 million.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an outflow of 721 million dollars.

Canada came in second after the United States with $27.9 million.

In the face of these outflows, Germany experienced an inflow of $16.3 million.